These portfolios are designed to diversify a portfolio, primarily acting as a line of defence, by producing returns that are uncorrelated to those of stocks and bonds. These funds employ a wide range of sometimes complex tactics to achieve this.

Having been out of favour for several years due to their inability to outperform broad indices tracking the equity and fixed income markets, liquid alternatives proved their value proposition last year, said Francesco Paganelli, manager research analyst at Morningstar.

"Some of the largest players have not delivered on their promises throughout the years and that has weighed on the entire sector," he said.

"But last year they proved that they can be a complement to a diversified portfolio and provide a differentiated exposure relative to stocks and bonds."

Shorting for ESG: Could liquid alternatives be part of the next wave of responsible investments?

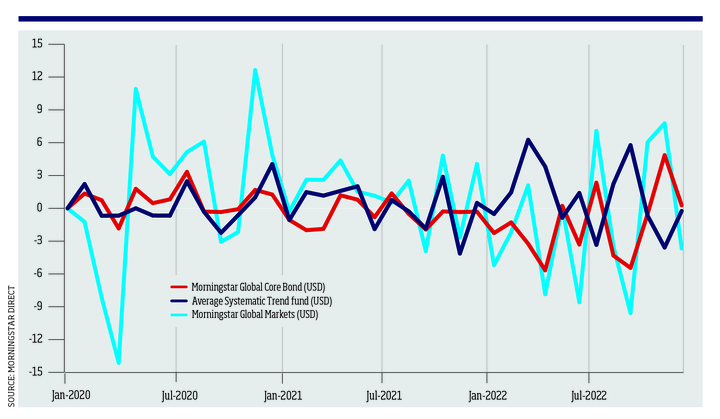

The average alternatives fund, excluding event-driven and arbitrage strategies, was up 0.5% last year, according to data from Morningstar Direct, while the Morningstar Global Markets index is down 17.9% and the Morningstar Global Core Bond index is down 11.4%.

James de Bunsen, multi-asset portfolio manager at Janus Henderson, said that liquid alternatives demonstrated they can generate returns that are not dependent on benign movements in rates, spreads or equity markets last year.

However, investors needed to own the right funds.

"Dispersion within sectors was even more extreme than usual due to the spike in yields and rotation within equity markets," de Bunsen said.

His own alternatives funds returned between 2% to 29% last year.

Standout year for systematic trend funds

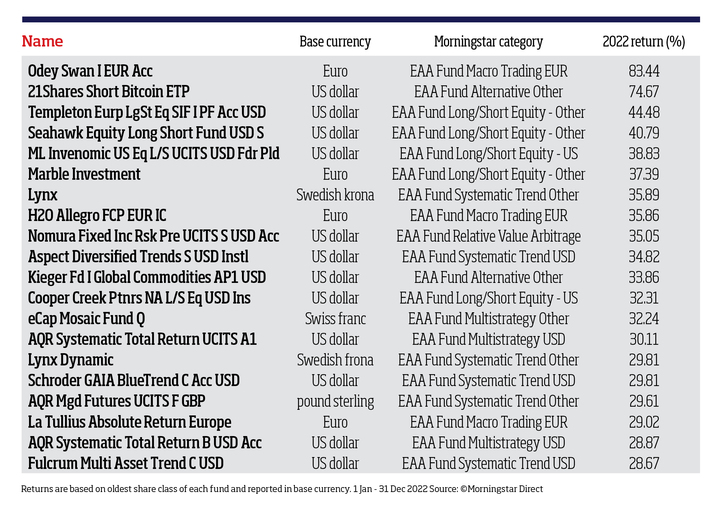

Among alternative categories, systemic trend funds were the best-performing group last year.

They are the third-largest category of alternative strategies with $27bn in assets and are up an average of 10.8% so far this year, with some funds returning over 35%.

Systematic trend funds mainly implement trend-following, price-momentum strategies by trading long and short liquid global futures, options, swaps and foreign-exchange contracts.

Strategies invest across geographies and assets, including equities, fixed income, commodities and currencies.

Managers attempt to benefit from trends arising across asset classes and perform particularly well when there are clear, strong upward or downward market movements.

An eventful yet slow-moving 2022 created a perfect environment for systematic trend funds to flourish.

Systematic trend funds outperformed global equities and bonds in 2022

Paganelli said: "It has been a fantastic year for systematic funds in absolute terms, but on a relative basis, returns have been even more valuable considering that conservative 60/40 portfolios had such a dire year in 2022."

According to Paganelli, managers were able to extract their standout return from three key slow-moving trends in 2022: fixed income, currency and commodities.

"Being short bonds was quite beneficial for them, especially after Ukraine's invasion pushed central banks to pivot to hiking rates at a more aggressive pace.

"Long US dollar and energy contracts were also fruitful trades last year," he said.

Wellington hires long/short boutique team as it expands alternatives platform

Among the best performing funds, Lynx, Aspect Diversified Trends and Schroder GAIA BlueTrend returned 35.9%, 34.8% and 29.8% respectively in 2022.

Long/short funds, which tend to have higher exposure to equity markets, did not fare as well. According to Morningstar Direct, the average long/short strategy fell by 8.6% last year.

Still, certain funds managed to provide excellent absolute returns.

Out of the top 15 performers across liquid alternatives last year, five funds followed a long/short strategy.

Top 20 performers across all liquid alternatives categories

The Templeton European Long/Short Equity fund was up 44.5%, the Seahawk Equity Long/Short fund gained 40.8% and the Invenomic US Equity Long/Short fund returned 38.5%.

Stiff competition

Dan Ryan, multi-asset portfolio manager at Fidelity International, said that in 2022 it paid to emphasise manager expertise and a demonstrable edge when selecting liquid alternative strategies.

"Given the current uncertainty and high volatility in markets, it makes sense to allocate selectively to strategies that hedge traditional equity or bond exposures," he said.

"This means having a thorough understanding of the source of the manager's edge as well as the conditions that might cause particular liquid hedge funds to deviate from expected performance."

Despite the strong relative performance of liquid alternatives in 2022, competition for investors' favour has stiffened up for liquid hedge funds given the return of fixed income yields.

Man GLG hires investment team for new European opportunities strategy

The outlook for liquid alternatives now seems brighter because they were finally able to show their value proposition, Morningstar's Paganelli noted.

However, the need to find diversifiers was more compelling back when investors could extract "little to no yield" from safe haven assets, he added.

Following last year's valuation adjustment across bond prices, multi-asset funds can now rely more heavily and reliably on high quality fixed income to achieve their targets, de Bunsen said.

"However, we will always have material exposure to those liquid alternative funds that have the right toolkits for higher volatility environments," he added.