Market Rout Deepens Globally: Will ISM Services Provide Relief?

The global market turmoil showed no signs of easing as the week began, with Japanese stocks taking a severe hit during Asian session. Both the Nikkei 225 and Topix indices plunged by as much as nearly -10%, marking a -20% drop from their all-time highs on July 11. This selloff extended to the cryptocurrency market, where Ethereum fell more than -20% since Friday.

In the currency markets, Yen and Swiss Franc continue to be the preferred safe havens amidst the chaos. On the other hand, Aussie and Kiwi are bearing the brunt of the selloff. Euro is currently outperforming both Dollar and Sterling, while Canadian Dollar is mixed in the middle.

Investors are now anxiously awaiting US ISM services data, which could potentially exacerbate recession fears if the figures disappoint. Beyond the headline PMI reading, employment component will be closely scrutinized. Last week’s increase in the unemployment rate triggered the Sahm Rule, a historically reliable recession indicator. Once the Sahm Rule threshold is breached, history suggests that the unemployment rate could rise rapidly.

Technically, EUR/GBP would be an interesting one to look at this week, as it’s quickly approaching falling channel resistance with last week’s strong rally. Decisive break of this channel resistance will be a strong sign of 0.8382 is already a medium term bottoming. Stronger rally could be seen to 0.8643 and possibly 0.8764 resistance, even just as a corrective move. On the other hand, rejection by the channel will keep medium term outlook bearish in EUR/GBP for another fall through 0.8382 at a later stage.

In Asia, at the time of writing, Nikkei is own -9.78%. Hong Kong HSI is down -1.25%. China Shanghai SSE is down -0.61%. Singapore Straeit Times is down -3.75%. Japan 10-year JGB yield is down sharply by -0.167 at 0.792, breaking 0.8% handle.

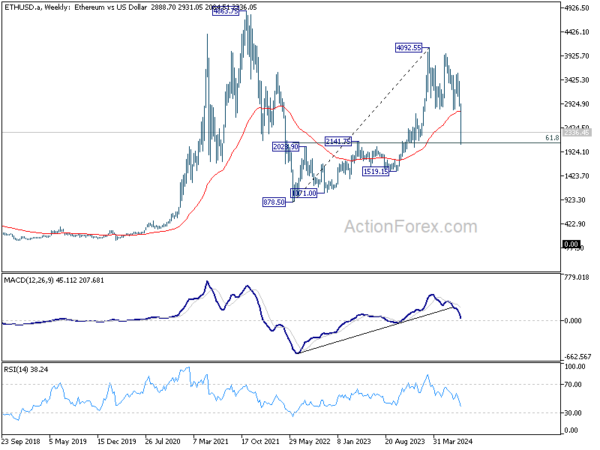

Ethereum may find temporary support at 2100 after freefall, but threat lingers below 2800

Ethereum has taken a severe hit in the past few days, plunging over 20% since Friday as the global market downturn extends its reach into the cryptocurrency space. This steep decline is fueled by a combination of broad-based risk aversion and specific pressures within the crypto market. Notably, Jump Crypto has been liquidating approximately USD 300m from a single wallet over the past two weeks, exacerbating the sell-off.

ETH is clearly reversing whole up trend from 878.50 (2022 low). Technically, there is prospect for a bounce at current levels, which is close to 61.8% retracement of 878.50 to 4092.55 at 2106.26, to bring near term consolidations. But risk will stay on the downside as long as 2797.60 support turned resistance holds. Sustained break of 2106.26 will pave the way to 1519.15 support next.

In summary, while Ethereum may find some temporary support around 2100 level, the overall risk remains skewed to the downside as long as it remains below 2800 resistance.

Japan’s PMI services finalized at 53.7, concerns on sustained inflationary pressure

Japan’s PMI Services was finalized at 53.7 in July, up from June’s 49.4. PMI Composite was finalized at 52.5, up from June’s 49.7.

Usamah Bhatti, Economist at S&P Global Market Intelligence, highlighted a “renewed upswing” in the services sector at the start of Q3, driven by “improved demand conditions and stronger customer numbers.” This growth was largely domestic, as new export business declined for the first time this year. The outlook for the service sector remains positive, with outstanding business levels increasing and strong confidence in the 12-month outlook.

While the combined output of the manufacturing and services sectors expanded at a “moderate pace,” the growth was primarily driven by the service sector, with manufacturing experiencing a slight contraction. Private sector companies reported that input price inflation remained “stubbornly high,” affecting total output. There are concerns that “sustained inflationary pressure” could pose a downside risk to the economy in the coming months.

China’s Caixin PMI services rises to 52.1, composite falls to 51.2

China’s Caixin PMI Services increased from 51.2 to 52.1 in July, surpassing the expected 51.4 and remaining in expansionary territory for the 19th consecutive month. Meanwhile, PMI Composite fell from 52.8 to 51.2, but still marking the ninth consecutive month of expansion.

Wang Zhe, Senior Economist at Caixin Insight Group, noted that while the services sector saw improvement, manufacturing faced greater pressure. “The former outperformed the latter in terms of supply, demand and employment,” Wang said. Despite this, composite prices remained weak, especially on the sales front, which further squeezed company profit margins. Market optimism improved, although it remained at a low level.

The latest data revealed that China’s real GDP growth in Q2 slowed to 4.7% yoy, significantly lower than market expectations. This slowdown suggests that it will be challenging for the country to meet its annual growth target of around 5%. Wang said the primary issues remain insufficient effective domestic demand and weak market optimism.

RBA to hold rates steady, US ISM services key to market sentiment

RBA is widely expected to keep its interest rate unchanged at 4.35% this week. The pressure to raise rates has eased, at least temporarily, following Q2 CPI data, which showed moderation in underlying inflation. However, it is too early for RBA to adopt a dovish stance or signal future rate cuts. Governor Michele Bullock is likely to maintain the stance of “not ruling anything in or out.”

A recent Reuters poll indicated that 22 out of 23 economists forecast no change in RBA’s key interest rate before 2025, with only 10 expecting a 25bps cut in Q4. The market is pricing in roughly a 55% chance of a rate cut by the end of 2024.

In terms of central bank activities, BoJ summary of opinions from its latest meeting and BoC summary of deliberations will also be closely watched.

On the data front, US ISM services PMI will be a major focus at the start of the week. Market sentiment is increasingly centered around the risk of a looming recession or even hard landing in the US. The services sector, which has been a key driver of economic growth since early 2023, has shown signs of losing momentum in recent months. Any downside surprises in this data could prompt another selloff in risk assets.

Elsewhere, employment data from New Zealand and Canada will attract significant attention, along with Eurozone Sentix investor confidence and China’s Caixin PMI services, CPI, and PPI.

Here are some highlights for the week:

- Monday: BoJ minutes; China Caixin PMI services; Eurozone PMI services final, Sentix investor confidence; UK PMI services final; US ISM services.

- Tuesday: Japan average cash earnings, household spending; RBA rate decision; Swiss unemployment rate, retail sales; Germany factory orders; UK PMI construction; Eurozone retail sales; Canada trade balance; US trade balance.

- Wednesday: New Zealand employment; China trade balance; Japan leading indicators; Germany industrial production, trade balance; France trade balance; Swiss foreign currency reserves; Canada Ivey PMI, BoC summary of deliberations.

- Thursday: BoJ summary of opinions; Japan current account, economy watchers sentiment; New Zealand inflation expectations; US jobless claims.

- Friday: China CPI, PPI; Germany CPI final; Swiss SECO consumer climate; Canada employment.

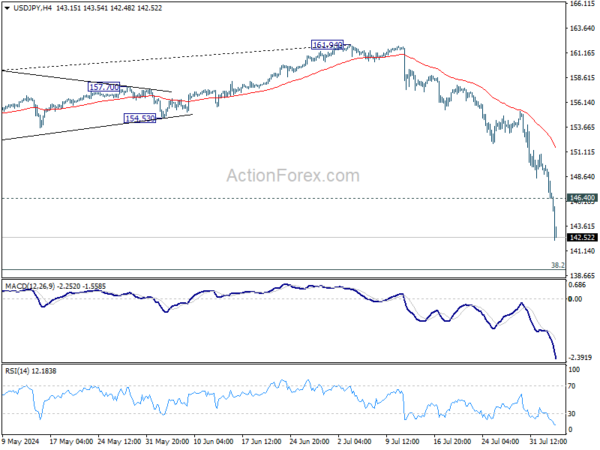

USD/JPY Daily Outlook

Daily Pivots: (S1) 145.40; (P) 147.59; (R1) 148.76; More…

USD/JPY’s decline accelerates further to as low as 142.17 so far today There is no sign of bottoming yet. Intraday bias stays on the downside for 140.25 support next. On the upside, above 146.40 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

In the bigger picture, the strong break of 55 W EMA (now at 149.98) argue that fall from 161.94 medium term is correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. In any case, risk will stay on the downside as long as 55 W EMA (now at 149.98) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Meeting Minutes | ||||

| 01:00 | AUD | TD Securities Inflation M/M Jul | 0.40% | 0.30% | ||

| 01:45 | CNY | Caixin Services PMI Jul | 52.1 | 51.4 | 51.2 | |

| 07:45 | EUR | Italy Services PMI Jul | 53 | 53.7 | ||

| 07:50 | EUR | France Services PMI Jul F | 50.7 | 50.7 | ||

| 07:55 | EUR | Germany Services PMI Jul F | 52 | 52 | ||

| 08:00 | EUR | Eurozone Services PMI Jul F | 51.9 | 51.9 | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Aug | -7.3 | |||

| 08:30 | GBP | Services PMI Jul F | 52.4 | 52.4 | ||

| 09:00 | EUR | Eurozone PPI M/M Jun | 0.30% | -0.20% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Jun | -3.30% | -4.20% | ||

| 13:45 | USD | Services PMI Jul F | 56 | 56 | ||

| 14:00 | USD | ISM Services PMI Jul | 51.4 | 48.8 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more