Quiet Forex Trading With Dollar Leading, AUD/JPY At Make-or-Break Level

Overall trading in the forex markets remained relatively subdued today. Dollar continues to hold the top position, despite the absence of clear follow-through buying momentum. Investor caution is also evident in US stock futures, which are moving within a tight range. Any movement in the US markets is likely to be temporary today, as traders are holding off on major bets until tomorrow’s FOMC rate decision, looking for clear guidance on a September rate cut.

Elsewhere in the forex markets, Euro remains sluggish despite stronger-than-expected Q2 GDP data and German CPI figures. It is also starting to face selling pressure against Swiss Franc as this week’s recovery loses steam. British Pound is also soft, with some traders guarding against a dovish rate cut from BoE on Thursday.

Yen and Australian Dollar are also on the weaker side, with key events scheduled for the upcoming Asian session. For Australian Dollar, Q2 CPI data will be crucial for RBA’s decision on whether another rate hike is needed to curb inflation. Australian Dollar will also be influenced by domestic retail sales data and PMIs from China. As for Yen, it is anticipated that BoJ will outline its plan to taper bond purchases, but there is uncertainty over the announcement of an additional rate hike.

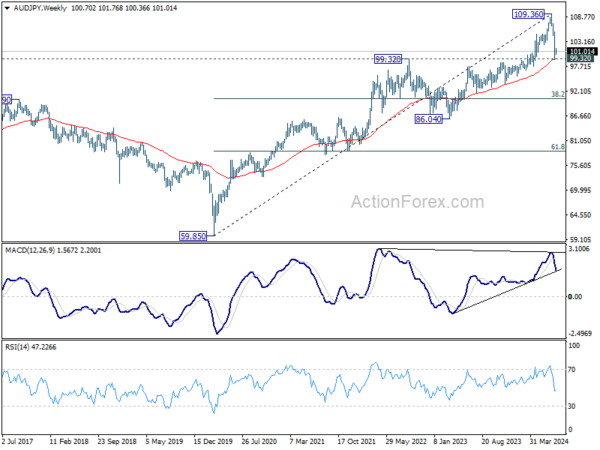

Technically, AUD/JPY is sitting slightly above clear cluster support level of 99.32, with 55 W EMA (now at 99.33). Decisive break of this level will strengthen the case that fall from 109.36 is already correcting the whole up trend from 59.85 (2020 low). That would set the set the stage for deeper medium term fall to 38.2% retracement of 59.85 to 109.36 at 90.44. It’s make-or-break time for AUD/JPY in the upcoming Asian session.

In Europe, at the time of writing, FTSE is down -0.17%. DAX is up 0.64%. CAC is up 0.60%. UK 10-year yield is down -0.019 at 4.033. Germany 10-year yield is down -0.010 at 2.352. Earlier in Asia, Nikkei rose 0.15%. Hong Kong HSI fell -1.37%. China Shanghai SSE fell -0.43%. Singapore Strait Times fell -0.07%. Japan 10-year JGB yield fell -0.0318 to 0.997, back below 1% mark.

Eurozone GDP grows 0.3% qoq in Q2, above expectation 0.2% qoq

Eurozone GDP grew 0.3% qoq in Q2, better than expectation of 0.2% qoq. EU GDP also grew 0.3% qoq. Comparing with the same quarter a year ago, Eurozone GDP grew 0.6% yoy while EU grew 0.7% yoy.

Among the Member States for which data are available , Ireland (+1.2%) recorded the highest increase compared to the previous quarter, followed by Lithuania (+0.9%) and Spain (+0.8%). The highest declines were recorded in Latvia (-1.1%), Sweden (-0.8%) and Hungary (-0.2%).

The year on year growth rates were positive for eight countries and negative for three.

Swiss KOF falls to 101, signals moderate growth ahead

Swiss KOF Economic Barometer fell from 102.7 to 101.0 in July, missing the expected 102.6. This drop indicates that the Swiss economy is likely to continue growing at a “rather moderate pace” in the near future, according to KOF.

The decline, while not unanimous across all indicators, is “very widely visible”. The outlook for both foreign and consumer demand is worsening. Moreover, sectors such as hospitality, construction, other services, and manufacturing showed negative developments. However, financial and insurance services sector bucked the trend, showing an increase and “resist the widespread downward tendency”.

Japan’s unemployment rate falls to 2.5%, job availability declines

Japan’s unemployment rate fell to 2.5% in June, down from 2.6%, outperforming expectations of being unchanged at 2.6%.

The number of employed persons reached 68.22mmarking an increase of 370k compared to the same month last year. This represents the 23rd consecutive month of employment growth and the highest number since comparable records began in 1953. However, the number of unemployed persons also saw an increase, rising by 20k from the same month last year to 1.81m marking the third consecutive month of increase.

In separate data, the Ministry of Health, Labor and Welfare reported that the job availability ratio fell by 0.01 point from June to 1.23. This marks the third consecutive month of decline in the ratio, indicating that there are now 123 jobs available for every 100 job seekers, down slightly from previous months.

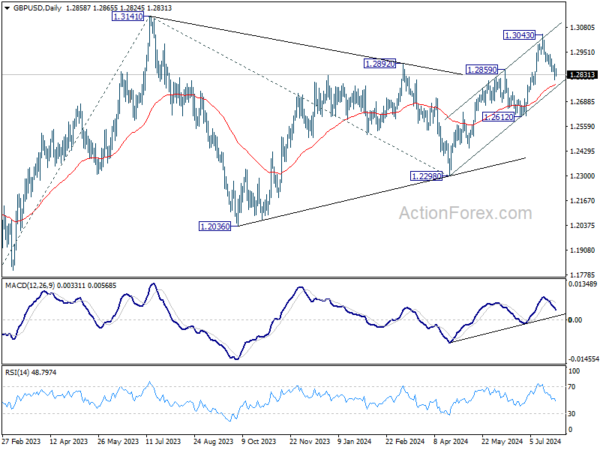

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2816; (P) 1.2852; (R1) 1.2898; More…

No change in GBP/USD’s outlook and intraday bias stays on the downside. Decisive break of 55 D EMA (now at 1.2779) will suggest that rise from 1.2298 has completed with three waves up to 1.3043 Deeper fall would be seen to 1.2612 support and below. On the upside, above 1.2936 resistance will bring retest of 1.3043 resistance instead.

In the bigger picture, corrective pattern from 1.3141 medium term top (2023 high) could have completed with three waves to 1.2298 already. This will now remain the favored case as long as 1.2612 support holds. Firm break of 1.3141 will target 61.8% projection of 1.0351 (2022 low) to 1.3141 from 1.2298 at 1.4022. However, break of 1.2612 support argue that this corrective pattern is extending with another falling leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Jun | 2.50% | 2.60% | 2.60% | |

| 01:30 | AUD | Building Permits M/M Jun | -6.50% | -2.30% | 5.50% | 5.70% |

| 06:45 | EUR | France Consumer Spending M/M Jun | -0.50% | -0.40% | 1.50% | |

| 05:30 | EUR | France GDP Q/Q Q2 P | 0.30% | 0.20% | 0.20% | |

| 07:00 | CHF | KOF Leading Indicator Jul | 101 | 102.6 | 102.7 | |

| 08:00 | EUR | Italy GDP Q/Q Q2 P | 0.20% | 0.20% | 0.30% | |

| 08:00 | EUR | Germany GDP Q/Q Q2 P | -0.10% | 0.10% | 0.20% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.30% | 0.20% | 0.30% | |

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Jul | 95.8 | 95.4 | 95.9 | |

| 09:00 | EUR | Eurozone Industrial Confidence Jul | -10.5 | -10.5 | -10.1 | -10.2 |

| 09:00 | EUR | Eurozone Services Sentiment Jul | 4.8 | 6.4 | 6.5 | 6.2 |

| 09:00 | EUR | Eurozone Consumer Confidence Jul F | -13 | -13 | -13 | |

| 12:00 | EUR | Germany CPI M/M Jul P | 0.30% | 0.30% | 0.10% | |

| 12:00 | EUR | Germany CPI Y/Y Jul P | 2.30% | 2.20% | 2.20% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y May | 6.80% | 7.40% | 7.20% | |

| 13:00 | USD | Housing Price Index M/M May | 0.00% | 0.20% | 0.20% | 0.30% |

| 14:00 | USD | Consumer Confidence Jul | 99.8 | 100.4 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more