But what happens when traditional asset classes are disappointing at the same time - like this year when stocks and bonds have fallen together?

In the face of such broad equity and fixed income market downturns, some investors may be tempted by so-called alternative assets.

These investments may include liquid alternatives, or "liquid alts," a subset of fund and ETF investments that offer easier-to-access exposure to alternative strategies which may claim to offer higher potential returns and lower correlations to stocks and bonds.

But those twin claims of higher return and a smoother investment return are not supported by the data.

Four graphs explaining... alternatives

Our data show that for more than a decade, liquid-alts funds in the US have underperformed broad indices tracking the equity and fixed income markets.

Liquid alts may do little to diversify a portfolio composed of stocks and bonds, given that many hold a subset of these traditional asset classes.

The growth in popularity of liquid alts is strong around the world. According to data from Morningstar, since 2006, the US market has grown from around 20 funds to more than 100. In Europe that growth is from roughly 50 funds in 2006 to more than 300 in 2022.

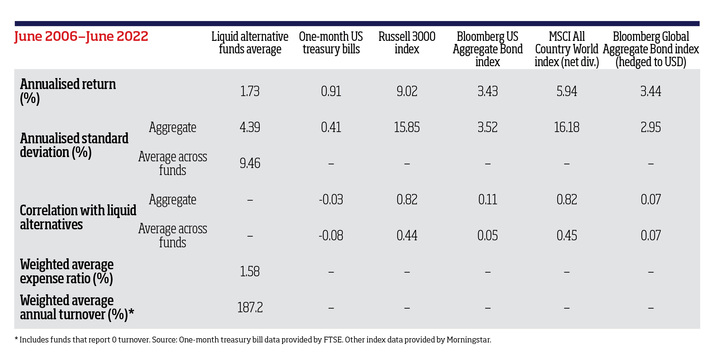

The increasing popularity of liquid alts cannot be traced to strong fund performance. The table below shows that the annualised return for the strategies investing around the world and available to US investors trailed that of global stocks by 4.2 percentage points and global bonds by 1.7 percentage points from June 2006 to June 2022.

Only against one-month US Treasury Bills did liquid alts manage to eke out a slight return advantage - but with 10 times higher volatility. Substantial costs for liquid alts were likely a factor in their disappointing performance: according to Morningstar, the category's weighted average expense ratio was 1.6%, with average annual turnover of 187%.

Performance and characteristics of liquid alternative funds

Investments belong in an investor's asset allocation when they satisfy one of two roles: increasing expected return, or managing risk. Based on the evidence, we see the performance of liquid alts do not tick the box for the former and that their ability to fulfill the latter is questionable.

Fixed income investments are better suited for reducing return volatility than liquid alts, given the latter have had close to 50% more volatility than global bonds.

It us also not clear liquid alts offer a diversification benefit.

Diversification arises from broadening an investor's opportunity set.

Deep Dive: Alternatives offer diversification as stocks and bonds fall in lockstep

Many liquid-alternative strategies start from the same building blocks as global stock and bond markets, then deviate in their security selection and weighting, even shorting securities in their attempt to deliver positive returns that are uncorrelated to returns in stock and bond markets.

But slicing and dicing the same set of securities does not constitute expansion of the opportunity set. I can cut my children's pancakes into the shape of a dinosaur but I am still serving them pancakes.

So what is the alternative to alts? Stock and bond markets are broadly diversified, offering investors exposure to tens of thousands of securities across more than 40 countries and different currencies.

Unlike liquid-alt claims that fall short, stock and bond markets have a track record of increasing expected returns or managing risks. Liquid alternatives may look attractive when traditional asset classes are down, but over time an allocation to liquid alts may leave investors high and dry.

Wes Crill is head of investment strategists at Dimensional Fund Advisors