According to a survey commissioned by Fulcrum Asset Management - which runs several absolute return products - investors were "inclined to consider absolute return funds as part of their overall asset allocation" because of ongoing market volatility.

It found that seven in 10 institutional investors were considering allocating to absolute return.

CIO of Fulcrum Nabeel Abdoula said he was "not surprised" at the recent interest in absolute return given how "poorly traditional asset classes were performing", however he recognised that there were still some "negative perceptions about the asset class".

Jackson Hole predictions: Higher interest rates for longer as the Fed maintains hawkish rhetoric

AR funds' continue to suffer from a poor reputation, largely linked to the fact no IA Targeted Absolute Return fund has delivered consistent, positive rolling returns since the start of 2016.

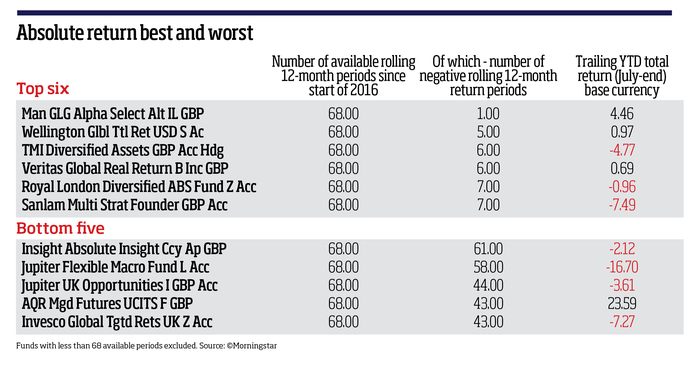

According to data from Morningstar, only 56 out of 108 IA Targeted Absolute Return funds have achieved at least 50% positive periods on a rolling basis since the beginning of 2016. This was based on the funds with data for that entire time frame, or 68 rolling periods.

The same data revealed that of all AR funds that had 68 rolling periods of performance, only ten funds had fewer than ten periods of negative returns.

Man GLG Alpha Select came the closest to its rolling returns goal, with only one negative period during the set timeframe.

In its study, Fulcrum even found that despite investors being more open to adding AR to their portfolios they were split on the quality of the asset class. Just 35% of those surveyed were "broadly positive" on the sector, while 34% said they were "broadly negative". The remaining 30% said they were "unsure".

Losses of any kind are especially significant in absolute return, as these funds strive to deliver a positive return in any market conditions by making full use of the strategies and vehicles available to them, such as short-selling or derivatives.

Kyle Caldwell, collectives specialist at interactive investor, told Investment Week that since the start of the year, the best performing IA Targeted Absolute Return fund was up 40.5%, while the worst performer is down 17%.

"Absolute return can mean different things to different people - because the definition tends to be based around the end result. Positive ‘absolute' returns is a common objective, rather than how you got there," Caldwell said.

He continued that when investors are buying a fund, the number one rule is to "understand how the fund manager invests".

"With absolute return funds, given how complex the strategies tend to be, it is important to understand how the fund manager is seeking to try to protect capital during more turbulent times," he said.

"Investors need to know what kind of journey they are going on, and whether they are cut out for the ride, so it is really important to know what strategies are being used."

Deep Dive: Frontier markets require caution due to 'barrage' of shocks

Given that more investors are looking at this space as a way to diversify from equities, Investment Week asked a variety of experts which AR funds they were backing.

Dzmitry Lipski, the head of funds research at ii, picked the LF Ruffer Diversified Return fund.

He said the portfolio was a "strong core holding option for risk-adverse investors", with the platform adding the fund to its own model portfolio back in April.

As the fund is less than a year old its performance data is limited, however, year-to-date it has returned 0.31%, one of only 30 absolute return funds to stay in the black over 2022's volatility.

Lipski said the management team was "highly experienced and well resourced" and "focused on striking the appropriate balance of ‘greed and fear' assets in the portfolio" to help "weatherproof" the fund.

James Burns, managing partner at wealth manager Evelyn Partners, highlighted the Lazard Rathmore Alternative fund, which aims to generate positive returns 6-8% above cash and record volatility in line with investment grade bonds.

The five strong management team runs a hedged convertible portfolio, typically buying a convertible bond then hedging it with a short (negative) position in the same company. Lead manager Sean Reynolds has a "long-standing track record of delivering excellent risk-adjusted returns," Burns said.

"We believe that the strategy is attractive in what has become a less crowded market since the financial crisis. We view this as a low volatility, defensive strategy which should offer genuine protection in difficult markets."

Out of 39 rolling return periods, it has only had six negative ones.

The final fund was Janus Henderson Absolute Return, run by Ben Wallace and Luke Newman.

Laith Khalaf, head of investment analysis at AJ Bell, said the pair had a wealth of experience running money together, having run the fund since 2009.

"Like any absolute return fund it will not deliver a positive return over absolutely every 12 month period without fail, but it should provide some downside protection when markets are wobbling," Khalaf said.

Out of 68 rolling performance periods, only 13 have been negative.