A fund manager, multi-asset manager, fund picker and economist picked graphs that show the difficulties and benefits of investing in this asset class amid the everchanging backdrop, dealing with factors such as supply and demand, inflation and stagflation.

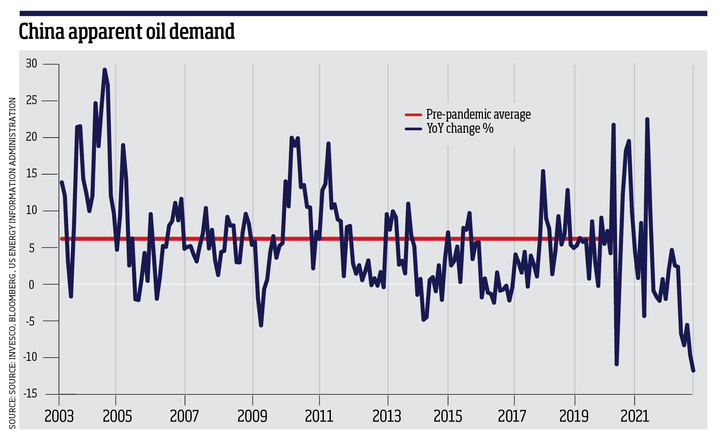

China apparent oil demand

Martin Walker, head of UK equities at Invesco

The balance between supply and demand in oil markets is always tight - the easiest place to store oil is still in the ground. And there is an old maxim that it is easier to change supply than it is demand. But right now, global oil supply is running at full tilt, with very little outage and negligible spare capacity in the system. Against this backdrop, lockdown in China has curtailed demand for oil to a level we estimate to be 18% below what might expect were the economy to be fully functioning. This amounts to around 2.9% of global demand. The price of oil has moderated from highs reached earlier in the year, however when China eventually opens up, the tension in global oil markets will necessarily increase. In our view, the revenues of energy stocks are set to remain stronger for longer.