Euro Tumbles Amid Political Uncertainty, Market Eyes FOMC Dot Plot And US CPI This Week

In holiday-thinned Asian trading today, Euro’s sharp decline was the focal point. Investors’ reaction to European Parliament election results was overwhelmingly negative. The far-right’s significant gains have sparked concerns, driving the common currency through key support level against both Sterling, and a near term support again Dollar. This technical development suggests further downside risks for Euro, which may persist at least until the political uncertainties within the EU are resolved.

Dollar, on the other hand, managed to hold most of the gains achieved from last week’s robust job data, although it has shown some struggle to extend its rally against commodity currencies today. The market’s attention is now shifting towards the upcoming FOMC rate decision and the closely watched dot plot. However, the forthcoming May CPI data could be an even more significant market mover. Any indication that disinflation is stalling again could constrain Fed’s ability and desire to ease monetary policy this year.

As of today, Australian Dollar leads as the strongest among commodity currencies, including the New Zealand Dollar and the Canadian Dollar, which are also showing strength. Japanese Yen and Swiss Franc trail behind Euro, marked as weaker performers. Dollar and British Pound hold middle ground in the currency rankings.

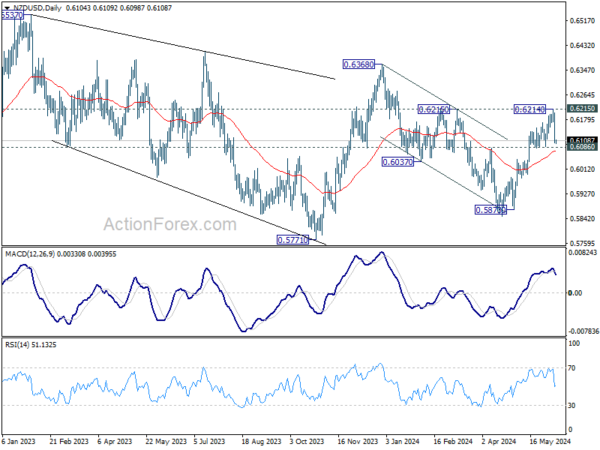

Technically, NZD/USD was rejected by 0.6215 resistance and fell sharply on Friday. But it’s holding above 0.6086 support so far. The favored outlook is still that rise from 0.5870 is resuming rally from 0.5771. Firm break of 0.6215 resistance will strengthen this case, and target 0.6368 and above. However, firm break of 0.6086 will bring deeper fall back to 0.5870 instead. Such bearish development, if accompanied by decisive break of 0.6578 support in AUD/USD will affirm Dollar’s overall strength.

In Asia, Nikkei rose 0.92%. Japan 10-year JGB yield is up 0.0611 at 1.034. Singapore Strait Times is down -0.23%. Hong Kong and China are on holiday.

Euro dives as eurosceptics gain in European Parliament Elections

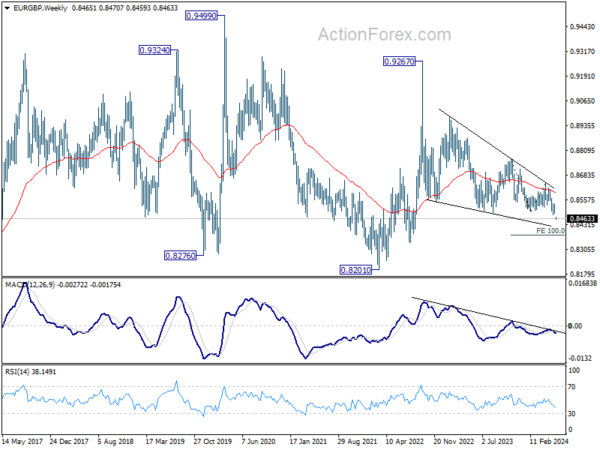

Euro spiked sharply lower in thin Asian session today, breaking a crucial support level against Sterling. This decline was sparked by the results of European Parliament elections, where Eurosceptic nationalists made notable gains, although the Centre, liberal, and Socialist parties are still expected to hold a majority.

The election outcomes prompted a dramatic response from French President Emmanuel Macron, who called for a parliamentary election with the first round set for June 30. This move gives the far-right an opportunity to gain substantial political power, potentially weakening Macron’s presidency three years ahead of its end. In Germany, Chancellor Olaf Scholz’s Social Democrats experienced their worst electoral result ever, losing ground to both mainstream conservatives and the hard-right Alternative for Germany.

The announcement of snap elections in France introduces significant uncertainty for the EU, likely impacting economic and market confidence, particularly in France.

Technically, EUR/GBP’s strong break of 0.8491 support confirms resumption of whole down trend from 0.9267 (2022 high) Outlook will stay bearish as long as 0.8529 resistance holds. Next target is 100% projection of 0.8764 to 0.8497 from 0.8643 at 0.8376.

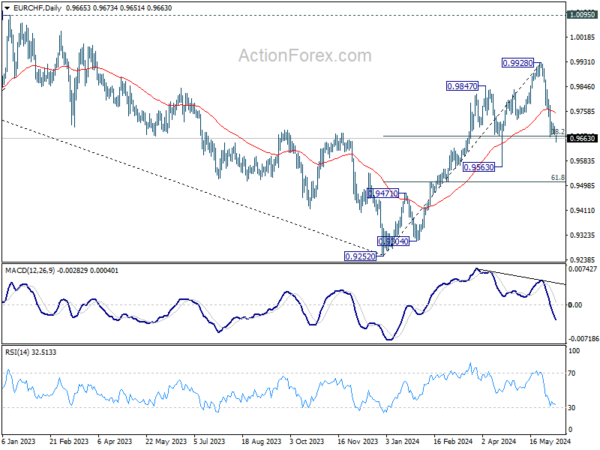

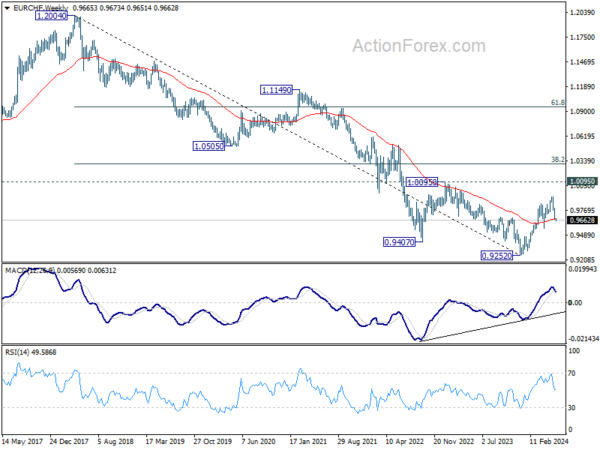

As for EUR/CHF, sustained trading below 38.2% retracement of 0.9252 to 0.9928 at 0.9670 and 55W EMA (now at 0.9672) will raise the chance that whole rise from has completed at 0.9928 already. Deeper decline would be seen to 0.9563 support first. Further break there will strengthen this bearish case.

ECB’s Holzmann cautions on risks of further rate cuts

ECB Governing Council member Robert Holzmann expressed concerns on Saturday about the risks of further reductions in ECB borrowing costs, particularly regarding their impact on the Euro exchange rate and inflation.

Holzmann warned, “If the original assumption of three rate cuts were to materialize, and the Federal Reserve didn’t respond, it would certainly have an impact on the exchange rate, and with it inflation.”

Holzmann was the lone dissenter against ECB’s rate cut last week but stated that the decision didn’t yet make him concerned about inflation risks.

He explained that ECB officials’ implicit commitment to a rate cut was a significant factor in last week’s decision. “There was a review of the data and a discussion about it with different points of view,” he said. “The council’s opinion was that there was no other way, also because it had been announced that such a decision would be made in June.”

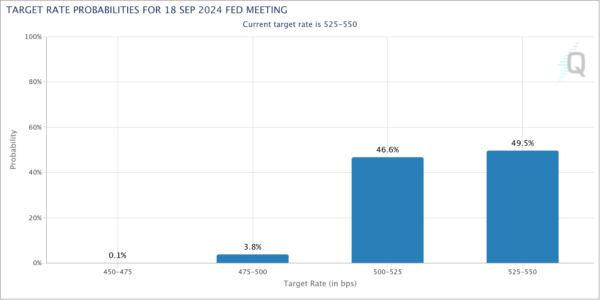

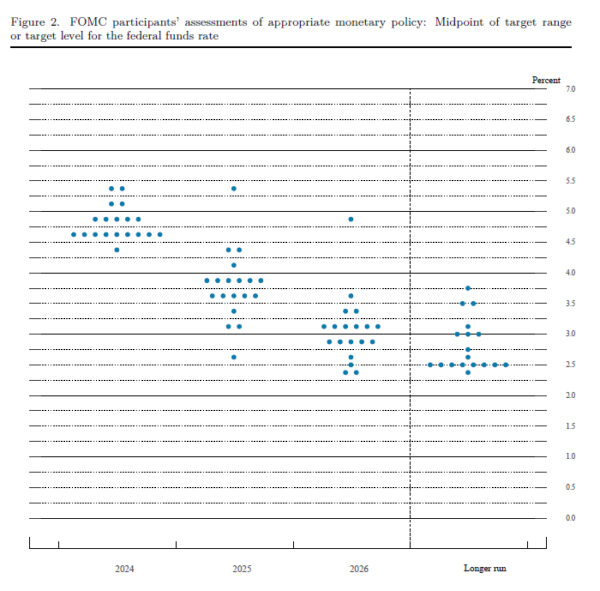

Fed to stand pat, markets await new dot plot

FOMC meeting is the major focus of the week, and Fed is widely expected to keep interest rates unchanged at 5.25-5.50%. Market expectations are fluctuating around 50% chance for a rate cut in September. The upcoming economic projections and dot plot may hopefully provide clearer guidance.

Back in March, Fed’s dot plot revealed a divided outlook among policymakers: ten anticipated up three rate cuts this year, while nine foresaw rates holding steady or increasing, including four who projected additional hikes. This division is expected to shift towards a more hawkish stance in the upcoming update.

Key questions include how many policymakers now foresee two or less cuts this year and whether any still consider further hikes necessary. A scenario where more policymakers lean towards two cuts while fewer envision hikes could be market neutral. .

For Dollar and broader markets, more significant movements might be spurred by the latest CPI and PPI data, rather than Fed’s rate decision alone.

Simultaneously, BoJ is expected to keep its policy rates steady at 0-0.10%. A Bloomberg survey suggests a slight majority of economists predict BoJ might begin reducing its JPY 6T monthly bond purchases. Regarding interest rate hikes, about one-third expect an increase in July, with 41% looking to October, though signals for another rate hike remain premature.

In the UK, upcoming GDP and employment data will be crucial, especially as BoE Governor Andrew Bailey indicated that a June rate cut is not guaranteed. The MPC has been more divided than its counterparts globally, making this week’s data particularly significant in shaping both market expectations and the MPC’s forthcoming decisions.

Additionally, global economic indicators such as Eurozone Sentix investor confidence, Australian employment and NAB business confidence, along with China’s CPI, are also on the radar and could impact market sentiment.

Here are some highlights for the week:

- Monday: Japan GDP final, current account, Eco Watcher sentiment; Swiss SECO consumer climate; Italy industrial production; Eurozone Sentix investor confidence.

- Tuesday: Australia NAB business confidence; UK employment; US NFIB small business index; Canada building permits.

- Wednesday: Japan PPI; China CPI, PPI; Germany CPI final; UK GDP, production, trade balance; US CPI, FOMC rate decision.

- Thursday: Japan BSI manufacturing; Australia employment; Swiss PPI; Eurozone industrial production; US PPI, jobless claims.

- Friday: New Zealand BNZ manufacturing; BoJ rate decision, tertiary industrial index; Eurozone trade balance; Canada manufacturing sales, wholesale sales; U of Michigan consumer sentiment.

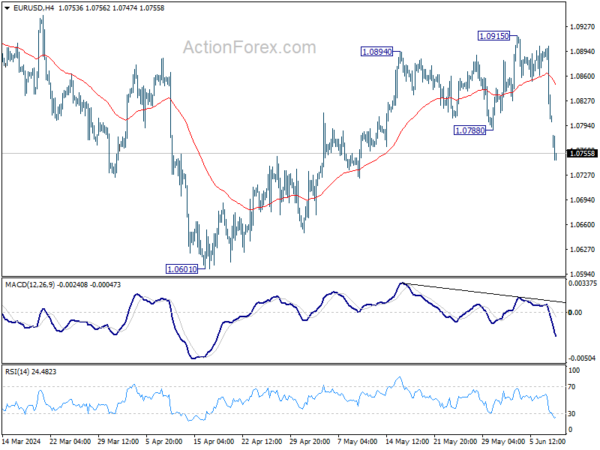

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0768; (P) 1.0835; (R1) 1.0870; More….

EUR/USD’s steep decline today and strong break of 55 D EMA (now at 1.0810) indicates short term topping at 1.0915. more importantly, rebound from 1.0601 might have completed already, and EUR/USD is now is another falling leg of the corrective pattern from 1.1274. Intraday bias is back on the downside for 1.0601 support next. For now, risk will be mildly on the downside as long as 1.0915 resistance holds, in case of recovery.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern, which might still be in progress. Break of 1.0601 will target 1.0447 support and possibly below. Nevertheless, on the upside, firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y May | 3.00% | 3.10% | 3.10% | |

| 23:50 | JPY | GDP Q/Q Q1 F | -0.50% | -0.50% | -0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | 3.40% | 3.70% | 3.60% | |

| 23:50 | JPY | Current Account (JPY) Apr | 2.52T | 2.06T | 2.01T | |

| 05:00 | JPY | Eco Watchers Survey: Current May | 45.7 | 48.9 | 47.4 | |

| 08:00 | EUR | Itay Industrial Output M/M Apr | 0.30% | -0.50% | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jun | -1.9 | -3.6 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more