Risk-On Sentiment Pushes US Stocks To New Highs, Safe-Haven Currencies Underperform

Risk-on sentiment dominated global financial markets last week, with investors buoyed by US inflation report that alleviated fears of another interest rate hike by Fed. The DOW defied gravity and surged to a new record high above the 40k mark, while S&P 500 and NASDAQ also set new records. Commodities mirrored this strong performance, with Copper hitting an all-time high and Gold poised to follow suit.

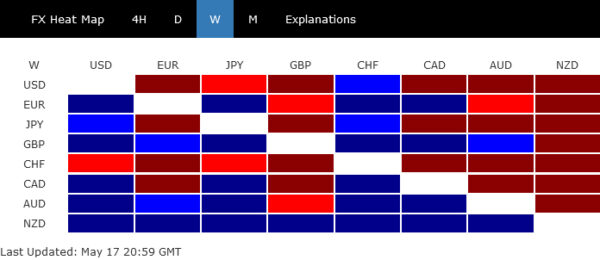

In the currency markets, Swiss Franc ended as the worst performer, followed by Dollar and Japanese Yen, reflecting the typical underperformance of safe-haven assets when investors embrace risk. Conversely, high-beta currencies such as New Zealand Dollar, British Pound, and Australian Dollar were the best performers, benefiting from their risk-sensitive nature. Euro and Canadian Dollar positioned themselves in the middle of the performance spectrum.

Dow Breaks 40k, Dollar Struggles

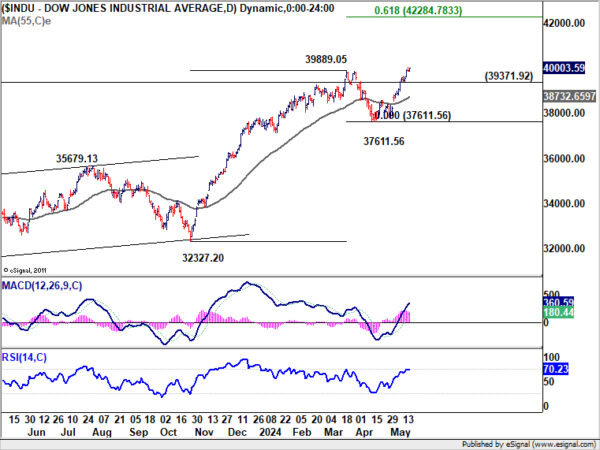

Dow Jones Industrial Average achieved a historic milestone, closing above the 40,000 mark for the first time on Friday. S&P 500 and NASDAQ also ended the week at record highs. This surge is fueled by a series of optimistic economic reports over the past two weeks, which have buoyed investor sentiment. The non-farm payroll report showed that while US labor market is cooling, it is doing so without major disruptions. Additionally, CPI report indicated that disinflation process has resumed, alleviating some inflation concerns.

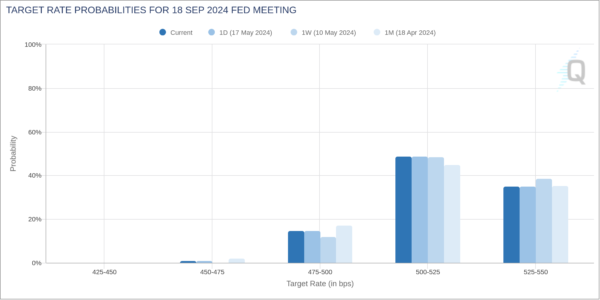

The question now is whether Fed is back on track to start easing monetary policy later this year. While it seems probable, much will depend on the forthcoming economic data. But at least for now, fear of another rate hike has significantly diminished, as indicated by Fed Chair Jerome Powell and corroborated by recent data. Fed funds futures now show around 65% chance of a 25 bps rate cut in September, up from approximately 61% a week ago.

Technically, near term outlook will stay bullish in DOW as long as 39371.92 support holds. Next target is 61.8% projection of 32327.20 to 39889.05 from 37611.56 at 42284.78. Break of 39371.92 will bring consolidations first, before staging another rally.

Dollar index is now at a critical juncture, pressing channel support at around 104. Decisive break there, which could be triggered by extended risk-on rally, would indicate that whole rise from 100.61 has completed with three waves up to 106.51 already. Fall from 106.51, as another down leg in the sideway pattern from 99.57 ,would target 102.35 and then 100.61. Nevertheless, strong bounce from current level, followed by break of 105.74 resistance, will retain near term bullishness.

High-Beta Currencies Strong But Aussie Lags

The risk-on mood in global markets has buoyed high-beta currencies including Sterling, Aussie, and Kiwi, though with varied performances based on differing domestic economic data.

Australian Dollar underperformed its peers due to mixed job data that dampened the chance for further rate hikes by RBA. While Australia’s job growth in April significantly exceeded forecasts, unemployment rate unexpectedly rose from 3.9% to 4.1%. Additionally, Wage Price Index’s growth slowed to 0.8% qoq in Q1. Reflecting these mixed signals, money markets now suggest a roughly 50% chance that RBA will cut cash rate to 4.1% by December, marking a significant shift from just a month ago when traders were evenly split on the likelihood of a rate increase.

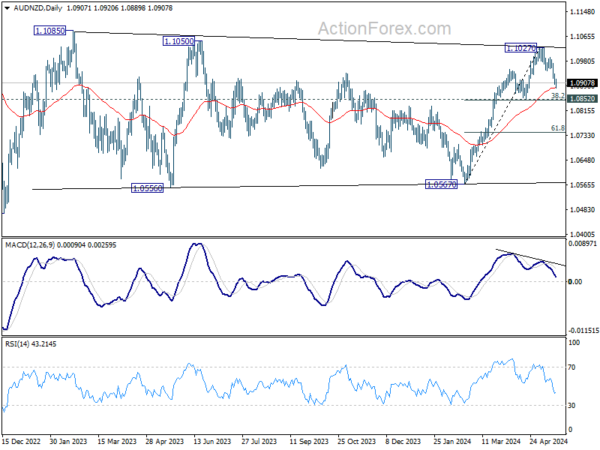

In contrast, Sterling found support from robust wage growth data in March, which remained steady in March. While BoE Chief Economist Huw Pill noted that a summer rate cut remains “not unreasonable,” a June rate cut now appears less likely. New Zealand Dollar emerged as the strongest of the trio, buoyed by optimism towards China’s economic recovery and a technical rebound against Australian Dollar.

Technically, AUD/NZD’s sharp decline last week argues that rise from 1.0567 might have completed at 1.1027 already, on bearish divergence condition in D MACD. Firm break of 1.0852 cluster support (38.2% retracement of 1.0567 to 1.1027 at 1.0851 will indicate that the range pattern from 1.1085 has already started another falling leg. Deeper decline would be seen to 61.8% retracement at 1.0743 and below. Nevertheless, strong bounce from 1.0852 will retain near term bullishness for another rally at a later stage.

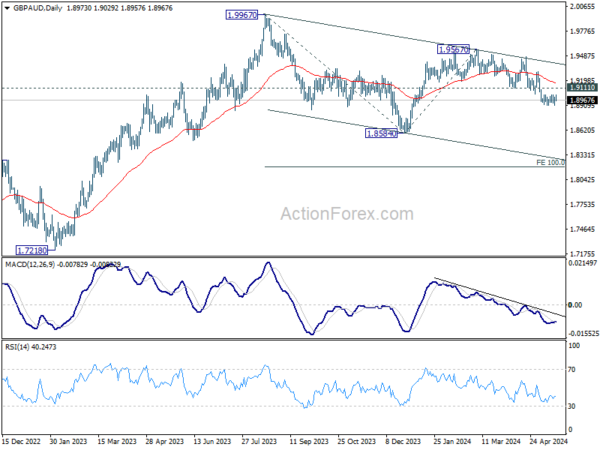

GBP/AUD remains bearish in the near term, as it’s capped well below 1.9111 support turned resistance, even more by 55 D EMA (now at 1.9163). Current fall from 1.9567 is seen as the third leg of the corrective pattern from 1.9967. Deeper decline should be seen to 1.8584 first. Firm break there will target 100% projection of 1.9967 to 1.8584 from 1.9567 at 1.8184.

Copper hits new record, Gold to follow?

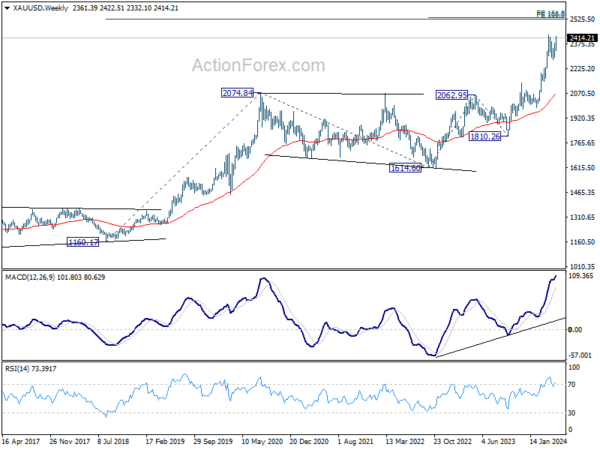

Metals had a strong run last week with Gold now approaching record high at 2431.27. Decisive break there will confirm long term up trend resumption. However, stiff resistance lies ahead around 2500 psychological level. There lies 161.8% projection of 1614.60 to 2062.95 from 1810.26 at 2535.69, and 100% projection of 1160.17 to 2074.84 at 1614.60 at 2529.27. So, beware of strong resistance around 2500 to limit upside to complete the five-wave sequence from 1810.26.

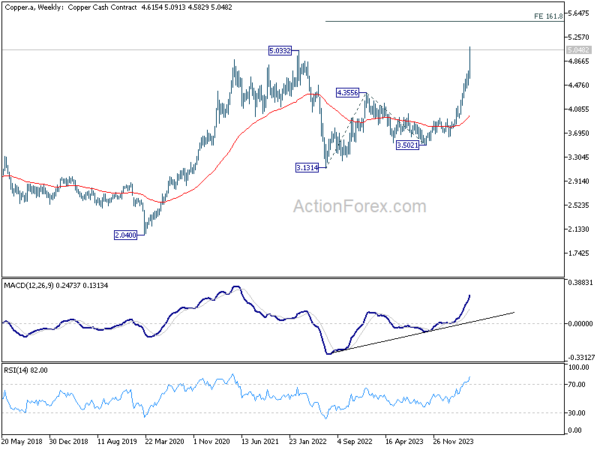

Copper also accelerated to new record high last week. Near term outlook will stay bullish as long as 4.6545 resistance turned support holds. Next target is 161.8% projection of 3.1314 to 4.3556 from 3.5021 at 5.4829.

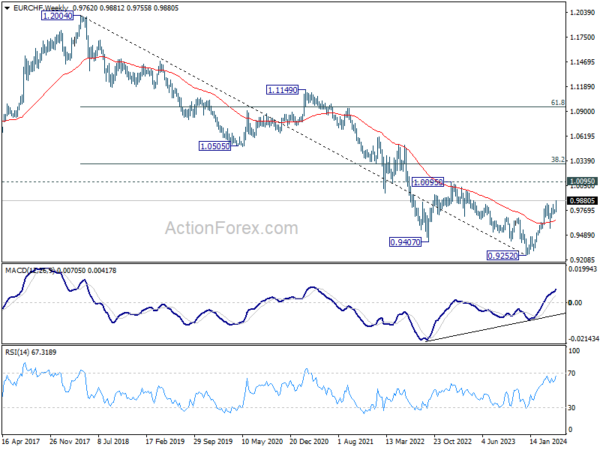

EUR/CHF’s rally from 0.9252 resumed by breaking through 0.9847 resistance last week. Initial bias stays on the upside this week for 61.8% projection of 0.9304 to 0.9847 from 0.9563 at 0.9899. Decisive break there could prompt upside acceleration to 100% projection at 1.0106, which is slightly above 1.0095 key structural resistance. On the downside, below 0.9835 resistance turned support will turn intraday bias neutral and bring consolidations first. But near term outlook will remain bullish as long as 0.9728 support holds, in case of retreat.

In the bigger picture, as long as 0.9563 support holds, rise from 0.9252 medium term bottom is still in favor to continue. Next target is 38.2% retracement of 1.2004 (2018 high) to 0.9252 (2023 low) at 1.0303, even as a correction to the down trend from 1.2004.

In the long term picture, fall from 1.2004 (2018 high) is part of the multi-decade down trend. Firm break of 1.0095 resistance is needed to be the first sign of long term bottoming. Otherwise, outlook will remain bearish.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more