The headwinds facing the global economy have worsened and multi-asset teams are struggling for positivity in markets that are being heavily influenced by the expectations for interest rates and the likely actions of central banks. The outlook is cautious for most risk assets.

Positive sentiment towards

UK equities, cash, gold, and hedge / absolute return.

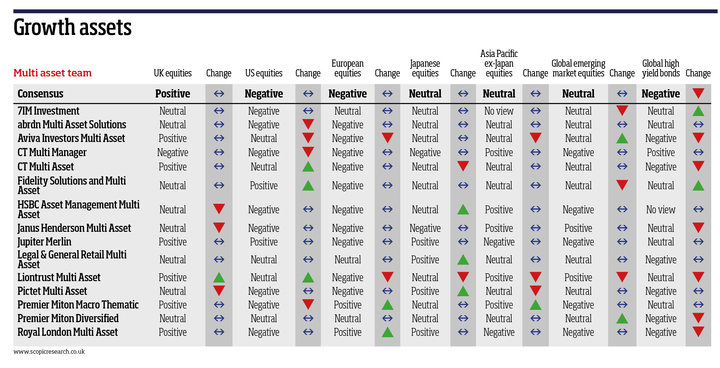

Positive sentiment is in very short supply - especially across equities and other growth assets. The higher yields now available from other asset classes such as government bonds when compared to a few months ago and a drain in confidence that companies will be able to maintain or grow their profits are being cited as the key reasons for this.

Within growth assets, UK equities continue to be favoured by some, but the strength of consensus has weakened over the calendar quarter.

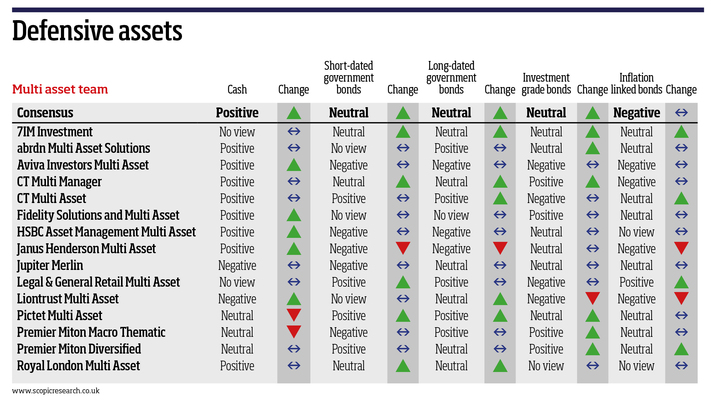

Cash may not be attractive in real terms (after the effects of inflation) but it's being favoured in absolute terms, and it gained the positive most ‘votes' of any asset class.

Negative sentiment towards

US and European equities, global high yield bonds and inflation-linked bonds.

The consensus towards European equities is strongly negative overall - with the region being seen as the one most at risk from a protracted conflict in Ukraine.

Having suffered a technical tech bear market, some multi-asset teams are now eying opportunities in the growth end of the US equity market. However, weighing against this is that an inflationary environment doesn't typically support growth (or long duration) stocks, and the US equity market has more of a skew towards these types of company than anywhere else.

Neutral sentiment towards

Japan and global emerging market equities, government bonds, investment grade bonds, commodities and property.

Commodities (ex-gold) are not viewed as being as attractive as they had been earlier in the year - having rebounded strongly as the global economy awoke from the covid pandemic. The potential for disappointing global growth is seen as a key factor in steering the consensus sentiment from being positive overall in the last calendar quarter, to being neutral this quarter.

Turning more positive on

Cash, government bonds and investment grade bonds.

The consensus on developed market government bonds is nuanced between those multi-asset teams who have turned positive and those who have moved from being negative last quarter to having a more neutral stance this quarter - with some pointing to the deterioration in global growth prospects and a possible peak in inflation having been reached (or an approaching peak) as a reason for this.

Turning more negative on

Global high yield bonds and property.

Although property can offer some protection against inflation, higher bond yields are viewed as offering a less supportive environment. Some multi-asset teams favour more specialist property exposure, such as healthcare, logistics and digital infrastructure.

The Scopic quarterly sentiment indicator is designed to show the current direction of sentiment towards a broad range of asset classes as expressed by some of the UK's leading multi-asset teams. The table splits asset classes between growth, defensive and diversifying assets.

Positive = The multi-asset team has a positive view on the prospects for the asset class over the next 12 months.

Negative = The multi-asset team has a negative view on the prospects for the asset class over the next 12 months.

Neutral = The multi-asset team has neither a positive nor negative view on the prospects for the asset class over the next 12 months.

No view = The multi-asset team has no view or would prefer not to express a view on the prospects for the asset class.

The 'change' column shows whether the team's views have become more positive, negative or remain the same since the last quarter.

More details can be found on Scopic Research's website at www.scopicresearch.co.uk.