Sterling And Aussie Show Strength In Quiet Trading

Trading as been relatively quiet in European session today. Sterling strengthened slightly despite CPI data showing inflation returning to BoE’s target for the first time in three years. Notably, services inflation remains elevated at 5.7%, which could limit the BoE’s ability to aggressively ease policy, although the first rate cut is still expected in August. Market participants will closely watch tomorrow’s BoE rate decision, with traders scrutinizing the statement and voting details.

Currently, Australian Dollar is the second strongest currency of the day, although it lacks strong follow through buying momentum. Euro follows as the third strongest. In contrast, New Zealand Dollar is the weakest, with traders awaiting New Zealand’s GDP data in the upcoming Asian session. Yen is the second weakest, followed by Dollar, while Swiss Franc and Canadian Dollar are positioned in the middle.

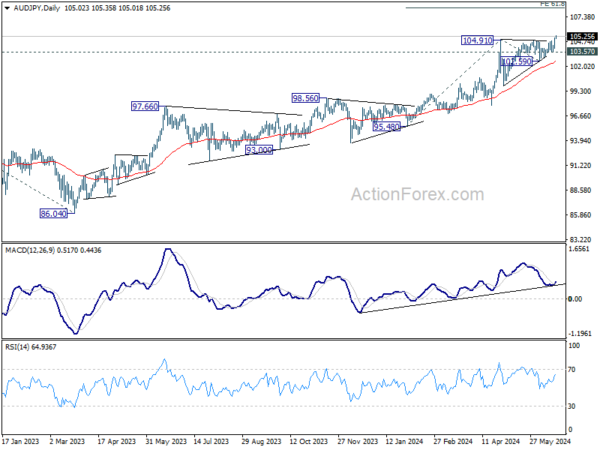

Technically, AUD/JPY is currently the top mover for the week, up more than 1%. The break of 104.91 resistance confirms long term up trend resumption. Near term outlook will stay bullish as long as 102.59 support holds. Next target is 61.8% projection of 95.48 to 104.91 from 102.59 at 108.41.

In Europe, at the time of writing, FTSE is up 0.21%. DAX is down -0.19%. CAC is down -0.51%. UK 10-year yield is up 0.0295 at 4.083. Germany 10-year yield is u 0.027 at 2.422. Earlier in Asia, Nikkei rose 0.23%. Hong Kong HSI rose 2.87%. China Shanghai SSE fell -0.40%. Singapore Strait Times rose 0.07%. Japan 10-year JGB yield fell -0.0114 to 0.936.

UK CPI slows to 2.0% in May, core CPI down to 3.5%

UK CPI slowed from 2.3% yoy to 2.0% yoy in May, lowest since July 2021. Core CPI (excluding energy, food, alcohol and tobacco) slowed from 3.9% yoy to 3.5% yoy. Both matched expectations.

CPI goods annual rate fell from – 0.8% yoy to -1.3% yoy, while CPI services annual rate eased slightly from 5.9% yoy to 5.7% yoy.

On a monthly basis, CPI rose by 0.3%, below expectation of 0.4% mom.

BoJ Minutes highlight concerns over weak Yen’s impact on inflation

Minutes from BoJ’s April 25-26 meeting revealed that board members are closely monitoring the ongoing risks posed by the weak Yen and its effect on inflation, which could force a monetary policy response.

“Some members” emphasized that exchange rates are crucial factors influencing economic activity and prices, suggesting that “monetary policy responses would be necessary” if there were significant changes in the economic outlook or associated risks.

One of these board members noted the “trilemma of international finance,” arguing that monetary policy should not be used solely to stabilize foreign exchange rates. However, they acknowledged that if exchange rate movements impacted firms’ medium- to long-term inflation expectations and corporate behavior, this could “raise the risk of prices being affected,” making monetary policy adjustments “necessary.”

The minutes also reflected a shared understanding among members that if underlying inflation increases in line with forecasts, BoJ would adjust its degree of monetary accommodation. Additionally, any changes in the outlook for economic activity and prices, or shifts in related risks, would warrant adjustments to the policy interest rate.

RBNZ’s Conway: Inflation sticky near-term, could fall more quickly medium term

In a speech today, RBNZ Chief Economist Paul Conway discussed the complexities of bringing inflation sustainably back to target, noting “remaining challenges” and various risks and uncertainties.

Conway pointed out that in the “near term”, inflation might be “more persistent” than current projections suggest. He highlighted that domestic or non-tradables inflation and services sector inflation have remained higher than expected, indicating a “sticky” inflationary environment.

Conversely, Conway also sees potential for inflation to “fall more quickly” than anticipated over the “medium term”. Factors such as increasing spare capacity in product and labor markets and shifting business and household inflation expectations could accelerate the decline in inflation.

He explained that RBNZ’s current policy strategy is “balancing these opposing factors.” The bank will closely monitor indicators of core inflation, non-tradables inflation, services inflation, and inflation expectations to assess how these risks unfold. The labor market will also be a critical signal of capacity pressure.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2678; (P) 1.2700; (R1) 1.2730; More…

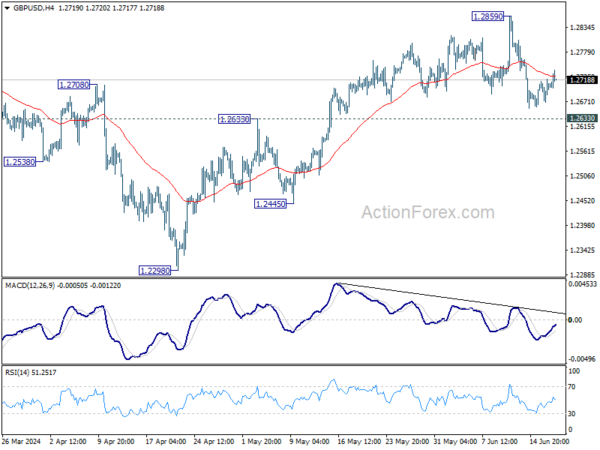

GBP/USD is still in weak recovery today and intraday bias remains neutral. Risk will stay on the downside as long as 1.2859 resistance holds. Firm break of 1.2633 resistance turned support will argue that whole rise from 1.2298 has completed, and target 1.2445 and below.

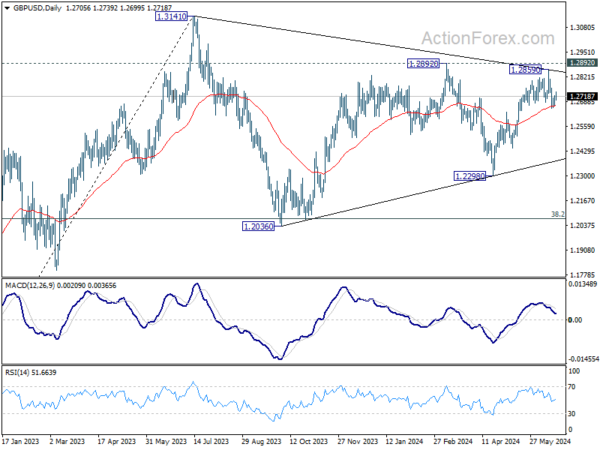

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern. Fall from 1.2892 is seen as the third leg which might have completed already. Break of 1.2892 resistance will argue that larger up trend from 1.0351(2022 low) is ready to resume through 1.3141. Meanwhile, break of 1.2445 support will extend the corrective pattern with another decline instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account (NZD) Q1 | -4.36B | -4.65B | -7.84B | -7.98B |

| 23:50 | JPY | Trade Balance (JPY) May | -0.62T | -0.63T | -0.56T | |

| 23:50 | JPY | BoJ Minutes | ||||

| 06:00 | GBP | CPI M/M May | 0.30% | 0.40% | 0.30% | |

| 06:00 | GBP | CPI Y/Y May | 2.00% | 2.00% | 2.30% | |

| 06:00 | GBP | Core CPI Y/Y May | 3.50% | 3.50% | 3.90% | |

| 06:00 | GBP | RPI M/M May | 0.40% | 0.50% | 0.50% | |

| 06:00 | GBP | RPI Y/Y May | 3.00% | 3.10% | 3.30% | |

| 06:00 | GBP | PPI Input M/M May | 0% | -0.20% | 0.60% | 0.80% |

| 06:00 | GBP | PPI Input Y/Y May | -0.10% | -1.60% | -1.40% | |

| 06:00 | GBP | PPI Output M/M May | -0.10% | 0.10% | 0.20% | 0.30% |

| 06:00 | GBP | PPI Output Y/Y May | 1.70% | 1.10% | ||

| 06:00 | GBP | PPI Core Output M/M May | 0.20% | 0.00% | 0.20% | |

| 06:00 | GBP | PPI Core Output Y/Y May | 1.00% | 0.20% | 0.30% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Apr | 38.6B | 35.2B | 35.8B | |

| 14:00 | USD | NAHB Housing Index Jun | 46 | 45 | ||

| 17:30 | CAD | BoC Summary of Deliberations |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more