Global Markets Hesitate; AUD/NZD Might Display Some Volatility

A quiet yet tense atmosphere pervades the financial markets today, as traders’ anticipation builds, eyes keenly focused on unfolding developments in the Israel-Hamas conflicts. Such geopolitical uncertainties are casting a shadow over most major trading hubs, prompting cautious moves among investors.

In the European markets, major indexes are painting a mixed image. FTSE is registering a modest ascent, a contrast to the stable stance of its counterparts. Across the pond, DOW futures hint at a bullish open, yet questions linger on the longevity of this buying momentum. In the energy market, oil prices are on a modest upward incline, though bereft of significant momentum. Gold, in the meantime, is in a phase of consolidation, holding firm to the gains achieved in the preceding week.

In the realm of forex, a similar pattern emerges. Major currency pairs and crosses are ensnared within the trading ranges established last Friday. Dollar, Yen, and Swiss Franc are trending softer. Contrarily, Kiwi and Aussie are faring stronger, joined by Sterling and Euro. The prevailing sentiment, however, hovers in a neutral zone, susceptible to rapid shifts should geopolitical events take an unexpected turn.

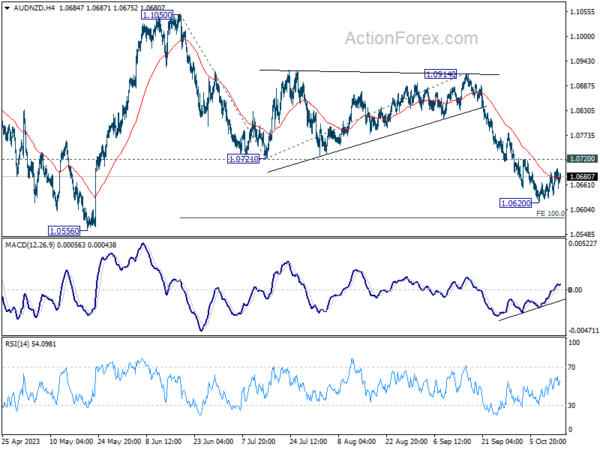

In the upcoming Asian session, the spotlight shifts to New Zealand’s CPI data and release of RBA minutes. That makes AUD/NZD an interesting one to watch. Technically, the cross recovered after falling to 1.0620 a week ago. Price actions from there are still clearly corrective. Near term outlook will stay bearish as long as 1.0720 resistance holds. Fall from 1.1050 is still in favor continue to 100% projection of 1.1050 to 1.0721 from 1.0914 at 1.0585 next.

In Europe, at the time of writing, FTSE is up 0.43%. DAX is up 0.02%. CAC is up 0.13%. Germany 10-year yield is up 0.042 at 2.779. Earlier in Asia, Nikkei fell -2.03%. Hong Kong HSI fell -0.97%. China Shanghai SSE fell -0.46%. Singapore Strait Times fell -0.69%. Japan 10-year JGB yield dropped -0.0036 to 0.755.

Canada manufacturing sales up 0.7% mom, but down -0.7% mom in real terms

Canadian manufacturing sales rose 0.7% mom to CAD 72.4B in August, below expectation of 1.1% mom. Sales were higher in 9 of 21 sectors, led by the petroleum and coal (+10.5%), food (+1.5%) and machinery (+2.4%) subsectors. Sales of fabricated metals (-3.5%) and miscellaneous (-9.4%) declined the most.

Sales in real terms, however, decreased -0.7% mom.

BoE’s Pill highlights incomplete inflation journey amidst falling headline rates

Speaking at a forum today, BoE Chief Economist Huw Pill asserted, “We still have some work to do in order to get back to 2%.”

“And we probably have some work to do to ensure that when we get it back to 2%, we do so in a way that is sustainable,” he added.

Pill voiced concerns over interpreting the recent decline in headline inflation as a success. He pointed out that the declining rate is “certainly not sufficient” to claim that their inflationary objectives have been met.

Emphasizing the need for a consistent strategy, he said, “If we have a persistent component of inflation, it seems natural to me that we have a persistent monetary response to it.”

“It is important that we do not declare victory prematurely just because movements which are relatively mechanical in headline inflation are working their way through.”

Eurozone goods exports down -3.9% yoy, imports down -24.6% yoy

Eurozone goods expects dropped -3.9% yoy to EUR 221.6B in August. Goods imports fell -24.6% yoy to EUR 214.9B. Trade surplus came in at EUR 6.7B. Intra-Eurozone trade fell -13.2% yoy to EUR 189.3B.

In seasonally adjusted term, goods exports rose 1.6% mom to EUR 236.0B. Goods imports dropped -2.0% mom to EUR 223.1B. Trade surplus widened to EUR 11.9B, above expectation of EUR 5.4B. Intra-Eurozone trade fell from EUR 217.2B to 216.9B.

New Zealand BNZ service rose to 50.7, yet uncertainties linger

New Zealand’s service sector showed signs of recovery in September, with BusinessNZ Performance of Services Index rising to 50.7, up from 47.7 in August. This improvement marks an end to the three consecutive months of contraction, though the index is still languishing below the long-term average of 53.5.

Among the key components, activity/sales witnessed a notable rise, moving up to 50.9 from 44.9. Meanwhile, employment indicators slightly dipped from 51.0 to 50.6. New orders/business experienced a healthy increase, reaching 53.9 from 48.5. However, stocks/inventories decreased to 47.9 from 51.4, while supplier deliveries inched up to 49.6 from 49.2.

Addressing the sentiment, BusinessNZ’s Chief Executive, Kirk Hope, pointed out that negative sentiments remained prevalent, with 61.8% in September, only slightly lower than 63.9% in August. A significant portion of these concerns was attributed to uncertainties surrounding the General Election and rising cost of living.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8986; (P) 0.9039; (R1) 0.9077; More….

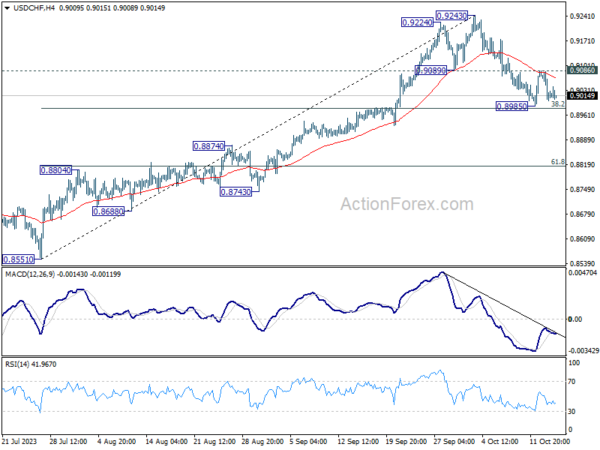

Range trading continues in USD/CHF and intraday bias stays neutral. On the upside, break of 0.9086 resistance will indicate that pull back from 0.9243 has completed, and turn bias to the upside for retesting this high. However, sustained break of 38.2% retracement of 0.8551 to 0.9243 at 0.8979 will argue that deeper fall is under way to 61.8% retracement at 0.8815.

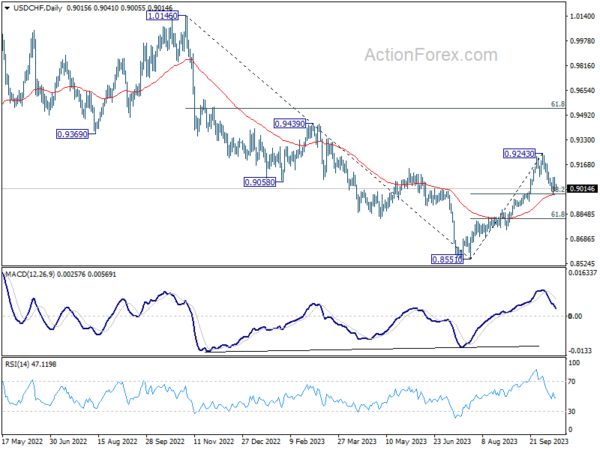

In the bigger picture, as long as 55 D EMA (now at 0.8976) holds rise from 0.8551 is viewed as reversing whole down trend from 1.0146 (2022 high). On resumption, further rise should be seen to 61.8% retracement of 1.0146 to 0.8551 at 0.9537 and above. However, sustained break of 55 D EMA will revive medium term bearishness, for retesting 0.8551 low at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PSI Sep | 50.7 | 47.1 | 47.7 | |

| 23:01 | GBP | Rightmove House Price Index M/M Oct | 0.50% | 0.40% | ||

| 04:30 | JPY | Industrial Production M/M Aug F | -0.70% | 0.00% | 0.00% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Aug | 11.9B | 5.4B | 2.9B | 3.5B |

| 12:30 | CAD | Manufacturing Sales M/M Aug | 0.70% | 1.10% | 1.60% | |

| 12:30 | CAD | Wholesale Sales M/M Aug | 2.30% | 2.50% | 0.20% | 0.00% |

| 12:30 | USD | Empire State Manufacturing Index Oct | -4.6 | -4.5 | 1.9 | |

| 14:30 | CAD | BoC Business Outlook Survey |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more