Light Week Ahead With Dollar Rally Awaiting PCE Inflation Insights

The forex markets display a calm demeanor in the Asian session, with most major pairs and crosses gyrating in very tight ranges. Australian Dollar finds modest support from the state orchestrated rebound in Chinese Yuan. However, this lift hasn’t translated into clear momentum for an extended rally in Aussie.

Meanwhile, Yen continues to pare back its recent losses. The release of BoJ’s minutes from its January meeting stirred little reaction among traders, as the market’s focus is keenly set on the upcoming summary of opinions from last week’s pivot meeting instead, expected to be released on Thursday.

Dollar’s recent rally is on pause, awaiting US PCE inflation data as a potential volatility trigger. Surprises in this data could lead Fed policymakers to recalibrate their projections on the timing and number of rate cuts this year. Atlanta Fed President Raphael Bostic is an example of FOMC member that shifted stance. He revised his expectations to just one rate cut for the year, likely occurring later than initially anticipated.

As March progresses, the competition to be labeled the month’s worst performer is between Japanese Yen, Swiss Franc, and New Zealand Dollar. Technically, NZD/JPY’s has now nearly reversed all of the rebound from 90.34 to 92.18. Break of 90.24 will resume the fall from 93.42 to 89.24 support. Firm break there will argue that it’s already in a larger scale correction to up trend from 80.42.

In Asia, at the time of writing, Nikkei is down -0.62%. Hong Kong HSI is up 0.51%. China Shanghai SSE is up 0.48%. Singapore Strait Times is down -0.21%. Japan 10-year JGB yield is down -0.0115 at 0.732.

BoJ Jan minutes: No need for aggressive tightening like Western counterparts

BoJ’s minutes from January meeting, ahead of the landmark March decision to end negative interest rates, reveal a cautious approach towards monetary policy adjustments. Members highlighted the Japan’s economic conditions “differed significantly” to those of US and Europe when they initiated interest rate hikes a few years ago. The consensus was clear: it was “not required in Japan to conduct rapid monetary tightening” as seen in Western economies.

Further discussions underscored three primary risks to Japan’s economic activity: shifts in global economic performance and financial markets, fluctuations in commodity and grain import prices, and future growth expectations of firms and households.

Members agreed these factors could significantly influence economic outcomes and emphasized the need for vigilance towards price-setting behaviors within the economy, as well as the impact of currency and commodity price movements on domestic inflation.

Yuan rebounds on PBoC’s aggressive fixing and state-owned banks’ support

Chinese Yuan rebounded significantly in Asian session, sparked by PBoC’s unexpectedly strong daily fixing. The fixing was set at 7.0996, markedly stronger than the anticipated 7.2222 by analysts, marking the largest strengthening bias since November. Also, reports suggest that state-owned banks actively participated in selling Dollars onshore, further tightening offshore Yuan liquidity.

Economists interpret this orchestrated maneuver as a decisive message from PBoC, indicating a refusal to tolerate further weakening of Yuan. This action seems to correct what the authorities considered an overreaction by the market to last Friday’s sharp decline. The market’s speculation on Yuan depreciation appeared to be challenged by today’s fixing, aimed at recalibrating market perceptions.

From a pure technical perspective, USD/CNH’s rise from 0.7087 is seen as the second leg of the corrective pattern from 7.3679 for now, which is still in progress. FUrther rally is expected as long as 55 D EMA (now at 7.2056) holds. Next target is 100% projection of 7.0870 to 7.2318 from 7.1715 at 7.3163. But break of 7.3679 high is not envisaged.

However, these technical observations stand independent of the significant influence of PBoC’s interventions in the currency market.

US PCE inflation and BoJ opinions to highlight a relatively light week

While economic calendar may seem less packed this week, certain events stand out with potential market-moving implications. Among the highlights, US PCE inflation data stands out as a key point of interest, especially in light of Fed’s recent projections, which showed a nearly even split among members (9 vs 10) regarding the outlook for two versus three rate cuts this year. Hence, any data surpassing expectations could pivot the scale towards fewer cuts. Additional economic indicators to watch include consumer confidence and durable goods orders.

Internationally, summary of opinions from BoJ’s recent groundbreaking meeting—where it raised interest rate to 0-0.10% and terminated Yield Curve Control—is eagerly awaited. This document is expected to offer a deeper understanding of the rationale and discussions behind the decision. It might also drop some hints on the likelihood of further tightening within the year. Tokyo Consumer Price Index (CPI) will also be under scrutiny, serving as a critical gauge for future BoJ actions.

Other significant data releases this week include the Swiss KOF economic barometer, Canada’s monthly GDP figures, Australia’s monthly CPI and retail sales reports, and New Zealand’s ANZ business confidence index.

New Zealand ANZ business confidence

- Monday: BoJ minutes: US new home sales.

- Tuesday: Australia Westpac consumer sentiment; Japan corporate services price; Germany Gfk consumer sentiment; US durable goods orders, house price index, consumer confidence.

- Wednesday: Australia monthly CPI; Swiss Credit Suisse economic expectations.

- Thursday: BoJ summary of opinions; New Zealand ANZ business confidence; Australia retail sales; Germany retail sales; UK Q4 GDP final; Swiss KOF economic barometer; Canada GDP; US Q4 GDP final, jobless claims, Chicago PMI.

- Friday: Japan Tokyo CPI, unemployment rate, industrial production, retail sales; France consumer spending; US personal income and spending, PCE inflation, goods trade balance.

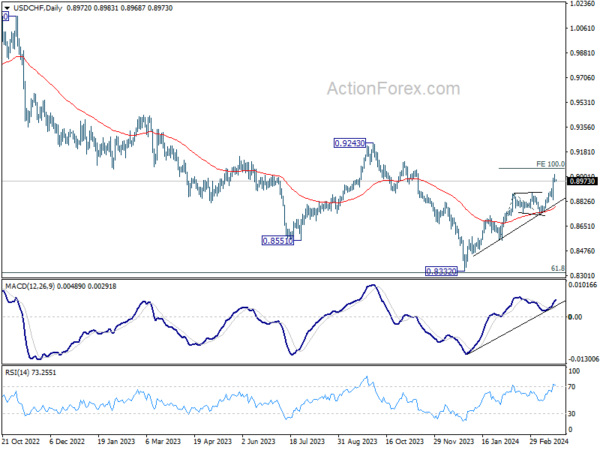

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.8953; (P) 0.8987; (R1) 0.9009; More….

Intraday bias in USD/CHF is turned neutral with 4H MACD crossed below signal line. Some consolidations would be seen below 0.9019 temporary top first. But downside of retreat should be contained above 0.8838 support to bring rebound. Break of 0.9019 will resume larger rally from 0.8332. Next target is 100% projection projection of 0.8550 to 0.8884 from 0.8728 at 0.9062.

In the bigger picture, price actions from 0.8332 medium term bottom as tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Further rise would be seen as long as 0.8728 support holds. But upside should be limited by 0.9243 resistance, at least on first attempt.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | ||||

| 14:00 | USD | New Home Sales Feb | 675K | 661K |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more