Yen Strengthens On Recession Avoidance, Dollar And Sterling Await Data-Driven Clarity

Yen rises broadly in Asian session today, lifted by economic data indicating Japan’s narrow escape from recession last year. This economic turnaround, while not directly influencing BoJ decision on interest rates decision next week, certainly does not obstruct the pathway for a hike. Yen’s momentum, though currently modest, could amplify with anticipated positive developments from wage negotiations throughout the week, with prospect of another round of vigorous rally.

In contrast, the Australian Dollar, New Zealand Dollar, and Sterling are showing relative weakness, whereas Canadian Dollar, Euro, and Swiss Franc are having slight gains, and Dollar is mixed. The currency movements today seem more reflective of a consolidation phase, following last week’s activities, rather than the formation of new trends.

With today’s economic calendar appearing light, trading activity might lean towards the quieter side. However, expectations of volatility loom on the horizon, with significant data releases from the US and UK slated for later in the week.

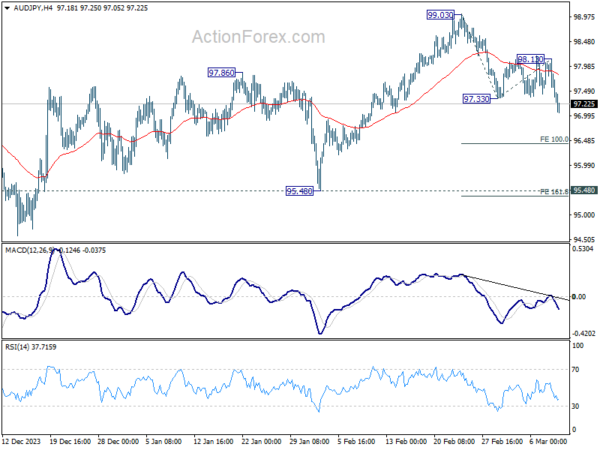

Technically, AUD/JPY’s declined from 99.03 short term top resumed by breaking through 97.33 low late last week. Deeper fall is now expected as long as 98.13 resistance holds, to 100% projection of 99.03 to 97.33 from 98.13 first. Firm break there will pave the way to 161.8% projection at 95.37.

In Asia, at the time of writing, Nikkei is down sharply by -2.60%. Hong Kong HSI is up 1.43%. China Shanghai SSE is up 0.14%. Singapore Strait Times is down -0.12%. Japan 10-year JGB yield is up 0.0299 at 0.764.

Japan’s Q4 GDP finalized at 0.1% qoq, a narrow escape from recession

Japan’s economy has narrowly avoided a recession, as shown in the final GDP figures for Q4. The revised data indicates a modest growth of 0.1% qoq, a positive swing from the preliminary estimate of -0.1% qoq contraction. On annualized basis, GDP expanded by 0.4%, contrasting sharply with initial reports of -0.4% decline.

The main driver behind this upward revision was significant increase in capital expenditure, which surged by 2% qpq, deviating markedly from the initially estimated -0.1% qoq drop. However, private consumption, accounting for approximately 60% of Japan’s economy, presented a less optimistic picture, declining by -0.3% qoq, a slight deterioration from the provisional figure of -0.2% qoq.

This latest economic data comes at a crucial time, but it does not seem to deter BoJ from considering an interest rate hike for the first time since 2007, scheduled for March 19. The anticipation builds around the annual Spring wage negotiations, which have so far shown strong momentum. Positive outcomes are also expected from the forthcoming results from Rengo, Japan’s largest union group, on March 15.

China’s CPI turned positive to 0.8% yoy amid Lunar New Year demands

In February, China’s CPI marked its first annual increase after a six-month sequence of declines. CPI rose by 0.7% yoy, surpassing expectation of 0.3% yoy and marking a significant rebound from January’s -0.8% yoy, the largest decrease in consumer prices since 2009. On a month-on-month basis, CPI acceleration was evident, jumping from a modest 0.3% mom to 1.0% om, well above the forecasted 0.7% mom.

This inflationary uptick, primarily driven by heightened demand during the Lunar New Year celebrations, underscores the seasonal influence on China’s economic activities. Notably, food prices witnessed a considerable increase of 3.3% mom, a reflection of the festive period’s impact.

Conversely, PPI had a contrary movement, declining by -2.7% yoy, indicating deeper deflationary pressures than the anticipated -2.5%.

EUR/GBP and GBP/CHF await UK data

Sterling would likely be on the move this week as key UK economic indicators, including GDP, employment, and wages data, are set to be released. These figures are eagerly watched, as any deviation from expectations could influence the market’s anticipations for the upcoming inflation report and BoE’s subsequent meeting next week.

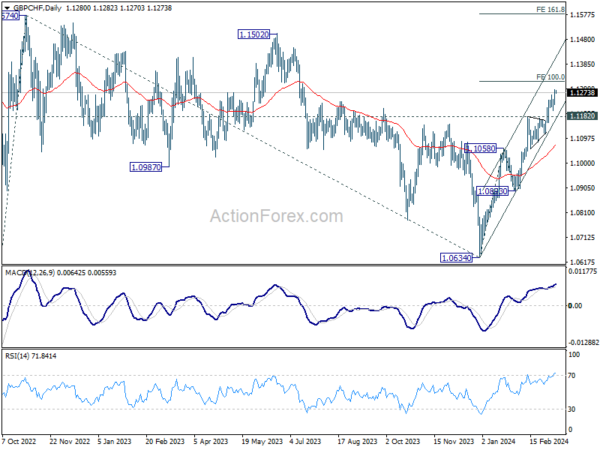

GBP/CHF’s rally from 1.0634 continued last week and hit as high as 1.1287. Immediate focus is now on 100% projection of 100% projection of 1.0634 to 1.1058 from 1.0893 at 1.1317. Decisive break there would prompt upside acceleration towards 161.8% projection at 1.1579. While overbought condition, as seen in D RSI, might limit upside at 1.1317 on initial attempt, near term outlook will stay bullish as long as 1.1182 resistance turned support holds.

In the larger picture, the break of 55 E EMA is a medium term bullish sign. This also strengthen the case that correction from 1.1574 has completed at 1.0634 already. Rise from 1.0183 (2022 low) could be ready to resume. Retest of 1.1574 should be seen next, and firm break there will pave the way to 100% projection of 1.0183 to 1.1574 from 1.0634 at 1.2025 in the medium term.

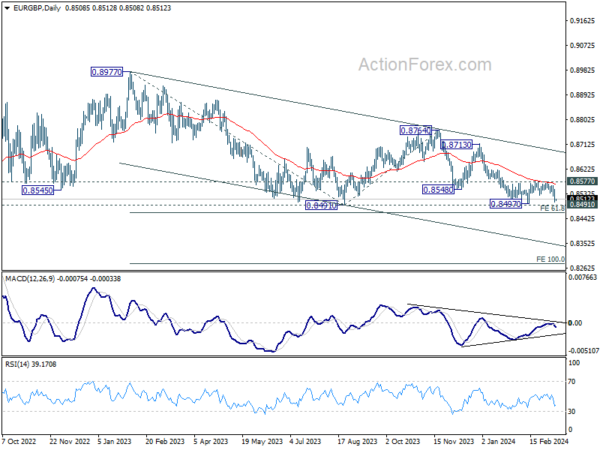

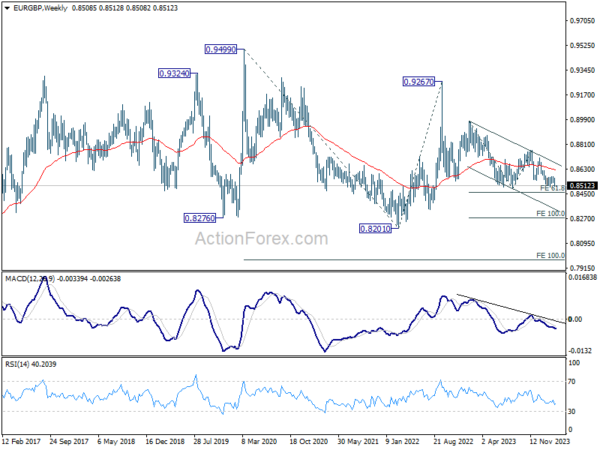

EUR/GBP’s rejection by 55 D EMA is a near term bearish sign, which suggests that fall from 0.8764 is still in progress. Break of 0.8497 support will resume this decline to 61.8% projection of 0.8977 to 0.8491 from 0.8764 at 0.8464. Firm break there could trigger downside acceleration to 100% projection at 0.8278.

Any downside acceleration ahead would also strengthen the case that fall from 0.9267 is going to extend through 0.8201 (2022 low) in the medium term, as the third leg of the pattern from 0.9499 (2020 high).

US CPI to test Fed’s rate cut timeline, UK GDP and wages growth crucial too

Spotlight turns to the US and the UK in this relatively light week, as both nations prepare to release crucial economic data.

In the US, all eyes are on the upcoming consumer inflation figures, positioned as the centerpiece. February’s CPI is anticipated to show 0.4% mom increase, primarily driven by a surge in gasoline prices. This expected rise would keep the annual inflation rate steady at 3.1% yoy, signaling a pause in the disinflation progress again. Core CPI, stripping out volatile food and energy prices, is forecasted to climb by 0.3% mom, with the yoy rate decelerating from 3.9% to 3.7%.

Should these expectations hold true, they would underscore Fed Chair Jerome Powell’s recent cautionary remarks, emphasizing the need for more data and confidence before contemplating rate reductions. Presently, futures markets assign roughly 75% probability to a June rate cut by Fed. A modest undershoot in CPI might not expedite this timeline to May, whereas a surprise on the upside could prompt a reassessment of the cut’s timing.

Other notable data from the US include PPI, retail sales, and the University of Michigan consumer sentiment index.

Across the Atlantic, the UK is poised to unveil GDP and employment statistics for January. GDP growth is forecasted at 0.2% mom, signaling a move towards stabilization from last year’s recessionary. This development would be greeted positively by BoE policymakers, allowing them a longer leash before reducing interest rates. Additionally, the wages growth data will offer insights into persistence of domestic inflationary pressures.

Amid diverging views among economists and even members of MPC regarding BoE’s rate cut timeline, August emerges as the more likely month for commencing policy easing.

Here are some highlights for the week:

- Monday: Japan GDP final, machine tool orders;.

- Tuesday: Japan BSI manufacturing, PPI; Australia NAB business confidence; Germany CPI final; UK employment; US CPI.

- Wednesday: UK GDP, production, trade balance; Eurozone industrial production.

- Thursday: UK RICS house price balance; Swiss PPI; Canada manufacturing sales; US PPI, retail sales, jobless claims, business inventories.

- Friday: New Zealand BNZ manufacturing; Japan tertiary industry index; UK consumer inflation expectations; Canada housing starts; US Empire state manufacturing, import prices, industrial production, U of Michigan consumer sentiment.

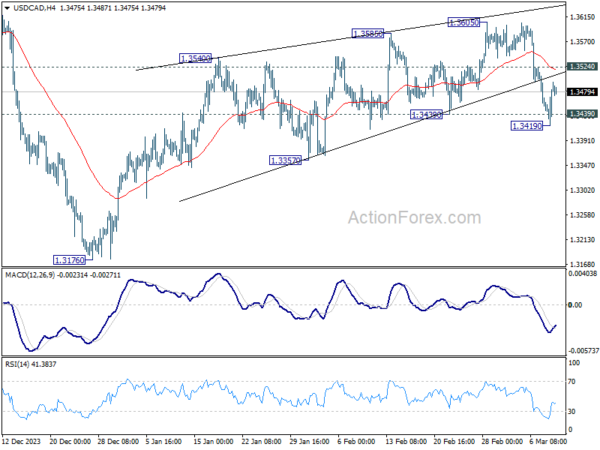

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3439; (P) 1.3469; (R1) 1.3517; More…

Intraday bias in USD/CAD remains neutral for the moment. On the downside, break of 1.3419 and sustained trading below 1.3439 support will argue that rebound from 1.3176 has completed as a corrective move to 1.3605. Near term outlook will be turned bearish for 1.3357 support first. On the upside, though, break of 1.3524 minor resistance will revive near term bullishness, and turn bias back to the upside for retesting 1.3605 resistance instead.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern only. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Overall, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q4 F | 0.10% | 0.30% | -0.10% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 F | 3.90% | 3.80% | 3.80% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Feb | 2.50% | 2.40% | 2.40% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Feb P | -8.0% | -14.10% | -14.0% |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more