Sterling Suffers As BoE Treads Cautiously With 25bps Rate Hike; Dollar Maintains Weekly Lead

Sterling falls significantly today following BoE’s decision to raise interest rates by only 25bps. This cautious, along with Governor Andrew Bailey’s clear indication that a 50bps hike was not on the table, has resulted in substantial pressure on the Pound. Meanwhile, currency markets remain mixed elsewhere, with Canadian and US Dollar on the softer side, while Japanese Yen stages a recovery. Swiss Franc and Euro have seen some uplift due to purchases against the faltering Pound. Australian and New Zealand Dollars have exhibited mixed behavior.

Despite a slight pullback in early US trading today, Dollar remains the top performer for the week. Euro and Swiss Franc follow closely, buoyed by Sterling’s downfall. The Pound currently holds the position of the second-worst performer, only outdone by Australian Dollar’s weakness, but has already overtaken New Zealand dollar.

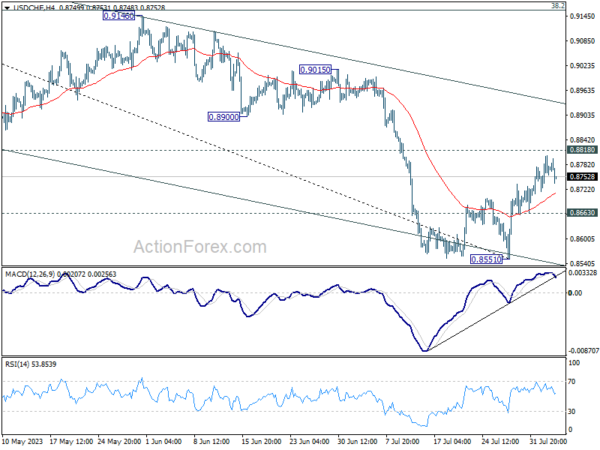

Technically, USD/CHF has been losing upside momentum as seen in 4 H MACD, as it approached 0.8818 support turned resistance. Rejection by 0.8818 will retain near term bearishness in the pair. Further break of 0.8863 support will indicate that larger down trend is resume to resume through 0.8551 low. If realized, that would be an early indicate of completion of Dollar’s near term rebound.

In Europe, at the time of writing, FTSE is down -0.66%. DAX is down -0.91%. CAC is down -0.76%. Germany 10-year yield is up 0.490 at 2.584. Earlier in Asia, Nikkei dropped -1.68%. Hong Kong HSI dropped -0.49%. China Shanghai SSE rose 0.58%. Singapore Strait Times dropped -0.63%. Japan 10-year JGB yield rose 0.0257 to 0.654.

In Europe, at the time of writing, FTSE is down -0.66%. DAX is down -0.91%. CAC is down -0.76%. Germany 10-year yield is up 0.490 at 2.584. Earlier in Asia, Nikkei dropped -1.68%. Hong Kong HSI dropped -0.49%. China Shanghai SSE rose 0.58%. Singapore Strait Times dropped -0.63%. Japan 10-year JGB yield rose 0.0257 to 0.654.

US initial jobless claims rose 6k to 227k

US initial jobless claims rose 6k to 227k in the week ending July 29, above expectation of 223k. Four-week moving average of initial claims dropped -5.5k to 228k.

Continuing claims rose 21k to 1700k in the week ending July 22. Four-week moving average of continuing claims dropped -4.5k to 1712k.

BoE hikes 25bps, softens hawkish bias slightly

BoE raises Bank rate by 25bps to 5.25% today. Two members, Jonathan Haskel and Catherine Mann voted for 50bps hike. Swati Dhingra voted for no change again. Six other MPC members vote for the decision.

Hawkish bias was somewhat softened slightly, as the language that “the MPC will adjust Bank Rate as necessary” was dropped. Nevertheless, the central bank maintained that “If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.”

In the new economic forecast, modal CPI inflation was downgraded slightly from 7.0% to 6.9% in 2023 Q3, and from 2.9% to 2.8% in 2024 Q4. CPI forecast was upgraded from 1.0% to 1.7% in 2025 Q3.

UK PMI composite finalized at 50.8, economy to flatline at best

UK PMI Services was finalized at 51.5 in July, down from June’s 53.7. PMI Composite was finalized at 50.8, down from June’s 52.8, sparking concerns over the possibility of an economic stagnation in the coming months.

Tim Moore, Economics Director at S&P Global Market Intelligence: “The loss of momentum signalled by service providers in July suggests that the UK economy is set to flatline at best in the coming months.

“There were sporadic reports that subdued demand had led to more competitive pricing and the pass through of lower fuel costs, which contributed to a slowdown in output charge inflation to its second-lowest since August 2021.

“However, there was no let-up in pressure on business expenses as the rate of input cost inflation was virtually unchanged from that seen on average in the second quarter of 2023.

“Survey respondents widely commented on strong cost pressures due to higher salary payments in July, which will add to concerns among policymakers that sticky inflation and stagnant growth will prove a persistent challenge for the UK economy during the second half of the year.”

ECB’s Panetta advocates for persistence over aggressiveness in monetary policy approach

ECB Executive Board member Fabio Panetta delivered a speech today, emphasizing the importance of “persistence” over “level” in executing the bank’s monetary policy given the present economic context.

Panetta stated, “In the current context where policy rates are around the level necessary to deliver medium-term price stability, I will argue that monetary policy may operate not just by increasing rates but also by keeping the prevailing level of policy rates for longer. In other words, persistence matters as much as level.”

The ECB official highlighted two primary approaches to the bank’s disinflationary monetary policy: the ‘level’ approach, which involves raising the policy rate beyond its current position, risking a potential need for faster and earlier cuts, and the ‘persistence’ approach, which advocates for maintaining the policy rates at their prevailing level for an extended duration.

“Emphasizing persistence may be particularly valuable in the current situation,” said Panetta, “where the policy rate is around the level necessary to deliver medium-term price stability, the risk of a de-anchoring of inflation expectations is low, inflation risks are balanced, and economic activity is weak.”

He warned against the pitfalls of an aggressive rate hike strategy, stating that it “might amplify the risk associated with overtightening, which could subsequently require rates to be cut hastily in a deteriorating economic environment.”

By contrast, Panetta argued, the ‘persistence’ element allows for greater flexibility, granting the central bank more time to assess the effects of its past policies and fine-tune its stance as new information emerges.

He added that by underlining the importance of this ‘breathing space’, stating, “This is crucial given that – as I said before – the transmission of our monetary policy may actually turn out to be stronger than our projections indicate.”

Eurozone PPI down -0.3% mom, -3.4% yoy in June

Eurozone PPI was down -0.3% mom, -3.4% yoy in June, versus expectation of -0.2% mom, -3.1% yoy. For the month, industrial producer prices decreased by -0.7% for intermediate goods and by -0.5% in the energy sector, while prices remained stable for durable consumer goods and for non-durable consumer goods, and prices increased by 0.1% for capital goods. Prices in total industry excluding energy decreased by -0.3%.

EU PPI was down -0.3% mom, -2.4% yoy. The largest monthly decreases in industrial producer prices were recorded in Hungary (-2.5%), Bulgaria and Latvia (both -2.4%) and Belgium (-2.2%), while the highest increases were observed in Ireland (+4.0), Croatia (+1.3%) and Sweden (+1.2%).

Eurozone PMI composite finalized at 48.6, off to a bad start in H2

Eurozone’s PMI Services was finalized at a six-month low of 50.9 in July, a considerable drop from June’s figure of 52.0. Moreover, PMI Composite was finalized at 48.6, descending from 49.9 in June, marking an eight-month low.

Turning attention to specific member states, PMI Composites revealed that Spain posted a 51.7, reflecting a six-month low. Ireland’s index equaled 50.0, an eight-month low, while Italy and Germany saw similar eight-month lows of 48.9 and 48.5, respectively. However, France’s PMI Composite showed the most significant contraction, falling to a staggering 32-month low of 46.6.

Reflecting on this troubling data, Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, stated: “The Eurozone is off to a bad start in the second half of the year. Economic output fell in July after stagnating the month before and showing generally solid growth during the first five months of the year.”

He pointed out that manufacturing primarily drove this slump in activity, though the services sector also saw a slowdown. He noted, “In the services sector, a weak phase is heralded by the fall of the incoming new business index into contractionary territory.”

De la Rubia also noted the divergent economic performance across Eurozone, with French service companies scaling back their activities significantly while Spanish companies continue to expand, albeit at a slower pace than in the first quarter.

“The contrasting economic performance is making the already-difficult job for the ECB even more challenging,” he added.

Swiss CPI slowed to 1.6% yoy in Jul, core CPI down to 1.7% yoy

Swiss CPI fell -0.1% mom in July, matched expectations. Core CPI (excluding fresh and seasonal products, energy and fuel) was down -0.2% mom. Domestic products prices rose 0.2% mom while imported product prices dropped -1.2% mom.

Annually, CPI slowed from 1.7% yoy to 1.6% yoy, above expectation of 1.5% yoy. Core CPI decelerated from 1.8% yoy to 1.7% yoy. Domestic products prices was unchanged at 2.3% yoy. Imported products prices dropped further from -0.1% yoy to -0.6% yoy.

China’s Caixin PMI composite fell to 51.9, lowest since Jan

China’s Caixin PMI Services increased slightly from 53.9 to 54.1 in July, surpassing the anticipated figure of 52.5. However, this reading fell short of the 55.5 average seen over the previous six months. Concurrently, PMI Composite dropped from 52.5 to 51.9, its lowest mark since January.

Commenting on the latest figures, Wang Zhe, a Senior Economist at Caixin Insight Group, expressed that the uneven recovery of the service and manufacturing industries remains a prominent concern. He noted, “Although the manufacturing sector was a drag, the steady expansion of the services industry still helped overall output, demand, and employment remain in positive territory.”

The contraction in exports appeared pronounced, and while input costs saw a slight uptick, output prices registered a minor drop. Despite these challenges, expectations for future output remained on the optimistic side, though this metric recorded a new low since November.

On the broader economic landscape, Wang Zhe noted, “Although the data for industrial production and investment in June showed some signs of recovery, macroeconomic growth remained sluggish, and considerable downward pressure on the economy persisted.”

Turning to policy recommendations, he emphasized the need for employment guarantees, stabilization of expectations, and boosting household income. He further argued that “At present, monetary policy only has a limited effect on boosting supply. An expansionary fiscal policy that targets demand should be prioritized.”

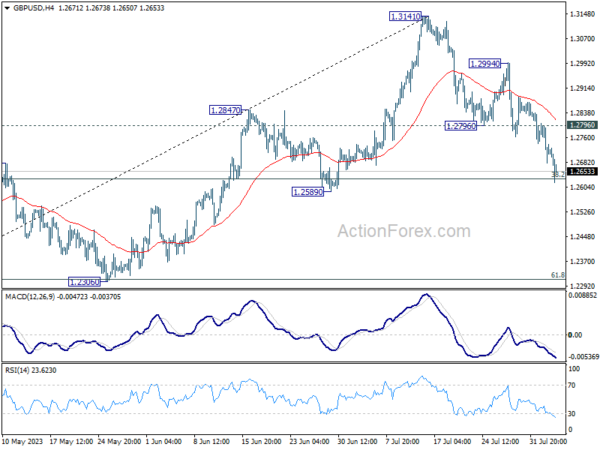

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2659; (P) 1.2732; (R1) 1.2784; More…

GBP/USD’s decline from 1.3141 extends to as low as 1.2618 so far today, and met 38.2% retracement of 1.1801 to 1.3141 at 1.2629 already. There is no sign of bottoming yet and intraday bias remains on the downside. Sustained trading below 1.2678 support turned resistance will argue that it’s already in a larger correction and target 1.2306 support next. Nevertheless, strong rebound from current level, followed by break of 1.2796 resistance, will retain near term bullishness and turn bias back to the upside.

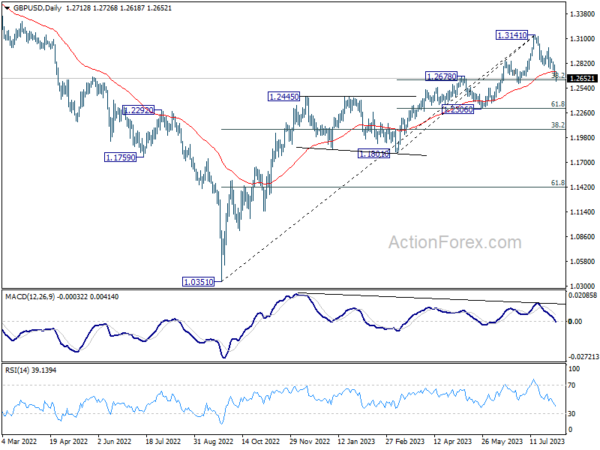

In the bigger picture, the firm break of 55 D EMA (now at 1.2723) is raising the chance of medium term topping at 1.3141. This is also supported by bearish divergence condition in D MACD. Sustained trading below 1.2678 will indicate that fall from 1.3141 is at least correcting whole up trend from 1.0351, with risk of bearish reversal. Deeper fall would be seen back to 38.2% retracement of 1.0351 to 1.3141 at 1.2075.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) Jun | 11.32B | 10.50B | 11.79B | 10.50B |

| 01:45 | CNY | Caixin Services PMI Jul | 54.1 | 52.5 | 53.9 | |

| 06:00 | EUR | Germany Trade Balance (EUR) Jun | 18.7B | 15.5B | 14.4B | |

| 06:30 | CHF | CPI M/M Jul | -0.10% | -0.10% | 0.10% | |

| 06:30 | CHF | CPI Y/Y Jul | 1.60% | 1.50% | 1.70% | |

| 07:45 | EUR | Italy Services PMI Jul | 51.5 | 52.3 | 52.2 | |

| 07:50 | EUR | France Services PMI Jul F | 47.1 | 47.4 | 47.4 | |

| 07:55 | EUR | Germany Services PMI Jul F | 52.3 | 52 | 52 | |

| 08:00 | EUR | Italy Retail Sales M/M Jun | -0.20% | 0.00% | 0.70% | 0.60% |

| 08:00 | EUR | Eurozone Services PMI Jul F | 50.9 | 51.1 | 51.1 | |

| 08:30 | GBP | Services PMI Jul F | 51.5 | 51.5 | 51.5 | |

| 09:00 | EUR | Eurozone PPI M/M Jun | -0.40% | -0.20% | -1.90% | |

| 09:00 | EUR | Eurozone PPI Y/Y Jun | -3.40% | -3.10% | -1.50% | -1.60% |

| 11:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.25% | 5.00% | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 8–0–1 | 7–0–2 | 7–0–2 | |

| 11:30 | USD | Challenger Job Cuts Y/Y Jul | -8.20% | 25.20% | ||

| 12:30 | USD | Initial Jobless Claims (Jul 28) | 227K | 223K | 221K | |

| 12:30 | USD | Nonfarm Productivity Q2 P | 3.70% | 1.10% | -2.10% | |

| 12:30 | USD | Unit Labor Costs Q2 P | 1.60% | 2.70% | 4.20% | |

| 13:45 | USD | Services PMI Jul F | 52.4 | 52.4 | ||

| 14:00 | USD | ISM Services PMI Jul | 53 | 53.9 | ||

| 14:00 | USD | Factory Orders M/M Jun | 0.20% | 0.30% | ||

| 14:30 | USD | Natural Gas Storage | 18B | 16B |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more