Clouds are starting to lift but the global economy continues to face challenging conditions. Markets are likely to continue being heavily influenced by expectations for interest rates and the likely actions of central banks for some time. Multi-asset teams have sought to look through the recent rally in markets at the start of the year and the outlook remains cautious for most risk assets.

Positive sentiment towards

UK equities, Asia Pacific equities, long dated government bonds, gold and hedge / absolute return

The UK remains the preferred equity market on the back of a weak currency, its relatively defensive nature, and its comparatively high weighting to businesses in the energy and resources sectors. Interestingly, this view is also held by some multi-asset teams whose portfolios tend not to have a bias towards the UK when looked at from a global market capitalisation perspective.

The higher yields available from government bonds now makes them more attractive as a natural hedge against falls from risk-based assets. However, some multi-asset managers have already banked some gains here and it seems likely that exposure to government bonds will be managed tactically depending on the outlook for inflation and interest rates.

Inflation remains high in the context of the recent past, and central banks are still tightening financial conditions (raising interest rates) and are unlikely to want to take risks with inflation. Lower interest rates which might benefit bonds are not on the horizon.

Negative sentiment towards

US and European equities

The consensus towards European equities in particular continues to be strongly negative. The weak growth outlook, together with the potential for the European Central Bank to continue to tighten interest rates and therefore hurt company profits, is cited as one of the main reasons.

Neutral sentiment towards

Japanese equities, global emerging market equities, high yield bonds, investment grade bonds, inflation-linked bonds, other commodities and property

The higher yields available from investment grade bonds now make them comparatively more attractive to multi-asset investors than they have been for several years. In the recent past, alternative-type investments have often been used as replacements for some of the exposure within portfolios that might otherwise have been awarded to bonds. The opportunity set for multi-asset investors has therefore broadened somewhat to include more traditional bond-type exposure. This marks a significant change.

Weighing against this though, is that deteriorating economic conditions are likely to impact corporate profits. For this reason, a greater number of multi-asset teams prefer the outlook for quality bonds as opposed to higher yielding bonds.

Turning more positive on

Government bonds and global emerging market equities

The sentiment towards global emerging markets is neutral overall but we have seen some improvement since last quarter aided by the recent and rapid phasing out of China's zero-Covid policy and the reopening of its economy. This could become a defining theme - helping to boost overall earnings growth for Chinese companies. That said, multi-asset teams are still deeply divided when it comes to the outlook for emerging market equities.

Turning more negative on

Cash

Although the consensus towards cash is neutral overall, we have seen a negative shift in sentiment towards it away from the positive stance in last quarter's sentiment indicator. That said, cash now offers a more attractive yield - and assuming inflation levels reduce - a store of value too.

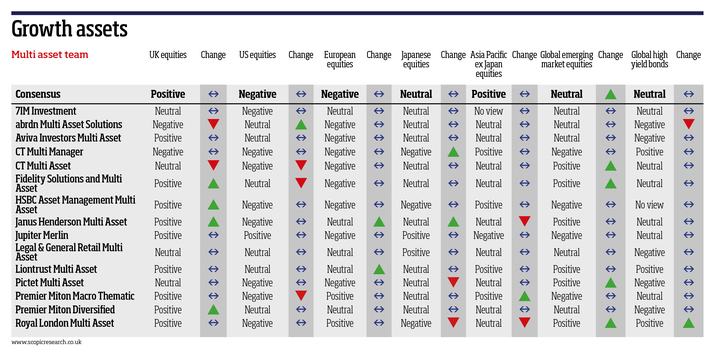

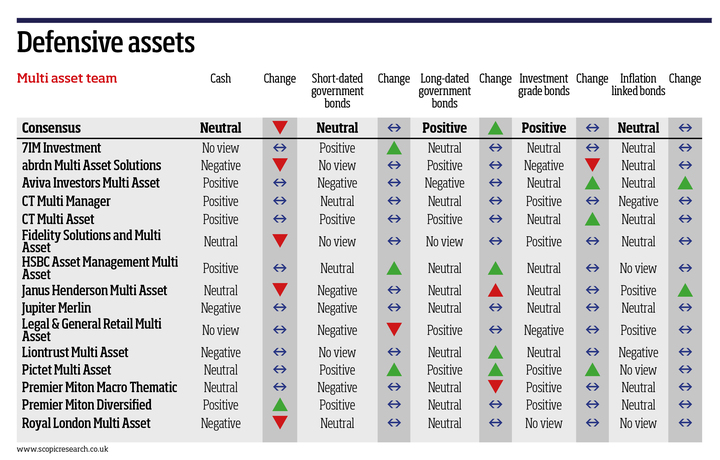

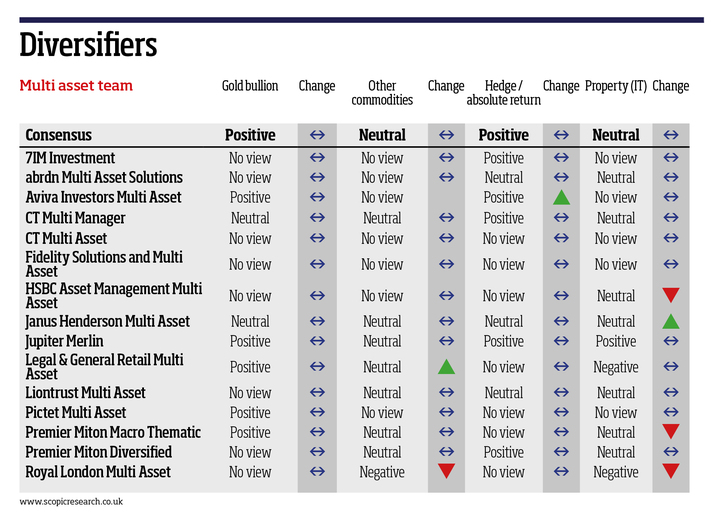

The Scopic quarterly sentiment indicator is designed to show the current direction of sentiment towards a broad range of asset classes as expressed by some of the UK's leading multi-asset teams. The table splits asset classes between growth, defensive and diversifying assets.

Positive = The multi-asset team has a positive view on the prospects for the asset class over the next 12 months.

Negative = The multi-asset team has a negative view on the prospects for the asset class over the next 12 months.

Neutral = The multi-asset team has neither a positive nor negative view on the prospects for the asset class over the next 12 months.

No view = The multi-asset team has no view or would prefer not to express a view on the prospects for the asset class.

The 'change' column shows whether the team's views have become more positive, negative or remain the same since the last quarter.

More details can be found on Scopic Research's website at www.scopicresearch.co.uk.