Quiet Forex Session Precedes Three Central Bank Meetings And High-Impact Data

Trading in the forex markets has been notably subdued during the Asian session today, even as major Asian stock indexes showed strong rebounds. This muted activity in currency trading is not surprising given that it’s a typical Monday, coupled with an ultra light economic calendar. However, significant volatility is anticipated later in the week with a series of high-impact events on the horizon.

Three central banks are scheduled to hold meetings that could result in a rate hike, a hold, and a cut. Additionally, important economic data releases are expected, including CPI figures from Eurozone, Switzerland, and Australia, GDP data from Eurozone and Canada, and the highly anticipated non-farm payroll data from the US.

As July draws to a close, Yen remains the top performer among currencies, followed by Sterling and Swiss Franc. New Zealand Dollar is at the bottom, trailed by Australian and Canadian Dollars. Dollar and Euro are positioned in the middle. The overall picture reflects risk-off sentiment that may persist into August.

Technically, Gold is stuck in range without a clear direction for now. Prior support from rising 55 D EMA (now at 2356.89) somehow maintains its near term bullishness. Yet, rebound from 2353.00 is capped by falling 55 4H EMA (now at 2398.51). On the upside, firm break of 2431.84 resistance will suggest that the pull back from 2483.52 has completed, and larger up trend might be ready to resume. However, break of 2353.00 will extend the fall towards 2293.45 support, with risk of starting larger scale correction.

In Asia, at the time of writing, Nikkei is up 2.59%. Hong Kong HSI is up 1.85%. China Shanghai SSE is up 0.10%. Singapore Strait Times is up 0.60%. 10-year JGB yield is down -0.0327 at 1.029.

In Asia, at the time of writing, Nikkei is up 2.59%. Hong Kong HSI is up 1.85%. China Shanghai SSE is up 0.10%. Singapore Strait Times is up 0.60%. 10-year JGB yield is down -0.0327 at 1.029.

Bitcoin rises but struggles to break 70k handle

Bitcoin saw a modest rise at the beginning of this week, yet it remains below 70k mark, lacking the momentum to push past this psychological barrier. The cryptocurrency community had high hopes for Republican presidential nominee Donald Trump’s keynote speech at the 2024 Bitcoin Conference over the weekend. However, the speech fell short of expectations, as Trump did not pledge to establish an official US bitcoin strategic reserve currency.

Instead, Trump promised to “keep 100% of all the bitcoin the US government currently holds or acquires into the future.” He further emphasized the importance of embracing crypto technology, warning, “If we don’t embrace crypto and bitcoin technology, China will, other countries will. They’ll dominate, and we cannot let China dominate. They are making too much progress as it is.”

Technically, Bitcoin’s prior bounce from 55 D EMA is keeping the bullish outlook alive. That is, consolidation pattern from 73812 should have completed with three waves down to 53426. Near term outlook will now stay bullish as long as 63421 support holds, for retesting 73812 high first.

Decisive break of 73812 will resume larger up trend. Next target will be 61.8% projection of 24896 to 73812 from 533426 at 83656. Nevertheless, break of 63421 support will delay the bullish case, and extend the corrective pattern with another falling leg.

Fed, BoJ, BoE, and more top-tier events

The coming week promises to be exceptionally busy for financial markets with three central bank meetings and a slew of top-tier economic data on the agenda.

FOMC meeting is a relatively straight forward one. It is widely anticipated that interest rates will remain unchanged at 5.25-5.50%. The spotlight will be on any forward-looking statements, as Fed likely indicate that monetary policy is finally looming near, and pave the way for the first rate cut at next meeting in September.

While fed fund futures suggest a 64% probability of consecutive rate cuts in November and December, Chair Jerome Powell is unlikely to provide explicit hint during this meeting. Instead, Fed may defer to the forthcoming economic projections and dot plots in September for clearer guidance.

BoJ faces a tough decision, with uncertainty around whether to implement a second rate hike at this meeting. While postponing the decision to September or October is seen as feasible, the imminent meeting remains a “close call.” It is more certain, however, that BoJ will outline plans to taper its bond purchases, potentially halving them in the coming years, fulfilling a commitment made at the last meeting.

BoE is also under significant scrutiny this week, with some market participants expecting a rate cut from 5.25% to 5.00%. A recent Reuters poll reflects a shift in sentiment, with 49 out of 60 economists surveyed anticipating the rate cut, a decrease in confidence from 97% in a previous June poll, showcasing growing uncertainty among economists.

BoE’s history of surprising voting adds an element of unpredictability to this decision. Recent comments from BoE officials didn’t suggest any consensus for a cut at this meeting. In addition to the rate decision, BoE will release new economic projections for markets to assess future monetary policy path.

Aside from central bank activities, top-tier economic data from around the globe will also play a crucial role in shaping market dynamics. In the US, consumer confidence, ADP employment, ISM manufacturing, and non-farm payrolls will be particularly influential, with the NFP report crucial for assessing the likelihood of multiple rate cuts by Fed this year. Eurozone GDP and CPI might help conclude the case for ECB to cut interest rate again in September. Likewise, Swiss CPI will also be an important piece of data for SNB to consider whether to cut interest rates again in September.

For Australia, Q2 CPI could be crucial for RBA to decide if another rate hike on August 6 to continue the inflation fight. Any significant upward surprises in CPI figures could compel RBA to act decisively, as failing to do so could impact its credibility. Ideally, RBA is hoping that both headline and underlying inflation are either continuing to decrease, or at least not accelerating. Additionally, Australian Dollar’s movements will be influenced by upcoming official PMI data from China and Caixin PMI manufacturing report.

Here are some highlights for the week:

- Monday: UK M4 monthly supply, mortgage approvals;.

- Tuesday: Japan unemployment rate; Australia building approvals; Swiss KOF economic barometer; France GDP; Germany GDP; Eurozone GDP; US house price index, consumer confidence.

- Wednesday: Japan industrial production, retail sales, consumer confidence, BoJ rate decision; New Zealand ANZ business confidence; Australia CPI, retail sales; China official PMIs; Germany import prices, unemployment; Swiss UBC economic expectations; Canada GDP; US ADP employment, employment cost, Chicago PMI, pending home sales, FOMC rate decisions.

- Thursday: Japan PMI manufacturing final; Australia goods trade balance, import prices; China Caixin PMI manufacturing; Eurozone PMI manufacturing final, unemployment rate; UK PMI manufacturing final, BoE rate decision; US jobless claims, non-farm productivity, ISM manufacturing, construction spending; Canada PMI manufacturing.

- Friday: Japan monetary base; Australia PPI; Swiss CPI, PMI manufacturing; France industrial production; US non-farm payrolls, factory orders.

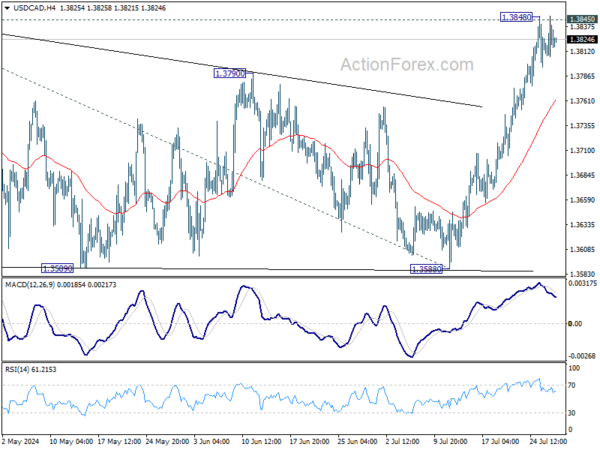

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3814; (P) 1.3831; (R1) 1.3856; More…

Intraday bias in USD/CAD remains neutral for consolidations below 1.3848 temporary top. Further rally is expected as long as 55 4H EMA (now at 1.3762) holds. Decisive break of 1.3845 will resume whole rally from 1.3176. Next target is 61.8% projection of 1.3176 to 1.3845 from 1.3588 at 1.4025.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern, that might have completed at 1.3176 (2023 low) already. Firm break of 1.3976 will confirm resumption of whole up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149. This will be the favored case as long as 1.3588 support holds, in case of pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:30 | GBP | M4 Money Supply M/M Jun | -0.10% | |||

| 08:30 | GBP | Mortgage Approvals Jun | 60K | 60K |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more