Gold And Oil Prices Rise Amidst Re-escalating Middle East Tensions

The Middle East sees a re-escalation in geopolitical tensions following a tragic strike on a Gaza hospital, leading to significant rise in both Oil and Gold prices. The effect of this development extends into Asian session. However, risk aversion is not starkly evident in other markets, as Asian indices, excluding Japan, record only marginal losses. Treasury bonds and Swiss Franc have not seen noteworthy inflows, indicating that traders are maintaining a cautious, observatory approach. All eyes are also set on the meeting between Russian President Vladimir Putin and Chinese President Xi Jinping.

China also attracts attention due to its encouraging economic data released today, lending a slight uplift to Chinese Yuan. This positivity has, in turn, given a slight uplift to Australian and New Zealand dollars. Conversely, Dollar has lost some steam as the rally following retail sales data from yesterday began to wane quickly. Euro and Sterling aren’t faring much better, with both currencies ranking among the day’s laggards. Japanese Yen is similarly on the softer side, eclipsed by Swiss Franc and Canadian Dollar. As it stands, the majority of major currency pairs and their crosses remain confined within the trading range set the previous day. However, the forthcoming UK inflation data could provide the catalyst for more significant market movements.

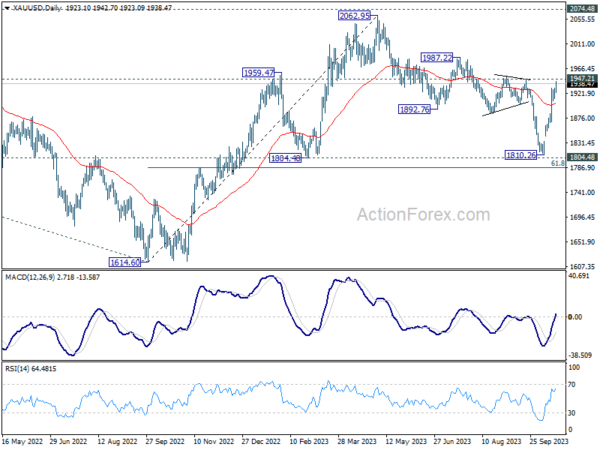

Technically, Gold’s rise from 1810.26 resumes today and it’s now targeting 1942.71 resistance. Decisive break there will further strengthen the case that correction from 2062.95 has completed with three waves down to 1810.26, just ahead of 1804.40. Further rally could then be seen through 1987.22 to retest 2062.95 high. In any case, near term outlook will stay bullish as long as 55 D EMA (now at 1902.96) holds.

In Asia, at the time of writing, Nikkei is up 0.03%. Hong Kong HSI is down -0.10%. China Shanghai SSE is down -0.61%. Singapore Strait Times is down -0.54%. Japan 10-year JGB yield is up 0.028 at 0.813. Overnight, DOW rose 0.04%. S&P 500 dropped -0.01%. NASDAQ dropped -0.25%. 10-year yield rose 0.135 to 4.847.

RBA’s Bullock highlights sticky services inflation, housing and job market

RBA Governor Michele Bullock voiced concerns over stickiness in services inflation, rising house prices and tight labor market at an Australian Financial Security Authority event.

“We’re seeing a slowdown in consumption,” Bullock said, pointing out a decline in per capita consumption. This can be attributed to the central bank’s policy measures, as indicated by her remark, “monetary policy is starting to bite.” She elaborated that businesses were starting to find it hard to pass on cost increases as demand begins to taper.

However, the stickiness of inflation remains a significant concern. Bullock highlighted a stubborn rise in services inflation, which encompasses various sectors, from restaurants to hairdressers. “That inflation is running at a bit over 4 per cent,” she noted, acknowledging it exceeds RBA’s target and mirrors inflationary trends observed globally.

Additionally, housing prices are on the rise again, coupled with a tight employment market, contributing to inflationary pressures. These economic elements, combined with external factors such as the Israel-Gaza conflict escalating fuel costs, suggest that inflation might remain a persistent issue.

Australia’s Westpac Index reports fourteenth month in red, despite marginal improvement.

Australia’s economic outlook remains subdued as indicated by the Westpac Leading Index, which, though it rose slightly from -0.48% to -0.34% in September, continues to signal prolonged weak conditions. Fourteen successive months of subzero readings on the headline index growth rate project that the anaemic sub-trend growth momentum is anticipated to linger into 2024.

Westpac anticipates the nation’s GDP growth to decelerate to 1.2% in 2023, maintaining this tepid pace into the initial half of 2024, with an annualized growth rate pegged at 1.1%. This projection is notably beneath the expected population growth, which is projected to hover around 2.3%.

The recent minutes from RBA’s October meeting shed light on the central bank’s discomfort with the current inflationary environment, revealing its “low tolerance” towards unexpected inflationary spikes.

As the market casts its gaze towards the upcoming RBA meeting slated for November 7, Westpac anticipates revisions in the near-term forecasts for headline inflation. However, adjustments to the central bank’s medium-term view, a critical determinant for any further rate hike, are not expected.

However, this anticipation hinges significantly on the unveiling of the September quarter CPI, scheduled for release on October 25. Any significant surprises in this data could recalibrate expectations and potentially prompt the RBA to rethink its stance.

China’s Q3 GDP growth beats expectations; IMF cautions on future prospects

China’s economy exhibited resilience in Q3, with GDP growing at 4.9% yoy, outpacing anticipated 4.5% yoy increase. However, this growth rate reflects deceleration from 6.3% yoy expansion observed in Q2. On quarterly basis, the economy grew 1.3% qoq, marking an improvement from revised 0.5% qoq in the preceding quarter and outpacing anticipated 1.0% qoq expansion.

Industrial output in September echoed the positive trend, registering a 4.5% yoy uptick, marginally above 4.3% yoy forecast. Retail sales also followed suit, with 5.5% yoy increase, surpassing expected 4.9% yoy rise. However, fixed asset investments underperformed expectations, with year-to-date growth of 3.1% yoy, slightly below anticipated 3.2%.

Despite these seemingly positive indicators, China’s National Bureau of Statistics sounded a note of caution. The NBS underscored the challenges posed by a complicated external environment and lackluster domestic demand, calling for enhanced efforts to fortify the economic recovery’s foundation.

Separately, International Monetary Fund adjusted its growth outlook for China downward, citing a “losing steam” recovery impacted significantly by the property sector’s frailty. IMF now projects China’s economy to grow by 5% in 2023 and 4.2% in 2024, a downward revision from its earlier forecast of 5.2% and 4.5% respectively.

The IMF’s report highlighted contraction in manufacturing purchasing managers’ indexes from April to August, coupled with additional weaknesses in real estate sector, as pivotal factors behind the revised forecast.

Looking ahead

UK CPI and PPI are the main focuses in European session while Eurozone will publish CPI final. Later in the day, US will release building permits and housing starts, as well as Fed’ Beige Book economic report.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6339; (P) 0.6360; (R1) 0.6386; More…

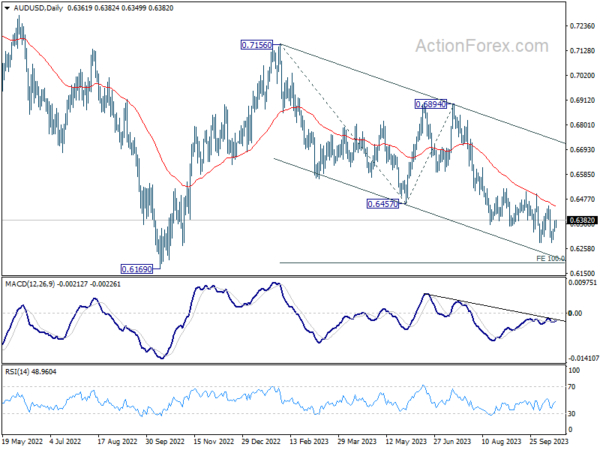

AUD/USD’s recovery continues today but stays below 0.6444 resistance. Intraday bias remains neutral and outlook stays bearish. On the downside, decisive break of 0.6284 will confirm resumption of whole decline from 0.7156. Next target is 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195, which is close to 0.6169 medium term support. Nevertheless, firm break of 0.6444 will confirm short term bottoming, and turn bias to the upside for stronger rebound.

In the bigger picture, down trend from 0.8006 (2021 high) is possibly still in progress. Decisive break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Sep | 0.10% | -0.04% | ||

| 02:00 | CNY | GDP Y/Y Q3 | 4.90% | 4.50% | 6.30% | |

| 02:00 | CNY | Retail Sales Y/Y Sep | 5.50% | 4.90% | 4.60% | |

| 02:00 | CNY | Industrial Production Y/Y Sep | 4.50% | 4.30% | 4.50% | |

| 02:00 | CNY | Fixed Asset Investment (YTD) Y/Y Sep | 3.10% | 3.20% | 3.20% | |

| 06:00 | GBP | CPI M/M Sep | 0.40% | 0.30% | ||

| 06:00 | GBP | CPI Y/Y Sep | 6.60% | 6.70% | ||

| 06:00 | GBP | Core CPI Y/Y Sep | 6.00% | 6.20% | ||

| 06:00 | GBP | RPI M/M Sep | 0.50% | 0.60% | ||

| 06:00 | GBP | RPI Y/Y Sep | 8.90% | 9.10% | ||

| 06:00 | GBP | PPI Input M/M Sep | 0.20% | 0.40% | ||

| 06:00 | GBP | PPI Input Y/Y Sep | -2.30% | |||

| 06:00 | GBP | PPI Output M/M Sep | 0.30% | 0.20% | ||

| 06:00 | GBP | PPI Output Y/Y Sep | -0.40% | |||

| 06:00 | GBP | PPI Core Output M/M Sep | -0.10% | |||

| 06:00 | GBP | PPI Core Output Y/Y Sep | 1.60% | |||

| 09:00 | EUR | Eurozone CPI Y/Y Sep F | 4.30% | 4.30% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep F | 4.50% | 4.50% | ||

| 12:30 | USD | Building Permits M/M Sep | 1.45M | 1.54M | ||

| 12:30 | USD | Housing Starts M/M Sep | 1.39M | 1.28M | ||

| 14:30 | USD | Crude Oil Inventories | -0.5M | 10.2M | ||

| 18:00 | USD | Fed’s Beige Book |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more