Risk-On Wave Sweeps Markets, Stocks Hit Records, Dollar Declines

The financial markets concluded last week on a robust risk-on sentiment, driven primarily by the flurry of central bank activities. The stock markets, in particular, resonated with a bullish tone, cementing their position after Fed’s dovish shift. This sentiment propelled key indices like the DOW, DAX, and CAC to new record highs. Despite a mild retreat towards the end of the week, these indices maintained their elevated levels, underscoring the market’s positive response.

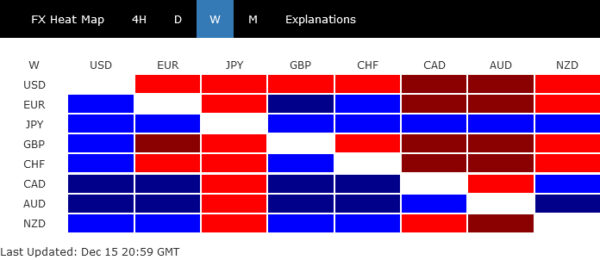

In the currency markets, the US Dollar emerged as the weakest performer, significantly influenced by the Fed’s projection of a cumulative 75 basis points rate cut for the next year. This shift in Fed’s stance considerably affected Dollar’s standing against its counterparts.

While European currencies also gained against the Dollar, they lagged behind other major currencies. ECB’s and BoE’s resistance to the speculation of imminent rate cuts did not significantly impact market sentiments, as their messages appeared to fall on deaf ears.

Japanese Yen stood out as the strongest currency and is poised for further near-term rally, heavily contingent on the upcoming BoJ policy decision. Australian Dollar led commodity currencies as the next strongest and could see a further rally if the risk-on sentiment persists.

Fed signals rate cuts, ECB and BoE take a cautious stance

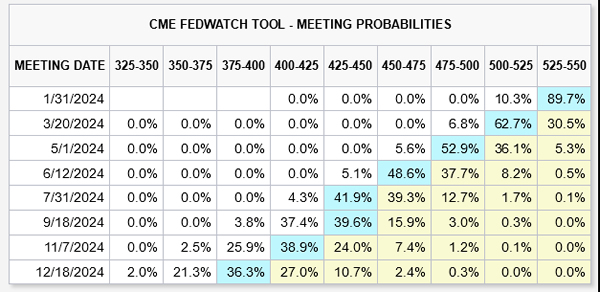

Fed’s “spectacular” dovish pivot last week, as marked by its new economic projections, had a significant impact on the financial markets. These projections indicate a substantial easing of monetary policy in 2024, with a forecasted total rate cut of 75 bps. This adjustment would bring federal funds rate down from its current range of 5.25-5.50% to a much lower bracket of 4.50-4.75%.

The market’s response to this prospective easing has been swift and decisive. Fed fund futures, a key indicator of market sentiment and expectations, now reflect 58.5% probability of the first 25bps rate cut occurring as soon as May 2024. However, the market sentiment doesn’t stop there. Traders are pricing in an even more aggressive easing trajectory, with over 75% chance that Fed will further reduce its interest rate to a range of 3.75-4.00% by the end of next year. This anticipated move would mark a dramatic 150bps decrease from the current rate.

In contrast to Fed’s apparent readiness to ease monetary policy, ECB and BoE adopted a more cautious approach, resisting the immediate speculation of rate cuts in their respective regions.

Despite the differing monetary stances, it appears almost certain that both the ECB and BoE will embark on policy loosening in the coming year, albeit at an undetermined pace and magnitude. The latest round of PMI data from Eurozone and UK provides some context for this outlook. The data suggests continued contraction in Eurozone’s manufacturing and services sectors, while UK’s economic growth remains stagnant.

The question is just on who’s first and who’s faster in cutting interest rates.

DOW, DAX and CAC hit new record highs

The anticipation of monetary easing has led to strong rally in global equity markets. DOW, DAX, and CAC all reached new record highs last week. From a technical standpoint, the near-term outlook for DOW remains bullish as long as the 26292.58 support holds. Next target is 100% projection of of 28660.94 to 34712.28 from 32327.20 at 38378.54.

The key question for DOW is whether it can maintain enough momentum to quickly reach 40k level, which is close to medium term target of 61.8% projection of 18213.65 (2020 low) to 3695.65 (2022 high), from 28660.94 (2022 low) at 42041.65.

DAX spiked higher to 17003.27 but retreated to close down at 16751.43, as reaction to poor PMI data. For now further rise is in favor as long as 16595.10 support holds. Next target is 61.8% projection of 11862.84 to 16528.97 from 14630.21 at 17513.87. Break of 1695.10 support will bring consolidations first. But pullback should be contained above 55 D EMA (now at 15919.20) to bring another rally.

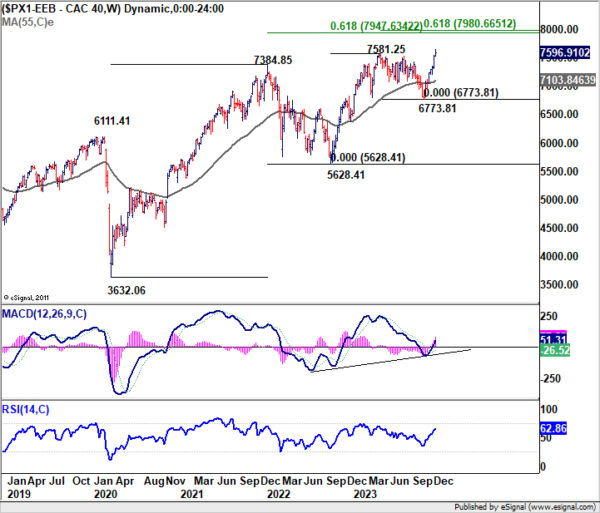

Further rally is expected in CAC as long as 7529.10 support holds. Next target is 61.8% projection of 5628.41 to 7581.25 from 6773.81 at 7980.66, which is close to 8000 psychological level. Break of 7529.10 will bring consolidations first. But downside of retreat should be contained above 55 D EMA (now at 7255.17) to bring up trend resumption.

US 10-year yield breaks 4%, Dollar Index resumes near term fall

US 10-year yield’s decline from 4.997 accelerate through 4% last week to close at 3.928. Technically speaking current level is an ideal area to stage a recovery. Oversold condition is seen in D RSI. There are 61.8% retracement of 3.253 to 4.997 at 3.919, 55 W EMA (now at 3.952) and well as long term channel support. But still break of 4.293 resistance is needed to indicate short term bottoming. Otherwise, any interim recovery would be brief.

On the other hand, sustained trading below 3.919 will pave the way to 3.253 cluster support (38.2% retracement 0.398 to 4.997 at 3.24), as a correction to whole up trend from 0.398 (2020 low).

Dollar index’s fall from 107.34 resumed by breaking through 102.46 last week, after failing to extend the rebound through 55 D EMA. Further decline is now expected to 61.8% projection of 107.34 to 102.46 from 104.26 at 101.24 first. Firm break there will target 100% projection at 99.38, which is close to 99.57 key support level.

The bigger question is whether DXY’s fall from 107.34 is resuming the whole down trend from 114.77 (2022 high), or as the second leg of the consolidation pattern from 99.57. For now, the latter case is favored, as Euro’s outperformance on Dollar shouldn’t last too long for ECB is also on track to rate cuts next year.

Hence, strong support is expected from 99.38/57 to contain downside to finish the fall from 107.34, and bring rebound. Break of 104.26 will argue that the third leg of the corrective pattern could have started.

AUD/USD, USD/JPY and USD/CNH

AUD/USD was the second biggest mover last week, and gained 1.84%. Technically, the break of medium term channel resistance affirm the case that whole decline from 0.7156 has completed with three waves down to 0.6269. Rise from 0.6269 is seen as the third leg of the pattern from 0.6169 (2022 low). Near term outlook will now stay bullish as long as 0.6524 support holds, for 0.6894 resistance first. Decisive break there will bring further rally to 0.7156 resistance next.

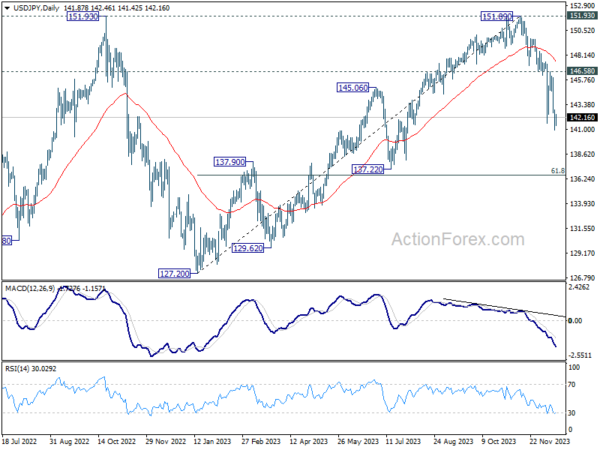

USD/JPY was the top mover last week, closed down -1.91%. The development is inline with the view that rise from 127.20 has completed at 151.89 already. Fall from 151.89 is seen as the third leg of the pattern from 151.93. Outlook will stay bearish as long as 146.58 resistance holds. Next target is 61.8% retracement of 127.20 to 151.89 at 136.63. Sustained break there will pave the way to 127.20 support (2022 low).

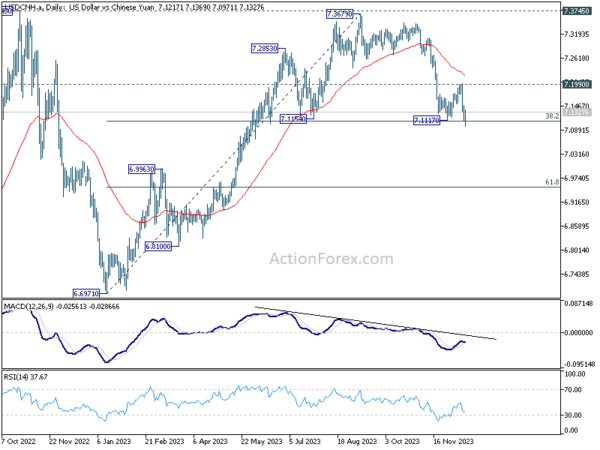

USD/CNH attempt to break through 38.2% retracement of 6.6971 to 7.3679 at 7.1117 last week, but failed again. Nevertheless, near term outlook will stay bearish as long as 0.7119 support holds. Fall from 0.73679 is tentatively seen as the third leg of the pattern from 7.3745. Sustained break of 7.7117 will affirm this view and pave the way to 61.8% retracement at 6.9533 below. If realized, extended decline in USD/CNH would give extra support to the rally in AUD/USD and pressure to the decline in USD/JPY.

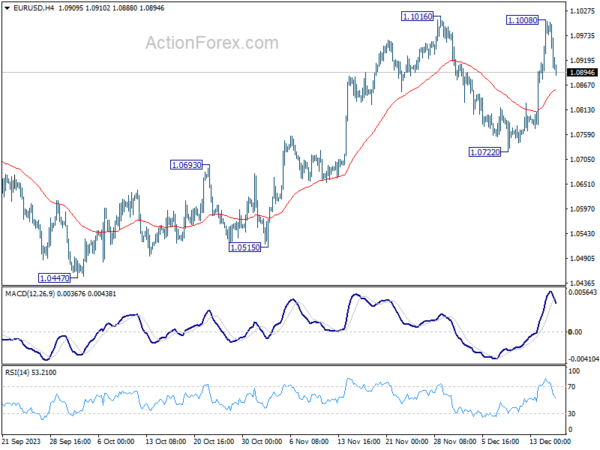

EUR/USD rose to 1.1008 last week but failed to break through 1.1016 resistance and retreated. Initial bias remains neutral this week first. Further rally is expected as long as 1.0722 support holds. Break of 1.1016 will resume the whole rise from 1.0447 to retest 1.1274 high.

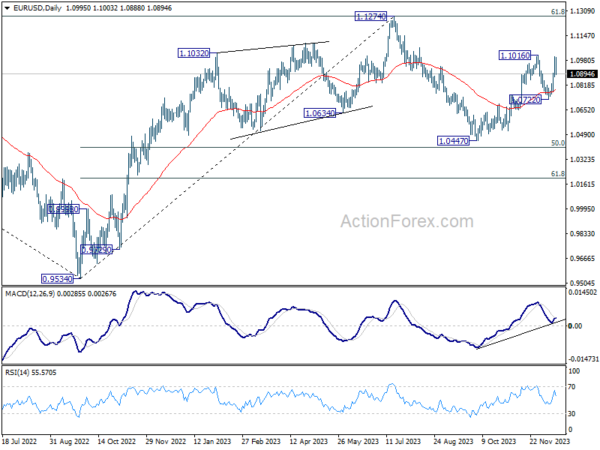

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

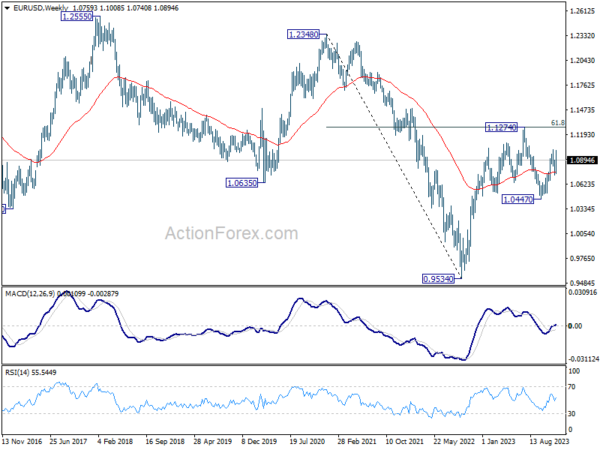

In the long term picture, a long term bottom is in place at 0.9534 on bullish convergence condition in M MACD. It’s still early to call for bullish trend reversal with the pair staying inside falling channel. Nevertheless, sustained trading above 55 M EMA (now at 1.1073) and break of 1.1274 resistance will raise the chance of reversal and target 1.2348 resistance for confirmation.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more