Feds Rate-Cut Debate Intensifies, Dollar Tumbles Amid Renewed 50bps Speculation

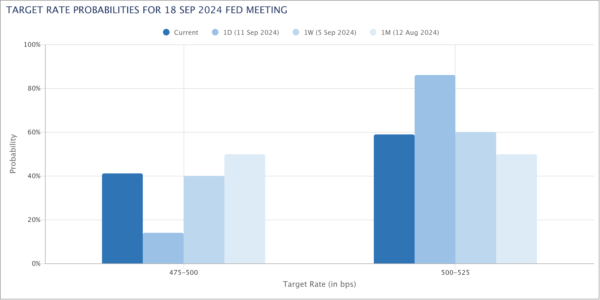

Dollar fell sharply overnight as the probability of a 50bps rate cut by Fed next week increased significantly. According to fed fund futures, the odds of a half-point cut now sit at around 40%, a notable jump from just 14% the day before. Market participants had widely assumed that Fed was firmly on track for a smaller 25bps cut. However, recent developments have brought a more aggressive rate reduction back into consideration.

After last week’s solid non-farm payrolls report and the higher-than-expected core inflation data earlier this week, most market participants had ruled out the likelihood of a 50bps cut. However, fresh commentary from key financial outlets, such as the Wall Street Journal and Financial Times, has flipped the narrative.

WSJ’s Nick Timiraos, often referred to as the “Fed Whisperer,” wrote that Fed now faces a “rate-cut dilemma” — whether to “start big or small.” He highlighted the Fed’s nervousness about keeping rates elevated for too long, particularly as evidence mounts that higher borrowing costs are indeed cooling the economy as intended.

An article in FT echoed this sentiment, highlighting the argument that a larger 50bps cut might minimize risks to the Fed’s goal of a soft landing. A more aggressive cut would allow borrowing costs to normalize faster, which could relieve economic strain and protect the labor market from further deterioration.

However, not all are in agreement. Fitch raised concerns, noting that the challenges posed by inflation over the past few years might make Fed officials more cautious. It took longer than expected to control inflation, revealing gaps in the central bank’s understanding of inflation drivers, which could make policymakers wary of moving too quickly.

In the forex markets this week so far, Yen remains the strongest performer, followed by Aussie and Sterling. On the other end, Swiss Franc is the weakest, followed by the Loonie and Dollar. Euro and Kiwi are positioned in the middle

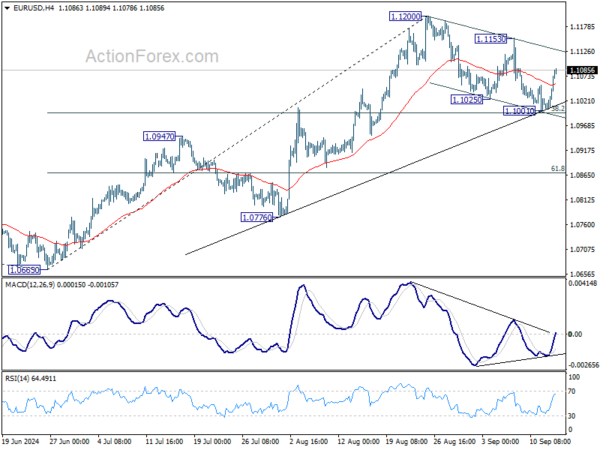

Technically, EUR/USD rebounded after receiving notable support from 38.2% retracement of 1.0665 to 1.1200 at 1.0996. Focus is now on whether this rebound could extend through 1.1153 resistance. That would mark the completion of correction from 1.1200, and that larger rally should then be ready to resume towards 1.1274 key resistance next (2023 high).

In Asia, at the time of writing, Nikkei is down -0.89%. Hong Kong HSI is up 1.20%. China Shanghai SSE is down -0.09%. Singapore Strait Times is up 0.21%. Japan 10-year JGB yield is down -0.024 at 0.842. Overnight, DOW rose 0.58%. S&P 500 rose 0.75%. NASDAQ rose 1.00%. 10-year yield rose 0.0270 to 3.680.

Momentum builds in Gold’s record run, will it push past 2600 barrier?

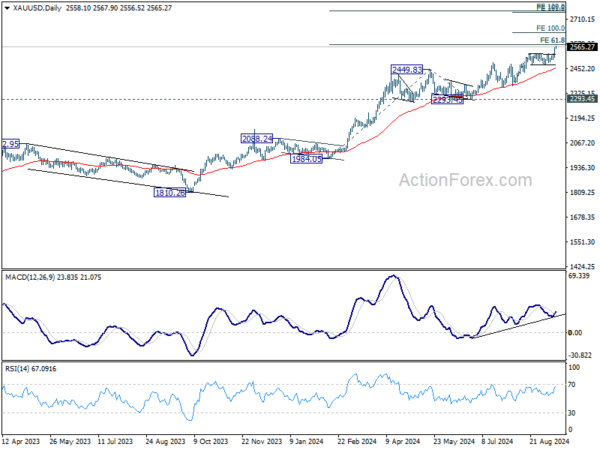

Gold’s rally accelerated after clearing 2531 resistance earlier in the week, and was further aided by the broad-based selloff in Dollar overnight. With price now nearing a critical resistance zone just below 2600 mark, focused is on whether Gold can sustain this momentum. Decisive break above this level could lead to upside acceleration, and extend the record run towards 2750 region.

Technically, near term outlook will stay bullish as long as 2531.52 resistance turned support holds. Next target is 61.8% projection of 2364.18 to 2531.52 from 2471.76 at 2575.17. Decisive break there will target 100% projection at 2639.10.

From a medium term perspective, outlook is staying bullish with continuous strong support from rising 55 D EMA. Key focus is on 61.8% projection of 1984.05 to 2449.83 from 2293.45 at 2581.30, which is close to above mentioned 2575.17 projection level. Sustained break of this cluster projections level could prompt further upside acceleration to 100% projection at 2742.51.

NZ BNZ manufacturing rises to 45.8, 18th month of contraction

BNZ Performance of Manufacturing Index for New Zealand edged higher in August, rising from 44.4 to 45.8. Despite the improvement, the sector remains in deep contraction, well below its long-term average of 52.6, marking the 18th consecutive month of declining activity.

A closer look at the data reveals that production increased from 44.2 to 46.3, while employment also saw a slight rise, moving from 43.5 to 46.6. New orders climbed from 43.3 to 46.8, signaling some improvement in demand. However, finished stocks dipped slightly from 46.3 to 46.2, while deliveries improved marginally from 44.7 to 45.6.

BusinessNZ’s Director of Advocacy, Catherine Beard, commented on the situation, noting that while the PMI is “heading back in the right direction,” the sector’s return to expansion is still distant after 18 months in contraction.

The ongoing challenges in the manufacturing sector were reflected in the proportion of negative comments, which, although improved, remained high at 64.2% in August, down from 71.1% in July and 76.3% in June. These negative sentiments were largely driven by concerns over the broader economic recession, with manufacturers citing weak demand and rising living costs as significant hurdles to recovery.

Looking ahead

Eurozone industrial production will be released in European session. Later in the day, Canada will publish wholesale sales. US will release import prices and U of Michigan consumer sentiment,

USD/JPY Daily Outlook

Daily Pivots: (S1) 141.35; (P) 142.20; (R1) 142.66; More…

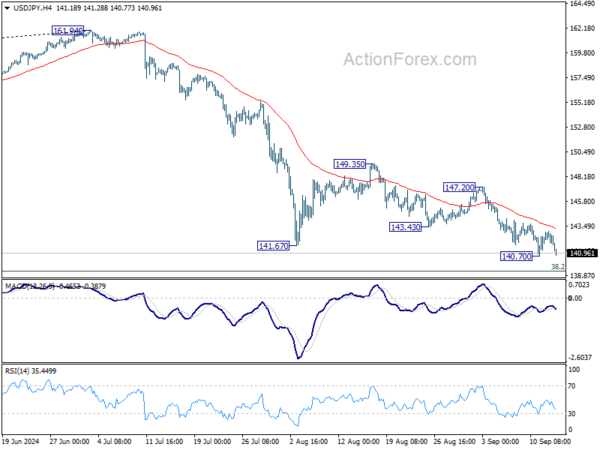

USD/JPY is staying above 140.70 temporary low despite current dip, and intraday bias stays neutral first. Outlook remains bearish as long as 147.20 resistance holds. On the downside, break of 140.70 will resume the fall from 161.94 to 140.25 support, and possibly to 139.26 fibonacci level too.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. Strong support could be seen there to bring rebound. But in any case, risk will stay on the downside as long as 55 W EMA (now at 148.93) holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Aug | 45.8 | 44 | ||

| 04:30 | JPY | Industrial Production M/M Jul F | 2.80% | 2.80% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Jul | 0.20% | -0.10% | ||

| 12:30 | CAD | Capacity Utilization Q2 | 78.40% | 78.50% | ||

| 12:30 | CAD | Wholesale Sales M/M Jul | -1.10% | -0.60% | ||

| 12:30 | USD | Import Price Index M/M Aug | -0.20% | 0.10% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Sep P | 68 | 67.9 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more