Huawei's Supply Chain Squeeze Tightens, As SK Hynix And Samsung Set To Stop Selling Chips To The Chinese Bogeyman As Of Next Week

Huawei’s rotten year looks to be getting worse amid reports in South Korean paper Chosun Ibo that Samsung and SK Hynix will turn off the component tap to the firm from next week, due to pressure from the US government.

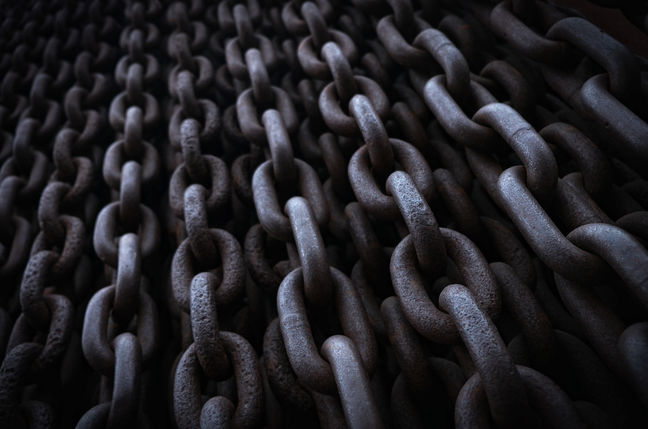

The two South Korean businesses - along with many others - will reportedly cease selling certain parts to Huawei, including chipsets and displays, on September 15, when stricter rules against Huawei, announced back in May, come into force. The May edict from the Trump Administration - which becomes active 120 days after it was announced - prohibits foreign companies from selling bits and pieces that were developed with US technology to Huawei unless they obtain a specific permit from the American government, cutting Huawei off from major parts of the global tech supply chain, including from bulk suppliers of storage and semiconductors.

Almost all global chipsets are currently developed using at least one US technology or patent or another.

Chosun Ibo quoted an official in South Korea's semiconductor industry as saying: "After the announcement, there was confusion because the range of semiconductors using US technology was not specified. It was concluded that all semiconductors, including memory semiconductors, could not be supplied."

SK Hynix is one of the largest makers of DRAM and storage chips in the world. According to a January report from tech analyst Gartner, it was the third-largest semiconductor company in 2019, behind Intel and Samsung, but ahead of Qualcomm, Broadcom, and Micron. It’s also a long-time Huawei customer, with its components appearing in flagship devices like the P30 Pro, as evidenced by subsequent iFixit teardowns.

When it was pressed by an analyst on its most recent earnings call - for Q2 2020 - about what it would do to offset the risks posed by the upcoming Huawei components ban, SK's CFO Cha Jin-seok told investors that "for the second half of this year, we will be operating a product mix that is well related to the launch of new products by the major customers and also make sure that we remain flexible in supply."

And while fellow Korean company Samsung is arguably best known for its own consumer tech, particularly in the mobile sphere, it also performs a brisk trade in components to other manufacturers, including Huawei and long-time archrival Apple. In fact memory accounts for the lion share of Samsung's profits.

Ultimately, both component makers will suffer because of these new rules. Huawei is the strongest vendor in Mainland China, holding onto its crown despite pressure from the US government, and the ascent of cheaper manufacturers like Xiaomi. It operates at a huge scale, pumping vast volumes of devices into the market.

But the biggest loser will undoubtedly be Huawei. The US government has attacked its mobile business at almost every part of the supply chain. On the chipset level, Huawei is unable to license new designs from Arm, or outsource production of its Kirin silicon to the two most advanced fabricators: TSMC and Samsung, which both tout 7nm processes, and will soon move to 5nm.

One option is to shift production to China’s biggest domestic chipmaker, SMIC. That would represent a major technological setback, however. SMIC’s fabrication processes lag far behind those used by its rivals on the Korean Peninsula, or across the Formosa Strait. It’s also worth noting that the US government has mooted imposing sanctions against SMIC, which would hamstring its effort to catch up with competitors.

This attack on Huawei’s supply chain has rippled out into other vital parts of its business, including its lucrative carrier unit. Huawei’s tenuous supply of components was one of the reasons cited in the decision to excise the vendor from the UK’s 5G network.

Separately, Huawei has massively scaled down the activities of its enterprise business group in the UK, withdrawing entire categories of products and handing out P45s.

In the short-term, Huawei faces huge disruption to its mobile business, as it shifts its supply chains to domestic manufacturers. The consequences of this may manifest in a vastly reduced menu of phones released by the firm, compounded by delays and lower production volumes. In the long term, it also risks falling behind, especially if its new supply-chain partners aren’t as advanced as its erstwhile component vendors.

The Register has contacted SK Hynix, Samsung, and Huawei for comment and at the time of writing none of them had replied.

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more