Dollar Weakness Continues As Focus Shifts To Non-Farm Payroll Data

Dollar weakens broadly in Asian session, continuing its selloff from the previous night, as influenced by rebound in US stocks and falling treasury yields. The focus is now squarely on today’s non-farm payroll report, a key indicator closely monitored by Fed policymakers. Preliminary data suggest possibility for an upside surprise in the jobs figures

For the Federal Reserve to consider rate cuts, there needs to be a clear trend of loosening in the job market that could contribute to cooling domestic inflation. Strong employment data today would suggest that high interest rates would need to persist longer than some investors anticipate, maintaining a restrictive policy environment to temper inflation pressures.

Overall for the week, the greenback in now the worse performer, followed by Canadian and then Euro. Yen remains the strongest one with help from alleged intervention earlier in the week. Australian Dollar is the second strongest, particular benefiting from extended rally in Hong Kong stocks. Swiss Franc is the third strongest, after rebounding on stronger than expected inflation data. Sterling and Kiwi are currently positioning in the middle.

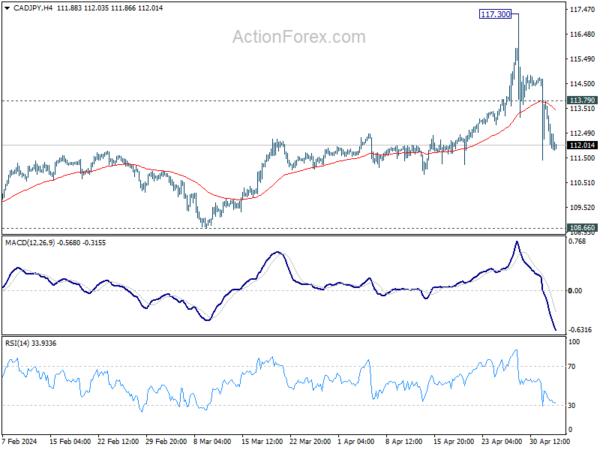

Technically, CAD/JPY is currently the second biggest mover for the week, down more than -3.4%. Risk will stay on the downside as long as 113.79 minor resistance holds. While corrective fall from 117.30 would spiral lower, strong support should emerge above 108.66 to contain downside. Meanwhile, break of 113.79 will suggest stabilization and set the range for sideway trading.

In Asia, Nikkei fell -0.10%. Hong Kong HSI is up 1.34%. China is on holiday. Singapore Strait Times is up 0.34%. Japan 10-year JGB yield is up 0.0101 at 0.906. Overnight, DOW rose 0.85%. S&P 500 rose 0.91%. NASDAQ rose 1.51%. 10-year yield fell -0.0240 to 4.571.

ECB’s Lane specifies three guiding factors for speed and scale of rate cuts

ECB Chief Economist Philip Lane reiterated the central bank’s cautious stance on interest rate policy in a speech overnight, underscoring that rate decisions will remain “data-dependent” and determined on a “meeting-by-meeting” basis. While ECB is open to rate cuts if inflation converges to target in sustainable manner, Lane emphasized that the bank is “not pre-committing to a particular rate path.”

Lane elaborated on the factors that will guide ECB’s decisions on the “speed and scale” of rate cuts. Firstly, he noted that the effects of previous interest rate hikes are “still unfolding”, with their full impact on inflation expected to manifest gradually. While the impact on GDP peaked in 2023, the “bulk of impact on inflation is comparatively backloaded” with substantial pass-through effects yet to occur.

Additionally, the evolution of inflation expectations remains a critical consideration for the ECB’s policy calibration. Lane also pointed out the dual risks associated with the timing of policy adjustments: easing too soon or too quickly could undermine stabilization efforts, while maintaining overly restrictive rates could hinder economic recovery.

US non-farm payroll takes center stage

US Non-Farm Payroll report stands as the focal point for global financial markets, with significant implications for Fed’s monetary policy easing decisions ahead. Throughout this year, the labor market has continually surprised economists by maintaining robust growth, contrary to predictions of a slowdown. This resilience has placed the Fed in a predicament, as policymakers remain reluctant to initiating interest rate cuts without more definitive signs that inflation is under control.

This month’s employment data, while not sufficient on its own to prompt immediate policy easing, is crucial for establishing a trend that could influence Fed’s confidence levels. For Fed to consider loosening its policy stance later in the year, key metrics including headline job growth, unemployment rate, and wage growth must start collectively pointing towards a cooling job market.

Market expectations for today’s NFP include job growth of 243k and unemployment rate holding steady at 3.8%, with average hourly earnings anticipated to increase by 0.3% mom. Related data saw 192k ADP private job growth. ISM Manufacturing Employment rose slightly from 47.4 to 48.6. There was a marginal decrease in the 4-week moving average of initial unemployment claims to from 214k to 210k. All suggest the prospect for an NFP figure that could exceed expectations.

In terms of market reactions, 10-year yield is worth some attention. Break of 4.568 support will argue that a short term top is already formed at 4.730. Deeper pullback would be seen back to 55 D EMA (now at 4.414) or even further to 38.2% retracement of 3.780 to 4.730 at 4.367. If realized, this decline in 10-year yield would be a drag to Dollar, in particular in USD/JPY.

Elsewhere

France industrial output, Italy unemployment, UK PMI services final, and Eurozone unemployment rate will be released in European session. Later in the day, US ISM services will also be released after non-farm payrolls.

EUR/USD Daily Outlook

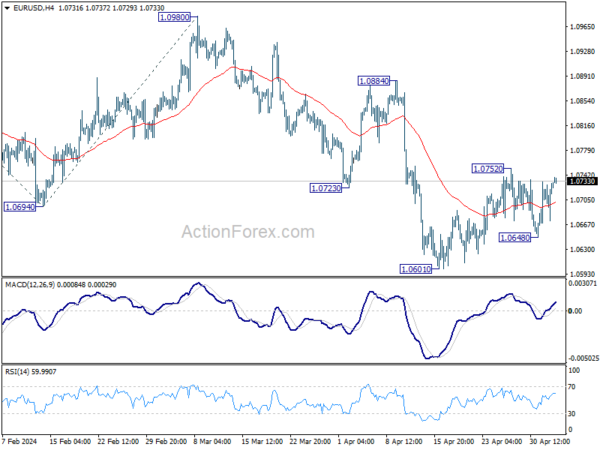

Daily Pivots: (S1) 1.0689; (P) 1.0710; (R1) 1.0745; More…

Range trading continues in EUR/USD and intraday bias stays neutral. On the upside, break of 1.0752 will resume the rebound from 1.0601. Sustained trading above 55 D EMA (now at 1.0769) will argue that fall from 1.0980 has completed. On the downside, though, break of 1.0648 will retain near term bearishness and bring retest of 1.0601 low first.

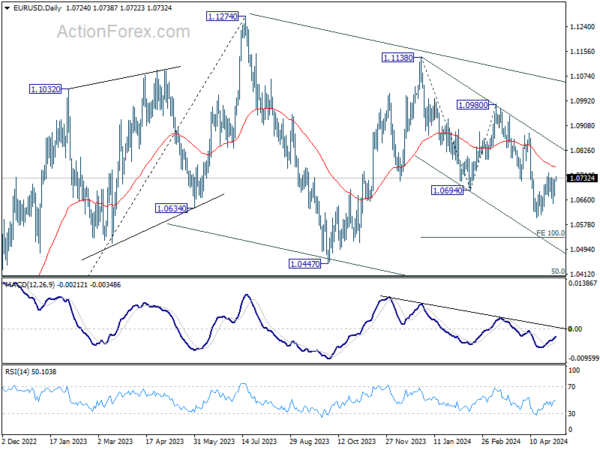

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Current fall from 1.1138 is seen as the third leg. While deeper decline is would be seen to 1.0447 and possibly below, strong support should emerge from 61.8% retracement of 0.9534 to 1.1274 at 1.0199 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:45 | EUR | France Industrial Output M/M Mar | 0.30% | 0.20% | ||

| 08:00 | EUR | Italy Unemployment Mar | 7.50% | 7.50% | ||

| 08:30 | GBP | Services PMI Apr F | 54.9 | 54.9 | ||

| 09:00 | EUR | Eurozone Unemployment Rate Mar | 6.50% | 6.50% | ||

| 12:30 | USD | Nonfarm Payrolls Apr | 243K | 303K | ||

| 12:30 | USD | Unemployment Rate Apr | 3.80% | 3.80% | ||

| 12:30 | USD | Average Hourly Earnings M/M Apr | 0.30% | 0.30% | ||

| 13:45 | USD | Services PMI Apr F | 50.9 | 50.9 | ||

| 14:00 | USD | ISM Services PMI Apr | 52.3 | 51.4 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more