Markets Poised For High-Stakes January Amid Fed And Trump Policy Shifts

As global markets return from the New Year holiday, trading remains subdued with light activity expected until next week when full operations resume. Today’s focus will be on Eurozone and UK PMI manufacturing finals alongside US jobless claims, while tomorrow’s US ISM Manufacturing Index could provide an early glimpse of potential volatility ahead. However, the broader tone for January—and likely much of 2025—will be set by a series of pivotal events and data releases in the coming weeks.

The month’s significance stems from two major developments. First, key US non-farm payrolls and inflation data are on the radar, likely determining whether Fed will pause its policy easing cycle later this month. Following the Fed’s hawkish December rate cut, markets expect a significantly slower pace of reductions for 2025.

Adding to market uncertainties (or maybe clarities) is Donald Trump’s inauguration on January 20. The incoming administration is expected to issue at least 25 executive orders immediately, targeting areas such as immigration, energy policy, and cryptocurrency regulation. Trump’s previously stated plans to impose tariffs on imports from China, Mexico, and Canada could introduce inflationary pressures by raising costs for companies and consumers. Markets will be on high alert for details of the policies and their implications for global trade outlook.

The crypto markets’ reaction in the coming days could give a sneak peak on how underlying risk sentiment is flaring back from holiday. Bitcoin’s pull back from 108368 has started to slow after hitting 55 D EMA (now at 92441). Strong bounce from current level, followed by break of 99866 resistance will argue that Bitcoin has completed the correction, and larger record run up trend is ready to resume. However, sustained trading below the EMA will likely pave the way back to 38.2% retracement of 49008 to 108368 at 85962, or even below, as correction deepens first.

In Asia, Japan was on holiday. Hong Kong HSI is down -2.40%. China Shanghai SSE is down -3.05%. Singapore Strait Times up 0.14%.

Happy new year, and wish you a prosperous and healthy 2025!

China’s Caixin PMI manufacturing falls back to 50.5 as downward pressures persist

China’s Caixin Manufacturing PMI dropped to 50.5 in December, down from 51.5 and below market expectations of 51.6, signaling a moderation in the sector’s growth.

While supply and demand expanded modestly, external demand remained a significant drag, according to Wang Zhe, Senior Economist at Caixin Insight Group.

Zhe highlighted several challenges, noting that external demand was “sluggish”, while job market suffered a “notable contraction.” Additionally, sales prices were weak, and market optimism continued to decline.

The survey pointed to “prominent downward pressures”, stemming from subdued domestic demand and challenging external conditions, which have squeezed profit margins and dented confidence.

The report also suggested that the impact of previous policy stimulus measures has yet to yield consistent results, with more time needed to gauge their effectiveness.

Looking ahead

Swiss PMI manufacturing, Eurozone PMI manufacturing final and M3 money supply, and UK PMI manufacturing final will be released in European session. Later in the day, US will release jobless claims, PMI manufacturing final, and construction spending.

USD/CAD Daily Outlook

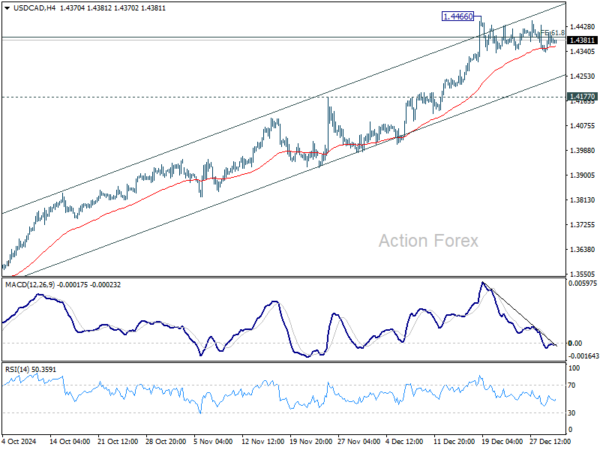

Daily Pivots: (S1) 1.4354; (P) 1.4394; (R1) 1.4442; More…

Intraday bias in USD/CAD remains neutral as consolidations continue below 1.4466. Deeper pullback cannot be ruled out, but outlook will stay bullish as long as 1.4177 resistance turned support holds. On the upside, break of 1.4466 and sustained trading above 1.4391 will pave the way to retest 1.4667/89 long term resistance zone.

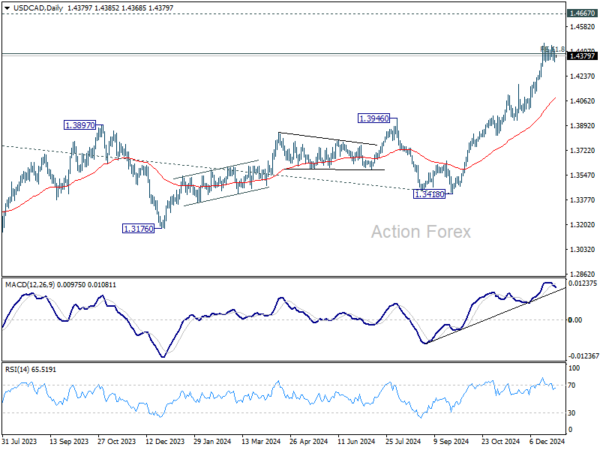

In the bigger picture, up trend from 1.2005 (2021) is in progress and met 61.8% projection of 1.2401 to 1.3976 from 1.3418 at 1.4391 already. Sustained trading above there will pave the way to 1.4667/89 key resistance zone (2020/2015 highs). Medium term outlook will remain bullish as long as 1.3976 resistance turned holds, even in case of deep pullback.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more