Coronavirus: US Unemployment Claims Hit 26.4 Million Amid Virus

Image copyright

EPA

Image copyright

EPA

A further 4.4 million Americans sought unemployment benefits last week as the economic toll from the coronavirus pandemic continued to mount.

The new applications brought the total number of jobless claims since mid-March to 26.4 million.

That amounts to more than 15% of the US workforce.

However, the most recent data marked the third week that the number of new claims has declined, raising hopes that the worst of the shock may be over.

"While this week's 4.4 million jobless claims are staggering, there are signs that the pace of layoffs has reached its peak," said Richard Flynn, UK managing director at financial service firm Charles Schwab.

"The key questions at this point are when can the economy reopen and what happens when it does?"

Economists have warned that the world is facing the sharpest slowdown since the Great Depression in the 1930s.

In the US, the economy is expected to contract 5.9% this year, according to the International Monetary Fund. In just six weeks, the surge in unemployment claims has exceeded the number of jobs created in the near-decade of expansion that ended in February.

In response, the US government has approved more than $2 trillion in rescue funds, which expanded eligibility for unemployment benefits and increased the payments, among other measures.

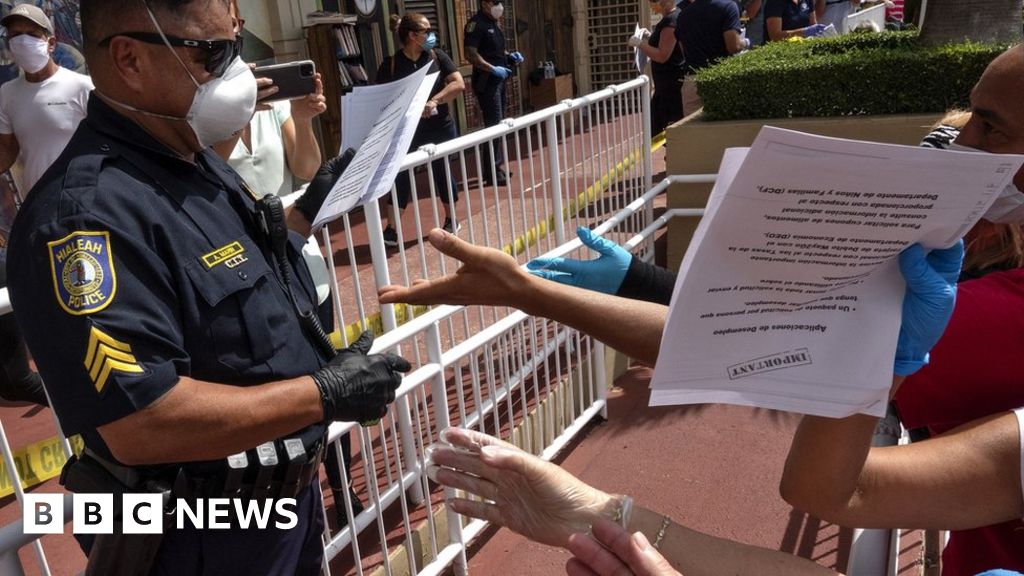

A record 16 million Americans received the benefits in the week ended 11 April, the Labor Department said. But many people have had trouble getting through to state offices processing the applications.

"The phones lines are often busy," said John Dignan, a 52-year-old real estate agent in Nevada.

"It's very frustrating because you have no control and no information. You already have so much anxiety about Covid-19, you know the economy's falling apart and I don't have much left in savings - maybe about a month left."

A $349bn relief programme for small businesses, part of the $2tn rescue legislation, ran out of funds within two weeks.

While Congress is expected to approve an additional $310bn this week, the programme, which offers low-cost loans that do not need to be repaid if the recipient meets certain conditions, has been attacked for not reaching the smallest firms.

"We're just waiting," said New York restaurant-owner Larry Hyland, who applied the first day that banks started accepting applications on behalf of his Brooklyn-based beer garden, Greenwood Park.

Reviews have found that roughly two-thirds of the money so far has gone to large publicly listed companies rather than mom-and-pop shops. Firms with pre-existing relationships with banks - typically larger businesses - were at an advantage.

Media playback is unsupported on your device

Mr Hyland said that even if he does get the money it may not help, since it is supposed to be spent primarily on wages within eight weeks - and he remains closed.

"The timeline is the biggest issue," he said. "Not knowing when you can actually reopen and to what capacity you can reopen, how can we take on the burden of that loan?"

US President Donald Trump, who is up for re-election in November, has pushed to loosen restrictions on activity, despite fears that testing and other safety measures remain insufficient.

Some states have already started to relax rules, while protests against lockdown orders have arisen elsewhere.

Even if jobless claims continue to subside as reopening gets underway, analysts say the scars on America's consumer-driven economy will linger.

"The damage" said Paul Ashworth, chief US economist at Capital Economics, "has already been done."

From Chip War To Cloud War: The Next Frontier In Global Tech Competition

The global chip war, characterized by intense competition among nations and corporations for supremacy in semiconductor ... Read more

The High Stakes Of Tech Regulation: Security Risks And Market Dynamics

The influence of tech giants in the global economy continues to grow, raising crucial questions about how to balance sec... Read more

The Tyranny Of Instagram Interiors: Why It's Time To Break Free From Algorithm-Driven Aesthetics

Instagram has become a dominant force in shaping interior design trends, offering a seemingly endless stream of inspirat... Read more

The Data Crunch In AI: Strategies For Sustainability

Exploring solutions to the imminent exhaustion of internet data for AI training.As the artificial intelligence (AI) indu... Read more

Google Abandons Four-Year Effort To Remove Cookies From Chrome Browser

After four years of dedicated effort, Google has decided to abandon its plan to remove third-party cookies from its Chro... Read more

LinkedIn Embraces AI And Gamification To Drive User Engagement And Revenue

In an effort to tackle slowing revenue growth and enhance user engagement, LinkedIn is turning to artificial intelligenc... Read more