Subdued Trading Continues As Dollar Range Bound, Gold Extending Recovery

Commodity currencies are maintaining their position as the stronger performers of the week, while overall trading continues in a noticeably subdued manner. Both Dollar and Yen are seen navigating within familiar ranges against their European counterparts. Market volatility might experience a slight uptick as US traders return from holiday break today. While FOMC minutes are expected to garner attention, traders will likely hold off on any major bets until Friday’s non-farm payroll data release.

Technically, Gold continues to warrant some attention as the rebound from 1892.76 support is trying to extend. Decisive break of near term channel resistance (now at 1931) will be another sign of bottoming, along with bullish convergence condition in 4H MACD. That came after just missing 38.2% retracement of 1614.60 to 2062.95 at 1891.68. In this case, stronger rally should be seen towards 55D EMA (now at 1947) and above. If realized, that would likely be accompanied by renewed weakness in Dollar.

In Asia, at the time of writing, Nikkei is down -0.25%. Hong Kong HSI is down -1.46%. China Shanghai SSE is down -0.51%. Singapore Strait Times is down -0.54%. Japan 10-year JGB yield is up 0.0187 at 0.394.

China Caixin PMI services fell to 53.9, recovery losing steam

China’s Caixin Services PMI for June plunged to 53.9, down from 57.1 in the previous month and significantly below the expectation of 56.2. The composite PMI also tumbled from 55.6 to a discouraging 52.5, marking the lowest readings since the growth cycle kick-started in January.

Wang Zhe, a senior economist at the Caixin Insight Group, commented on the less-than-promising data: “A slew of recent economic data suggests that China’s recovery has yet to find a stable footing, with prominent issues including a lack of internal growth drivers, weak demand, and dimming prospects persisting.”

Zhe emphasized the disparity between the manufacturing and services sectors, noting that “In June, Caixin China PMIs showed that conditions in the manufacturing sector lagged far behind services. Employment contracted, deflationary pressure mounted, and optimism waned in the manufacturing sector.”

Despite the ongoing post-Covid rebound of the services sector, Zhe expressed concerns about the sustainability of the recovery, adding that “the services sector continued a post-Covid rebound, but the recovery was losing steam.”

WTI oil hovers in range on divided interpretation of output cut

Despite an early-week upswing, oil prices have struggled to extend gains and remain bounded within a familiar range. Saudi Arabia announced extension of its voluntary output cut. Russia and Algeria offered to trim their August output and exports. But these decisions are more seen as a sign affirming a waning optimism in demand growth.

Technically, outlook in WTI crude oil is rather mixed for now. Repeated rejection by 55 D EMA is retaining bearishness. Yet there is no clear sign of extended selling.

Indeed, recent price actions could be interpreted as a triangle pattern that started in 74.74. If that’s true, there is prospect of another bounce to resume the rebound from 63.67. Break of 72.57 resistance will solidify this case and push WTI through 74.74 resistance. Yet, upside would likely be capped by 100% projection of 63.67 to 74.74 from 66.94 at 78.01.

On the other hand, break of 66.94 support could prompt deeper selloff back to retest 63.67 low.

Looking ahead

France industrial production, Eurozone PMI services final and PPI, UK PMI services are the main features in European session. US will release factory orders and FOMC minutes.

EUR/USD Daily Outlook

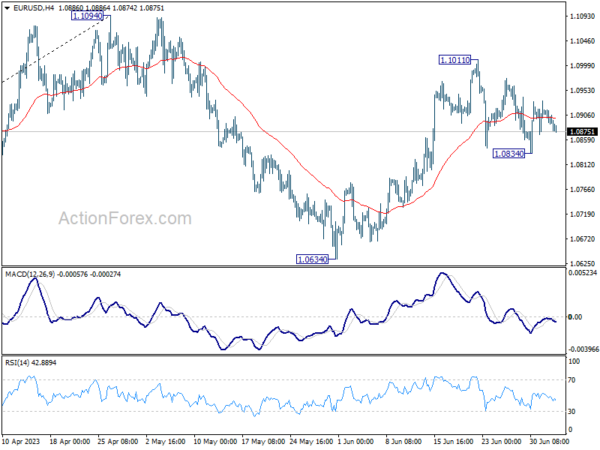

Daily Pivots: (S1) 1.0863; (P) 1.0893; (R1) 1.0908; More…

Intraday bias in EUR/USD remains neutral and further rally is still in favor with 55 D EMA (now at 1.0854) intact. On the upside, break of 1.1011 will resume the rise from 1.0634 and target 1.1094 resistance. Decisive break there will resume larger up trend from 0.9534 to 1.1273 fibonacci level. However, firm break of 1.0834 will turn bias to the downside for 1.0634 support instead.

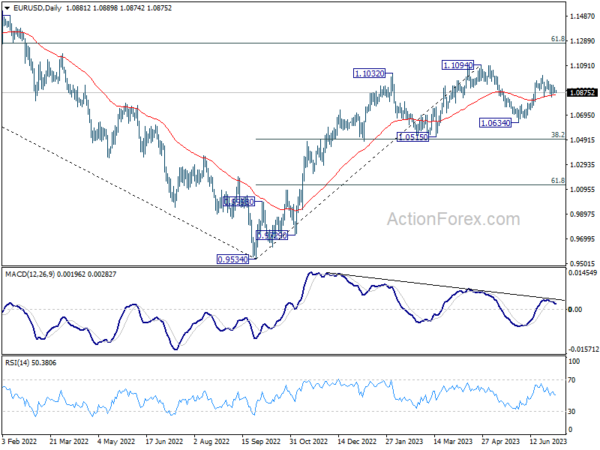

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:45 | CNY | Caixin Services PMI Jun | 53.9 | 56.2 | 57.1 | |

| 06:45 | EUR | France Industrial Output M/M May | -0.20% | 0.80% | ||

| 07:45 | EUR | Italy Services PMI Jun | 53 | 54 | ||

| 07:50 | EUR | France Services PMI Jun F | 48 | 48 | ||

| 07:55 | EUR | Germany Services PMI Jun F | 54.1 | 54.1 | ||

| 08:00 | EUR | Eurozone Services PMI Jun F | 52.4 | 52.4 | ||

| 08:30 | GBP | Services PMI Jun F | 53.7 | 53.7 | ||

| 09:00 | EUR | Eurozone PPI M/M May | -3.90% | -3.20% | ||

| 09:00 | EUR | Eurozone PPI Y/Y May | 6.10% | 1.00% | ||

| 14:00 | USD | Factory Orders M/M May | 0.60% | 0.40% | ||

| 18:00 | USD | FOMC Minutes |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more