Dollar Weakens Against European Majors Ahead Of Key Economic And Political Events

Dollar weakens notably against European majors in early US session, partially due to worse-than-expected ADP private job data. However, the primary reason seems to be traders becoming cautious ahead of several key events this week, including UK general elections, US non-farm payroll report, and French parliamentary elections. Traders are also mindful of thinner markets tomorrow due to US July 4 holiday.

Some focus will shift to FOMC minutes due later in the session. June meeting’s economic projections indicated a significant shift, with only one expected rate cut this year, compared to three projected in March. The debates behind this hawkish change, highlighted by 11 members favoring one or no cuts versus 8 members favoring two cuts, will be closely watched. Additionally, discussions about the raised long-term neutral rate will be analyzed for further insights.

Overall for the day, Euro and Sterling are the strongest currencies, followed by Aussie. Yen is the worst performer, followed by Dollar and then Kiwi. Swiss Franc and Canadian Dollar are positioned in the middle.

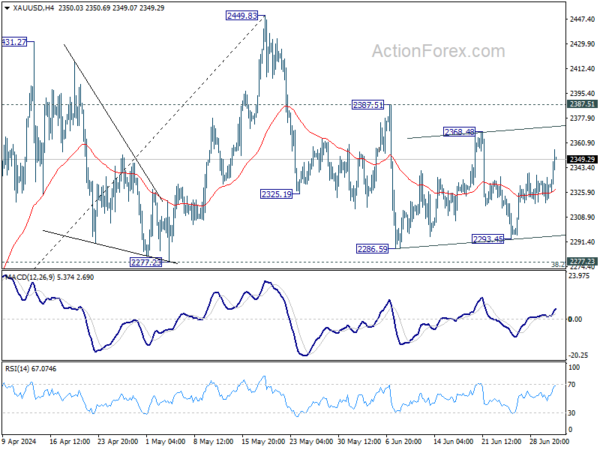

Technically, Gold’s rebound from 2293.45 also picks up momentum as Dollar declines. Further rise could be seen to 2368.48 resistance and possibly above. However, firm break of 2387.51 resistance is needed to confirm underlying momentum for retesting 2449.83 high. Otherwise, Gold is merely extending near term range trading between 2277.23 and 2387.51.

In Europe, at the time of writing, FTSE is up 0.51%. DAX is up 0.97%. CAC is up 1.38%. UK 10-year yield is down -0.0488 at 4.203. Germany 10-year yield is down -0.021 at 2.587. Earlier in Asia, Nikkei rose 1.26%. Hong Kong HSI rose 1.18%. China Shanghai SSE fell -0.49%. Singapore Strait Times rose 1.41%. Japan 10-year JGB yield rose 0.0103 to 1.102.

US jobless claims rises to 238k vs exp 235k

US initial jobless claims rose 4k to 238k in the week ending June 29, slightly above expectation of 235k. Four-week moving average of initial claims rose 2k to 239k.

Continuing claims rose 26k to 1858k in the week ending June 22, highest since November 27, 2021. Four-week moving average of continuing claims rose 17k to 1831k, highest since December 4, 2021.

US ADP jobs grow 150k, solid but not broad-based

US ADP private employment grew 150k in June, below expectation of 158k. By sector, goods-producing jobs rose 14k while service-providing jobs rose 136k. By establishment size, small companies added 5k jobs, medium companies added 88k, large companies added 58k. Year-over-year pay gains for job-stayers were at 4.9%, slowest since August 2021. Job-changers annual pay growth also slowed to 7.7%.

“Job growth has been solid, but not broad-based,” said Nela Richardson, chief economist, ADP. “Had it not been for a rebound in hiring in leisure and hospitality, June would have been a downbeat month.”

Eurozone PPI falls -0.2% mom, -4.2% yoy in May

Eurozone PPI fell -0.2% mom, -4.2% yoy in May, versus expectation of 0.0% mom, -4.1% yoy.

For the month, industrial producer prices increased by 0.1% for intermediate goods, 0.1% for capital goods, and 0.1% for non-durable consumer goods. Prices decreased by -1.1% for energy, and -0.1% for durable consumer goods.

EU PPI was down -0.3% mom, -4.0% yoy. The largest monthly decreases were recorded in Croatia (-4.1%), Greece (-2.9%) and Sweden (-1.8%). The highest increases were observed in Ireland (+7.7%), Bulgaria (+4.5%) and Estonia (+2.1%).

Eurozone PMI services finalized at 52.8, composite at 50.9

In June, Eurozone PMI Services index was finalized at 52.8, slightly down from May’s 53.2. PMI Composite also dropped, finalizing at 50.9 compared to the previous month’s 52.2.

The countries ranked by Composite PMI Output Index are as follows: Spain at 55.8 (a 2-month low), Italy at 51.3 (a 4-month low), Germany at 50.4 (a 3-month low), Ireland at 50.1 (an 8-month low), and France at 48.8 (a 3-month low).

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that Eurozone’s growth is driven entirely by the service sector. While manufacturing activity “weakened considerably”, the services sector continued to grow “nearly as robust as” the month before. De la Rubia emphasized that service providers will be crucial in maintaining overall economic growth throughout the year.

The recovery in service sector is broad-based across the top four Eurozone economies. Spain led with significant growth, followed by solid performances in Germany and Italy. However, France’s service providers were unable to increase their activity.

ECB, which cut interest rates in June, found some validation in the price indices. Input prices and prices charged to clients rose at the slowest pace in three years. Nonetheless, ECB would remain cautious, as these price increases are still above pre-pandemic levels and remain high considering the economy’s fragile state.

UK PMI services finalized at 52.1, growth slows amid election uncertainty

UK PMI Services index was finalized at 52.1 in June, down from May’s 52.9, marking the slowest growth rate since November of last year. PMI Composite also fell to 52.3, from the previous month’s 53.0, a six-month low.

Joe Hayes, Principal Economist at S&P Global Market Intelligence, noted signs of a “pre-general election seize up” in the UK services sector. He observed that business activity growth slowed to a seven-month low, as the prospect of a change in government led some businesses to adopt a “wait-and-see” approach, restraining sales. Despite the slowdown, Hayes indicated that the UK is still on track for another quarter of GDP growth, though it will be less robust than the first quarter’s 0.7%.

Prices in the UK service sector remain high, though input cost inflation trended lower. This is encouraging for BoE, but the survey also showed an increase in prices charged by companies, as some reported strong pricing power. While wage costs have been a major driver of services inflation, the UK’s economic recovery adds another factor for policymakers to consider, especially if improving conditions lead more companies to raise prices.

Australia’s retail sales rises 0.6% mom on sales events boost

Australia’s retail sales turnover increased by 0.6% mom to AUD 35.94B in May, well above expectation of 0.3% mom. On an annual basis, sales grew by 1.5% yoy.

Robert Ewing, ABS head of business statistics, highlighted the influence of early end-of-financial-year promotions and sales events on the boosted turnover.

Despite this seasonally adjusted rise, the underlying trend in spending remains flat. Retail businesses have increasingly relied on discounting and sales events to drive discretionary spending, following several months of restrained consumer activity.

Japan’s PMI services finalized at 49.3, ending 21-month growth streak

Japan’s PMI Services was finalized at 49.4 in June, a significant drop from May’s 53.8, ending a 21-month growth sequence. PMI Composite was finalized at 49.7, down from May’s 52.6, marking the first contraction in seven months.

Trevor Balchin, Economics Director at S&P Global Market Intelligence, highlighted the service sector’s recent strong upturn “ended abruptly”. He noted that the Business Activity Index dropped by -4.4 points during was the largest decline since January 2022 and among the biggest on record.

Despite the concerning headline figures, Balchin pointed out that the underlying details were “less concerning”. The fall in new business was merely a “pause” rather than an “outright decline” in demand. This pause is partly due to the weak yen boosting international new business. Additionally, the 12 month outlook and job growth remained “relatively strong”.

China’s Caixin PMI services drops sharply to 51.2

China’s Caixin PMI Services fell sharply to 51.2 in June, down from 54.0 in May, significantly below expectations of 53.4. This marks the lowest reading since October 2023 but remains in expansionary territory for the 18th consecutive month. PMI Composite also declined from 54.1 to 52.8, signaling an eighth month of expansion.

Wang Zhe, Senior Economist at Caixin Insight Group, stated, “Supply and demand expanded, with the manufacturing sector outperforming services.” He noted that employment at the composite level contracted, while price levels remained stable. However, price levels in the services sector were weaker compared to manufacturing.

“Notably, the gauge for future output expectations recorded a five-year low,” Wang added, indicating weak optimism among both manufacturers and service businesses. This suggests that while current activity remains in growth territory, there are significant concerns about future performance across sectors.

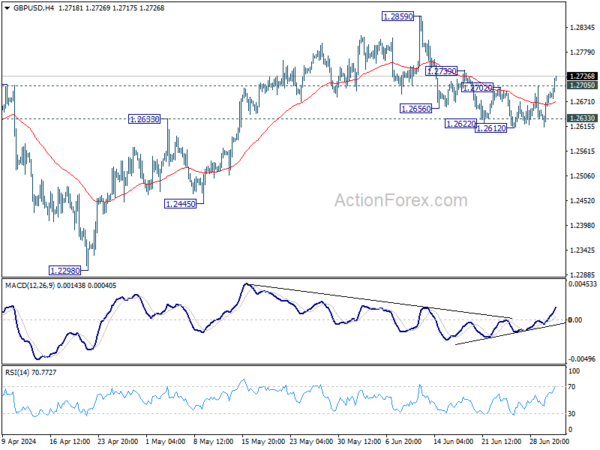

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2638; (P) 1.2663; (R1) 1.2710; More…

GBP/USD’s rebound from 1.2612 resumes today and the break of 1.2705 resistance suggests that pull back from 1.2859 has completed. More importantly, rise from 1.2298 is not over. Intraday bias is back on the upside for retesting 1.2859 high first. For now, risk will stay on the upside as long as 1.2612 support holds, in case of retreat.

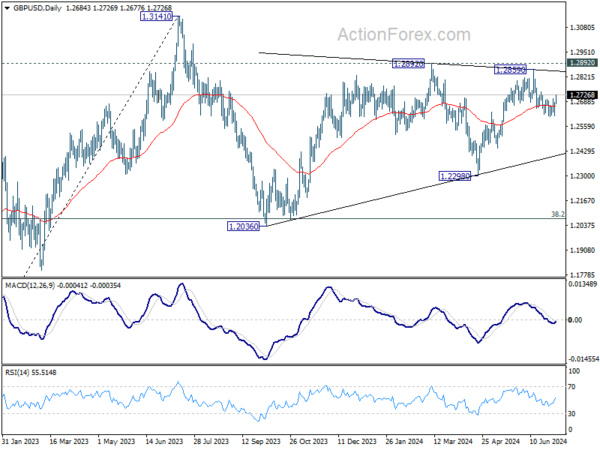

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern that is still in progress. Break of 1.2445 support will confirm that another falling leg has started and target 1.2036 cluster support again (38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075. Nevertheless, break of 1.2892 resistance will argue that larger up trend from 1.0351 is ready to resume through 1.3141.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Retail Sales M/M May | 0.60% | 0.30% | 0.10% | |

| 01:30 | AUD | Building Permits M/M May | 5.50% | 1.60% | -0.30% | 1.90% |

| 01:45 | CNY | Caixin Services PMI Jun | 51.2 | 53.4 | 54 | |

| 07:45 | EUR | Italy Services PMI Jun | 53.7 | 53.9 | 54.2 | |

| 07:50 | EUR | France Services PMI Jun F | 49.6 | 48.8 | 48.8 | |

| 07:55 | EUR | Germany Services PMI Jun F | 53.1 | 53.5 | 53.5 | |

| 08:00 | EUR | Eurozone Services PMI Jun F | 52.8 | 52.6 | 52.6 | |

| 08:30 | GBP | Services PMI Jun F | 52.1 | 51.2 | 51.2 | |

| 09:00 | EUR | Eurozone PPI M/M May | -0.20% | 0.00% | -1.00% | |

| 09:00 | EUR | Eurozone PPI Y/Y May | -4.20% | -4.10% | -5.70% | |

| 11:30 | USD | Challenger Job Cuts Y/Y Jun | 19.80% | -20.30% | ||

| 12:15 | USD | ADP Employment Change Jun | 150K | 158K | 152K | 157K |

| 12:30 | CAD | Trade Balance (CAD) May | -1.9B | -0.8B | -1.0B | |

| 12:30 | USD | Trade Balance (USD) May | -75.1B | -76.0B | -74.6B | |

| 12:30 | USD | Initial Jobless Claims (Jun 28) | 238K | 235K | 233K | 234K |

| 13:45 | USD | Services PMI Jun F | 55.1 | 55.1 | ||

| 14:00 | USD | ISM Services PMI Jun | 52.5 | 53.8 | ||

| 14:00 | USD | Factory Orders M/M May | 0.30% | 0.70% | ||

| 14:30 | USD | Crude Oil Inventories | -0.4M | 3.6M | ||

| 16:00 | USD | Natural Gas Storage | 29B | 52B | ||

| 18:00 | USD | FOMC Minutes |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more