Yen Rises On BoJ Rate Speculation, But Gains Muted

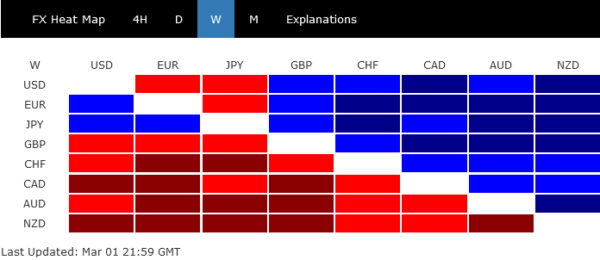

Yen ended as the best performer last week amidst intensifying discussions around BoC rate hike, spurred by comments from the central bank’s officials. The anticipation of policy tightening propelled Yen forward, although gains were tempered by uncertainties surrounding the timing of the first move, and the path of subsequent rate increases. The claimed the position of the second strongest currency, supported by higher than expected inflation data. Dollar ranked third, with its rally hindered by a series of weak economic data.

On the other hand, New Zealand Dollar found itself at the bottom of the performance chart, suffering significant losses after RBNZ decided to keep interest rates steady. The central bank’s statement was perceived as less hawkish than market participants feared, diminishing expectations for future rate hikes. Australian Dollar and Canadian Dollar also faced headwinds, ending the week among the weakest currencies, while Sterling and Swiss Franc were mixed.

The broader financial markets embraced risk-on mood, evidenced by record-setting performances across major indices. DOW, S&P 500, NASDAQ, DAX, CAC, and Nikkei all soared to new heights, underlining a pervasive optimism among investors. Gold capitalized on Dollar’s late-week pullback, mounting a surge that positions it on the cusp of reaching new record high. Simultaneously, Bitcoin broke through the 60k mark, signaling readiness to test its historical peak as well.

NASDAQ Reaches New Heights, 10-Year Yield Declines, Fed Still Seen to Cut in June

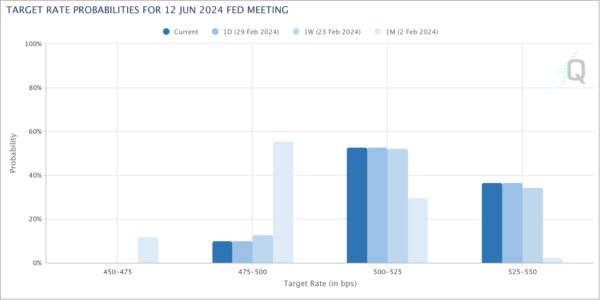

US economic data released last week painted a slightly dovish picture for Fed, subtly tipping the scales towards the start of rate reduction within the first half of this year. On the one hand, the alignment of both headline and core PCE inflation with market expectations last week signaled continued, albeit slow, disinflation progress.

On the other hand, the surprising downturn in ISM Manufacturing Index, which not only underscored the ongoing 16-month contraction within the manufacturing sector but also suggested exacerbation of the situation. Further compounding the outlook were the final consumer survey readings from University of Michigan, which revealed declines across all three measures—sentiment, current conditions, and consumer expectations—exceeding preliminary estimates.

In response to this trio of economic indicators, fed funds futures are now pricing in slightly less than 65% chance of the first rate cut in June, essentially unchanged from a week prior.

Amidst these economic undercurrents, NASDAQ managed to rally to new record highs, finally joining its counterparts, DOW and S&P 500, in achieving this milestone. The tech-heavy index has been particularly buoyed by the dual forces of anticipated monetary policy easing and a burgeoning enthusiasm for artificial intelligence technologies, notably propelled by Nvidia’s strong uptrend.

Technically, the break of the medium term channel resistance as well as 100% projection of 10982.80 to 14446.55 from 12543.85 at 16008.93 suggests that NASDAQ is probably now in acceleration phase again. That’s, though, subject to confirmation by D MACD breaking above the falling trend line. In any case, outlook will stay bullish as long as 15451.65 support holds. Next target is 161.8% projection at 18149.52.

The bond market, too, has responded to these developments, with 10-year yield falling notable on Friday to close at 4.180, alongside 2-year yield, which saw its most significant daily decline since the end of January. For 10-year yield, the close below 55 D EMA (now at 4.189) is a near term bearish sign. Sustained trading below the EMA will argue that recovery from 3.785 has completed at 4.354, and bring deeper all back to 4.000 mark or below.

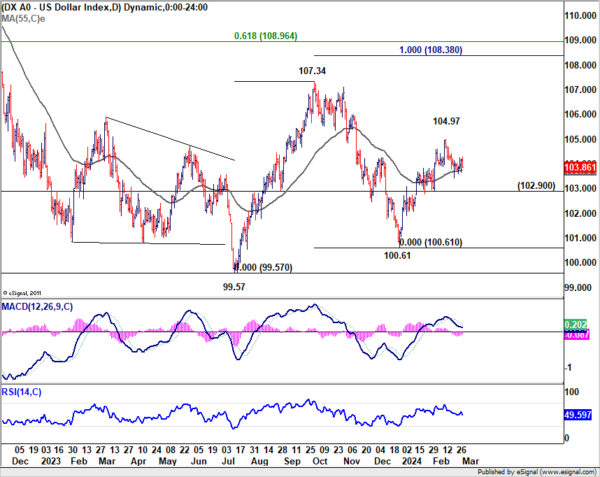

Dollar Index’s recovery last week was rather weak and lacks conviction. Corrective retreat from 104.97 short term top is still in progress and could extend lower, probably until there is more evidence supporting Fed to delay rate cut to the second half of the year. Nevertheless, near term outlook will stay bullish as long as 102.90 support holds. Rise from 100.61, as the third leg of the pattern from 99.57, is still in favor to continue through 104.97 towards 107.34 resistance at a later stage.

BoJ’s Rate Hike Debate Intensifies; Nikkei Hits Record

In Japan, the discourse surrounding BoJ’s monetary policy has become increasingly animated, marked by diverging opinions among the central bank’s top officials.

The conversation intensified following remarks from BoJ board member Hajime Takata, who posited that Japan is on the cusp of achieving sustainable 2% inflation. Takata advocated for a proactive and flexible approach to monetary policy adjustments, sparking immediate speculation among market observers that a rate hike could be on the horizon, as soon as March.

However, Governor Kazuo Ueda introduced a note of caution into the debate, suggesting that Japan has yet to reach the threshold of sustainable 2% inflation, thereby tempering expectations for an imminent policy shift.

Despite the divergent views on inflation and interest rate adjustments, both Takata and Ueda concurred on the positive developments emerging from this year’s Spring wage negotiations. They hinted at the possibility that wage hikes in the current year might outpace those of the previous year, contributing to wage-price spiral.

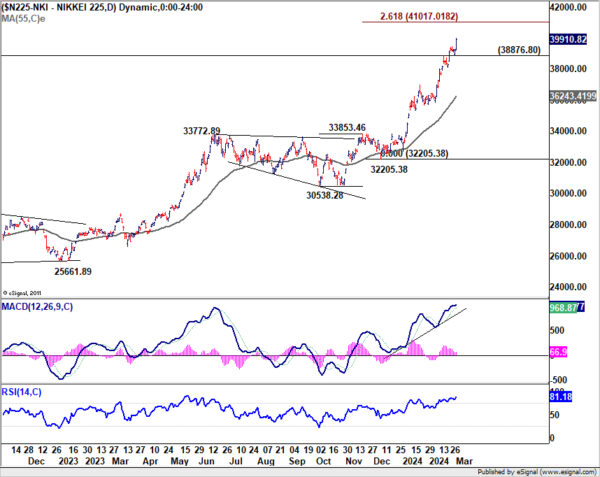

Amidst these monetary policy deliberations, Nikkei showcased remarkable resilience and bullish momentum, ascending to record-breaking close of 39,910.82, narrowly missing 40k mark. Near term outlook will stay bullish as long as 38876.80 support holds. Next target is 261.8% projection of 30538.28 to 33853.46 from 32205.38 at 41017.01. Break of 38876.80 will bring consolidations first, before rising again.

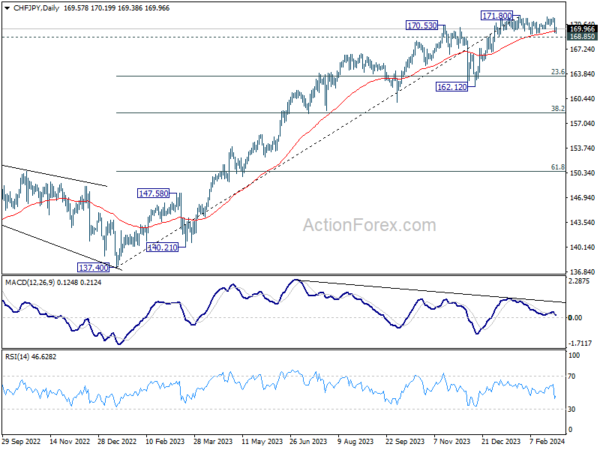

Despite the recent volatility stirred by rate hike speculations, a definitive bullish trend reversal in Yen remains unconfirmed, even against the relatively weak Swiss Franc. As long as 168.85 support holds in CHF/JPY, larger up trend could still resume through 171.80 resistance at a later stage. Nevertheless, considering bearish divergence condition in D MACD, firm break of 168.85 will argue that it’s already in correction to the whole rise from 137.40. In this case, near term outlook will be turned bearish for 162.12 support.

Euro Leads Against Sterling and Franc Following Inflation Data

Euro was the strongest performer among European majors last week, supported by stronger than expected inflation data, despite the ongoing progress in disinflation. This development has led even the most dovish observers of ECB to concur that an interest rate cut in the upcoming Thursday meeting is off the table, with meaningful discussions on rate reductions also unlikely. For now, given the current hawk-dove balance within ECB, a rate cut in June appears more feasible than in April.

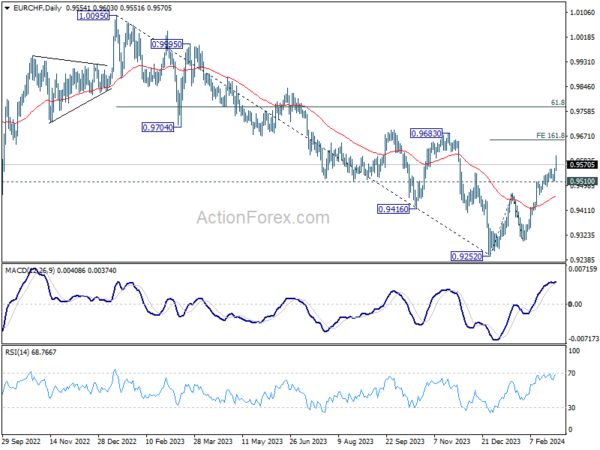

EUR/CHF’s rally from 0.9252 continued last week and showed sign of reacceleration. Near term outlook will stay bullish as long as 0.9510 support holds. Next target is 161.8% projection of 0.9252 to 0.9471 from 0.9304 at 0.9658. For now, this rebound is still seen a corrective move and could be limited by 0.9683 resistance. However, decisive break of 0.9683 will argue that EUR/CHF is already in medium term bullish trend reversal.

EUR/GBP recovered mildly last week but upside is capped below 0.8577 as well as 55 D EMA. Larger down trend is still in favor to resume through 0.8491/7 support zone at a later stage. However, considering bullish convergence condition in D MACD, sustained break of 55 D EMA will suggest that fall from 0.8764 has completed. Further rebound should then be seen, either as a correction to fall from 0.8764 or as the third leg of the pattern from 0.8491.

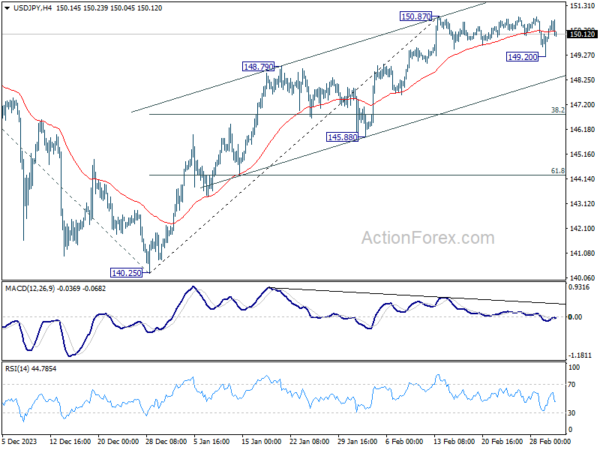

USD/JPY dipped to 149.20 last week but quickly recovered. Initial bias remains neutral this week first. On the upside, break of 150.87 will resume the rise from 140.25 to 151.89/93 key resistance zone. On the other hand, considering bearish divergence condition in 4H MACD, firm break of 149.20 will confirm short term topping at 150.87. Deeper fall would be seen to channel support (now at 148.33), even as a corrective move.

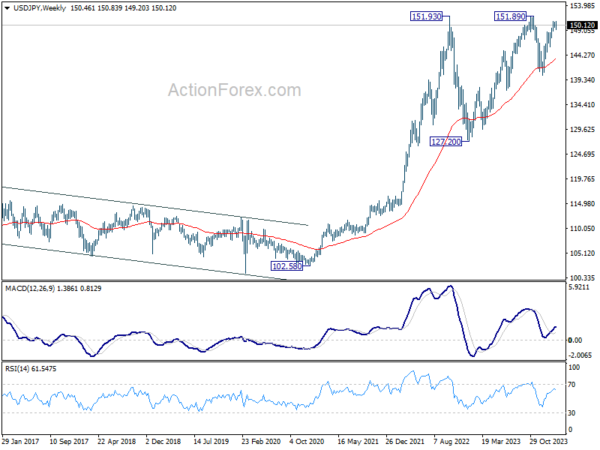

In the bigger picture, rise from 140.25 is seen as resuming the trend from 127.20 (2023 low). Decisive break of 151.89/.93 resistance zone will confirm this bullish case and target 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. However, break of 148.79 resistance turned support will delay this bullish case, and extend the corrective pattern from 151.89 with another falling leg.

In the long term picture, as long as 125.85 resistance turned support holds (2015 high), up trend from 75.56 (2011 low) is still in favor to continue through 151.93 (2022 high) at a later stage.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more