Some multi-asset teams remain relatively pessimistic about the outlook for most equity markets - citing that higher borrowing costs are yet to filter through to real economies. These teams remain cautiously positioned in asset allocation terms and often prefer to overweight defensive industry sectors.

If equity markets continue their recent upward trajectory, we might expect portfolios managed by these teams to lag broader market indices. Less valuation-conscious investors and multi-asset teams invested predominantly or wholly in passives are likely to outperform in this scenario.

Continuation of a higher-for-longer interest rate backdrop could well cause renewed bouts of market volatility. Under these conditions, multi-asset managers in the more cautious and active camp are possibly better positioned to outperform. Of course, this can't be guaranteed.

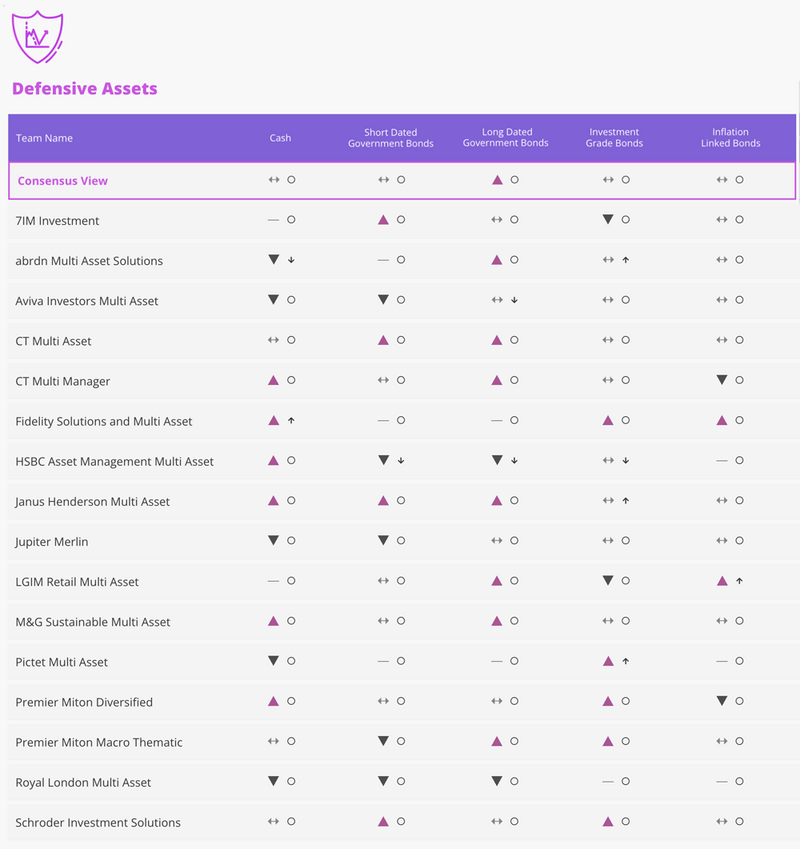

The information contained below was correct at the time it was received, but investment sentiment can change rapidly - even on a one-year view.

Positive sentiment towards

UK equities, Japanese equities, long-dated government bonds, and gold.

Japanese equities are comfortably multi-asset teams' most favoured asset class according to our sentiment indicator. Its economy continues to be viewed as being relatively sheltered from the effects of interest rate rises seen elsewhere.

In anticipation that the end is in sight for interest rate increases across developed economies, multi-asset managers are eying the potential for interest rates to fall, which could then enable them to profit from holding long duration (more interest rate sensitive) government bonds. For example, the impact of higher interest rates in the UK passing through to higher mortgage payments still has some way to go - indicating that interest rates may have peaked. UK gilts and US treasuries remain the primary beneficiaries here of multi-asset teams' attention.

Negative sentiment towards

US equities, European equities, and global high yield bonds.

Many multi-asset teams are wary of US equities given that recent returns from the S&P 500 index have been driven by a narrow cohort of companies known as ‘the magnificent seven'.

European equities and global high yield bonds are especially disliked, and if anything, sentiment towards them has further deteriorated.

In particular, European equities continue to be strongly out of favour - more so than any other equity region. Having had a strong start to the year, falling energy prices across Europe have not translated into the increases in disposable incomes that some were expecting - especially now that consumer borrowing costs have risen. Slowing demand from China for European exports is also seen as a concern for the region's manufacturers.

Sentiment towards global high yield bonds continues to weaken and the asset class is even more disliked than European equities.

Neutral sentiment towards

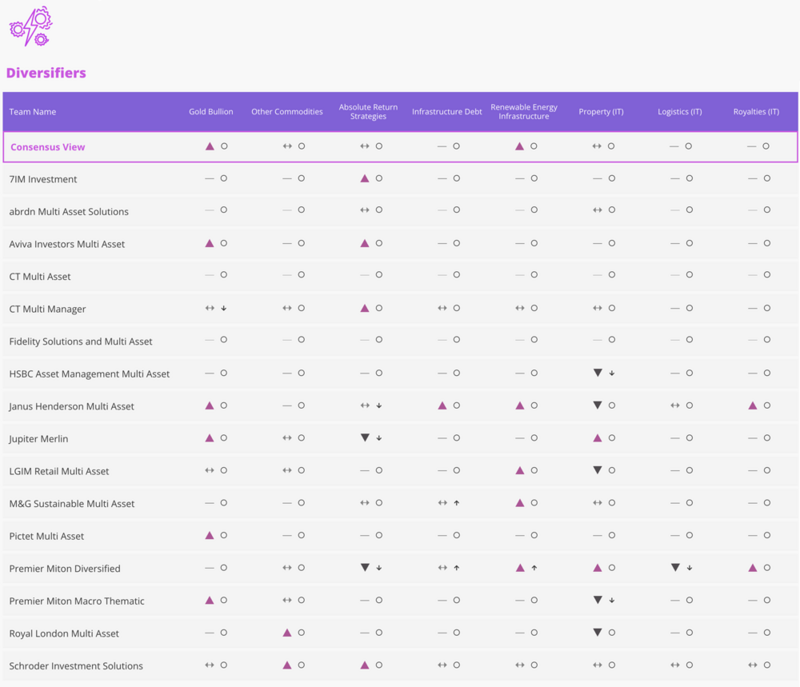

Asia-pacific equities, global emerging market equities, emerging market bonds (hard and local currency), cash, short-dated government bonds, investment grade bonds, inflation-linked bonds, other commodities, hedge / absolute return, and property.

Some see valuations across some emerging market countries as grounds for optimism - particularly in Latin America. While some multi-asset teams point to the prospects for a decline in the value of the US dollar over the medium term - a move that would generally be thought of as being positive for emerging market companies and governments that borrow in US dollars - others are less certain that this will be translated to emerging market equity market performance.

Turning more positive on

UK equities and Japanese equities.

Positive sentiment towards UK equities and Japanese equities has continued in an upward trajectory - with low valuations continuing to prove attractive to those who take a relative valuation-based approach.

Expectations for earnings growth from Japanese companies also have positive momentum; companies are cash rich, and a weak yen is also supportive of Japanese exports. Ongoing improvements in corporate governance are also being viewed positively.

Turning more negative on

European equities, Chinese equities, and global high yield bonds.

Evidence of a pick-up in consumer spending in China, a recovery in the country's real estate sector and a stabilisation in US-China relations are required before many multi-asset investors can become more interested in Chinese equities.

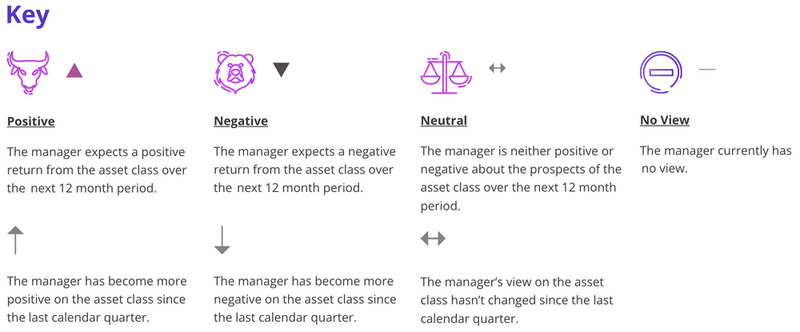

The Scopic quarterly sentiment indicator is designed to show the current direction of sentiment towards a broad range of asset classes as expressed by some of the UK's leading multi-asset teams. The table splits asset classes between growth, defensive and diversifying assets.

Positive = The multi-asset team has a positive view on the prospects for the asset class over the next 12 months.

Negative = The multi-asset team has a negative view on the prospects for the asset class over the next 12 months.

Neutral = The multi-asset team has neither a positive nor negative view on the prospects for the asset class over the next 12 months.

No view = The multi-asset team has no view or would prefer not to express a view on the prospects for the asset class.

The 'change' column shows whether the team's views have become more positive, negative or remain the same since the last quarter. The information contained was correct at the time it was received, but investment sentiment can change rapidly - even on a one-year view. These comments reflect the interpretation by Scopic Research of the results from its latest quarterly multi asset teams' sentiment indicator. They are in no way meant to confer investment advice. Past performance isn't a guarantee of the returns that might be achieved in the future, and investment returns can be negative as well as positive.

More details can be found on Scopic Research's website at www.scopicresearch.co.uk.