Longer duration assets - such as growth stocks that tend to have a higher proportion of their value discounted from some point in the future - have suffered the most, but with the risk of recession having increased, very few areas have been left unscathed as investors have sought the safety of value or more defensive stocks.

Some have pulled money out of equities altogether in favour of fixed income positions that now offer better returns than they have done for a long time.

Shareholder activism and M&A surge is a mixed blessing for investment trust sector

Many investment trust holders have suffered further as the funds they invest in have not only seen the value of their underlying holdings de-rate but their discounts to net asset value have widened as well.

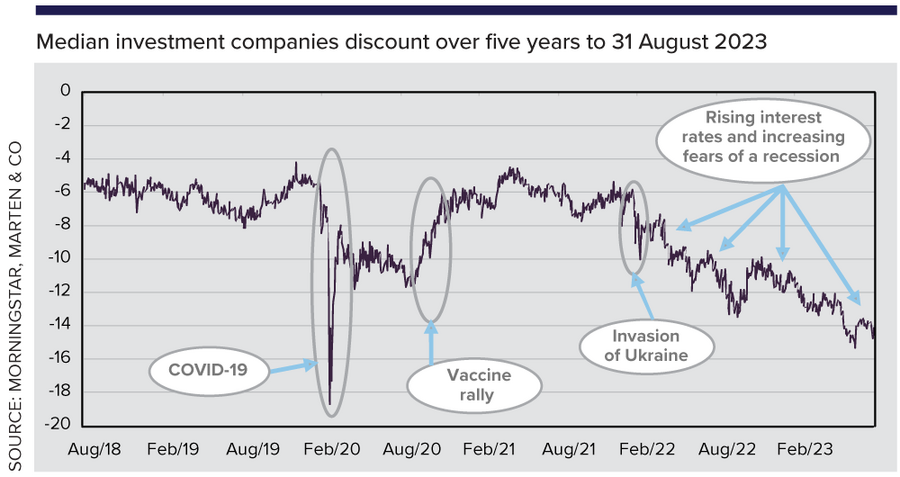

As is illustrated in the chart below, the median discount for the investment companies sector as a whole has widened by nearly nine percentage points over the five years to 31 August 2023 (from 5.5% to 14.1%).

However, this big-picture view masks the more savage deratings experienced by certain subsectors: private equity has widened by around 20 percentage points, from a discount of 19.1%, to a discount of 39.3%; flexible investment from 1.7% to 19.4%; property from a 2.2% premium to a 36.5% discount; infrastructure from a 10.6% premium to a 22.6% discount and renewable energy infrastructure from a 9.1% premium to a 24.1% discount.

Listed equity funds have seen more modest moves in comparison (from a discount of 7.7% to a discount of 10.7%).

Widening discounts are not good for shareholders as they will not be able to realise as much value from their investments should they wish to sell, so what can boards do about this?

Discounts/premiums reflect the balance between supply and demand for an investment company's shares and these can be driven by a range of factors.

Where there is a structural reason contributing to a discount, such as the market preferring lower debt levels, more liquidity or greater efficiencies, or perhaps wanting evidence that NAVs are justified, then corporate actions designed to address these should be welcome and help lower the discount over the longer-term.

The recently abandoned proposals for GCP Infrastructure to absorb both GCP Asset Backed Income (GABI) and RM Infrastructure offers a good example.

With all of these funds trading at wide discounts, and the latter two somewhat limited by their sizes, the merger, which aimed to create a larger vehicle, with greater liquidity, the ability to return capital while offering a potential re-rating over time, seemed to make sense.

For various company-specific reasons, the respective boards changed their minds, but both GCP Infrastructure and GABI said they plan to use surplus cash to pay down debt and to repurchase shares while these trade at significant discounts.

RM Infrastructure is adopting a managed wind down strategy.

GABI is introducing a regular continuation vote which will give its shareholders the opportunity to call time and exit if they are not happy with performance and feel the discount remains too wide. All these measures should help lower the discounts over time.

The same should apply to any measure that makes a fund more shareholder-friendly, for example reducing the management fee, introducing a buyback programme, or making a tender offer.

With many funds trading at discounts and unable to grow, expect to see more of these sorts of corporate actions.

Scottish Mortgage suffers Global sector's biggest discount widening in H1

Where the market has concerns around the validity of NAVs for funds with private assets, asset sales, assuming that these are completed around NAV or a premium to NAV, give credibility to both the NAV and its calculation methodology. An extreme example of this is Round Hill Music Royalty's sale of its entire catalogue at a 67.3% premium to its previous closing price.

This sale is still at an 11.5% discount to NAV but gives shareholders a substantial uplift over the pre-bid share price and it is commendable that its board rejected a number of offers before recommending the bid from Concord. With discounts for funds invested in unlisted assets at very high levels, we would expect to see more opportunistic bids emerging.

Buybacks can be a very effective tool for reducing discounts, at least in the short term, although this is not always straightforward if a fund does not have liquid underlying holdings that can be sold to fund such repurchases. This is part of the reason that some of the funds with unlisted assets have such wide discounts at present.

Buybacks have the advantage of being NAV accretive for remaining shareholders but the benefit of providing liquidity in the present comes at the cost of shrinking the fund which reduces liquidity over time and puts upwards pressure on ongoing charges ratios as fixed costs are spread over a smaller asset base.

Failed continuation vote leaves Hipgnosis Songs manager in a 'do or die' position

This can really limit their effectiveness for smaller funds. Buybacks therefore tend to work well for larger funds with liquid underling holdings and where there is a clear target.

Alliance Trust, which implicitly defends a 5% discount, is a good example of how buybacks can be deployed effectively.

Tender offers achieve a similar result although their timing is usually set some time in advance and so there is an inherent danger that if markets take a hit in the run up to a tender date that a fund can be forced to sell assets at depressed valuations.

Finally, there is good old fashioned marketing spend. Raising fresh capital for funds can be quite expensive (fees are often capped at 2%) and so spending a little to help keep this seems sensible, although many boards understandably struggle with this.

However, where boards and managers think that their fund has a good story and its discount is unjustified, it makes sense to get that message in front of investors and educate the market.

This can take time and effort, but our experience is that funds that are good at engaging with the market in both good and bad times, tend to have tighter discounts.

Matthew Read is senior analyst at QuotedData