If you are an adviser or paraplanner who recommends multi-asset funds as part of your investment company's proposition to clients - whether this is in the form of an outsourced or in-house centralised investment proposition, or whether you simply recommend multi-asset funds generally - then you need to know about embedded biases in multi-asset funds.

Why? Firstly, because without exception, all multi-asset funds have them, and secondly, if you understand embedded biases, then it will give you some key advantages…

- It will give you an edge when it comes to determining client suitability.

- At the point of recommendation, it will help you prepare your clients for the investment journey. You will be able to tell them when a particular multi-asset fund is likely to perform well and when it might find conditions more challenging.

- It will enable you to have better informed discussions with your clients about performance when it comes around to annual client reviews.

- It will help you to be more tolerant of periods of perceived poor performance when a multi-asset fund's embedded biases suggest that this is probably what you should expect given the market environment.

- It will enable you to be more justifiably critical of performance when a multi-asset fund's embedded biases suggests that it should have performed rather better than it did.

- It will help you to blend multi-asset funds together more successfully, if this is what you would like to do.

So, what are embedded biases?

Embedded biases effectively describe the DNA of a multi-asset fund. In our experience, each multi-asset fund is very likely to have its own unique DNA.

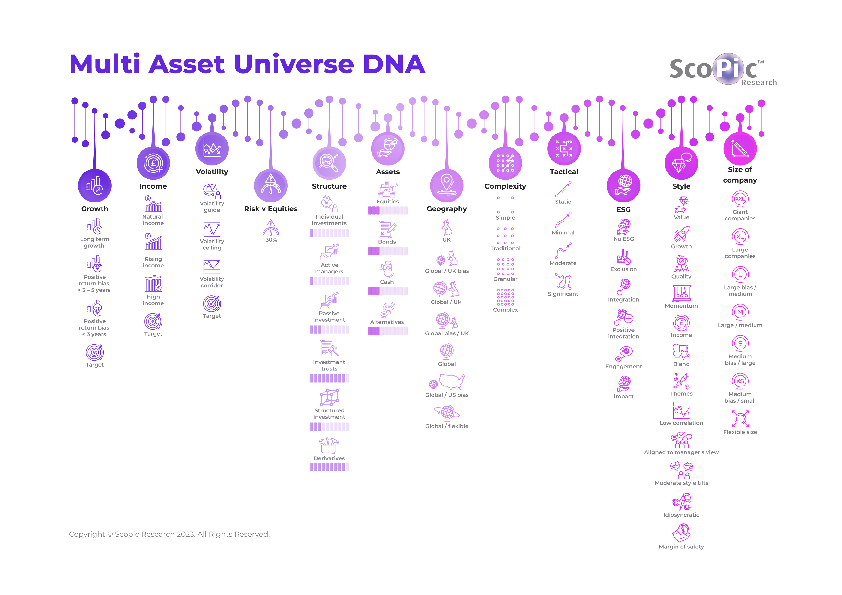

Embedded biases, and therefore a multi-asset fund's DNA, can be found in its intended investment outcome or sometimes its multiple intended outcomes for growth, income and volatility. They can also be found in a multi-asset fund's likely volatility temperature relative to broader equity markets, the types of underlying product structures and asset classes you can expect to see and the extent to which each of them is used, how complex the fund is to understand, its geographical reach, how its investment team addresses and assesses ESG-related risks, and finally, its dominant investment styles and the average size of company within its equity holdings.

For a clearer indication of embedded biases please see the attached multi-asset DNA graphic, which shows many of the DNA characteristics that we find in today's UK multi-asset funds' universe (click to enlarge).

All of these DNA characteristics either have a bearing on end client suitability and/or the likely investment journey pattern we can expect under different market conditions. In short, it is not hard to see how understanding a multi-asset fund's embedded biases (its DNA) can contribute towards intermediaries (and fund groups for that matter) meeting their consumer duty responsibilities.

Finally, the DNA offers another advantage, and that is when it comes to blending multi-asset funds together into one larger client portfolio. Here, understanding the DNA can help us to diversify, rather than to compound, different DNA characteristics and therefore sources of potential risk and return. No one wants a ‘Frankenstein's monster' portfolio that simply compounds the same factors.

Paul will examine each embedded bias in more detail in future articles in the series. Multi-asset DNA reports on individual funds can be accessed for free by Investment Week and Professional Adviser readers at www.scopicresearch.co.uk

Scopic Research is also working with Investment Week and Professional Adviser to provide a quarterly multi-asset team sentiment indicator. Click here for the latest findings from across the industry.