Dollar Staying Pressured Amid Risk-On Sentiment, Eyes On Michigan Consumer Sentiment Report

Dollar is still facing much broad-based pressure as risk-on sentiment continues to dominate the markets. A slight recovery could be on the cards due to pre-weekend profit-taking, although this largely hinges on the inflation expectation figures in the forthcoming University of Michigan Consumer Sentiment report. Should the inflation expectations display a substantial decrease, this could provide a further boost to risk appetite and potentially lead to another downturn for Dollar, before getting an opportunity to stabilize next week.

As far as this week’s currency performance is concerned, Swiss Franc maintains its position as the strongest currency, outpacing even the persistently robust Japanese Yen. New Zealand and Australian dollars follow closely behind, despite their impressive runs. Canadian Dollar follows suit with Dollar as the second-weakest, while the Euro and Sterling trail somewhat behind.

From a technical perspective, CHF/JPY stands out as an interesting pair to watch in order to gauge whether Swiss Franc can continue its domination over Yen. 200% projection of 137.40 to 147.58 from 140.21 at 160.57 was a resistance that limited CHF/JPY’s advance. However, the pullback has been quite shallow, making it seem negligible in comparison to the steep decline observed in other Yen crosses. Outlook will stay bullish as long as 156.97 support holds. Firm break of 161.61 resistance will pave the way to 261.8% projection at 166.86.

In Asia, at the time of writing, Nikkei is up 0.08%. Hong Kong HSI is up 0.35%. China Shanghai SSE is up 0.27%. Singapore Strait Times is up 0.18%. Japan 10-year JGB yield is up 0.0096 at 0.477. Overnight, DOW rose 0.14%. S&P 500 rose 0.85%. NASDAQ rose 1.58%. 10-year yield dropped -0.10 to 3.761.

Fed Waller: Two more 25bps hikes this year necessary

In a speech, Fed Governor Christopher Waller expressed his support for the additional tightening to combat inflation. Despite this week’s data showing a decrease in core CPI in June, Waller remains cautious, maintaining that “one data point does not make a trend.”

Arguing for a proactive stance, Waller voiced his view that “two more 25-basis-point hikes” this year would be “necessary to keep inflation moving toward our target.”

Waller believe there is “no reason why” the first hike should not occur this month. “If inflation does not continue to show progress and there are no suggestions of a significant slowdown in economic activity,” he added”, “then a second 25-basis-point hike should come sooner rather than later, but that decision is for the future.”

Furthermore, Waller anticipates a need to keep policy restrictive for a while to encourage inflation to settle around the 2% target. “I am going to need to see this improvement sustained before I am confident that inflation has decelerated,” he warned, calling for sustained evidence of improvement before he’s fully convinced of any deceleration in inflation.

NASDAQ on track to 14511 as up trend extends

US stocks once again surged overnight, with NASDAQ and S&P 500 making new highs. Investors cheered this week CPI and PPI data from the US, which affirmed their expectation that only one more rate hike would be delivered by Fed. That came even though hawkish Fed officials continued to indicate the need for more tightening.

Technically speaking, NASDAQ’s up rally from 1088.82 is still looking healthy. Outlook will stay bullish as long as 13584.86 support holds. Next target is 161.8% projection of 10088.82 to 12269.55 from 10982.80 at 14511.22. The index could start to lose upside momentum above that projection level, form a top without even testing 16212.22 high. Reading of D MACD should be watched closely to gauge the power of the move next.

Looking ahead

Swiss PPI, Italy trade balance and Eurozone trade balance will be released in European session. Canada will release manufacturing later in the day. US will release import price index and U of Michigan consumer sentiment.

GBP/USD Daily Outlook

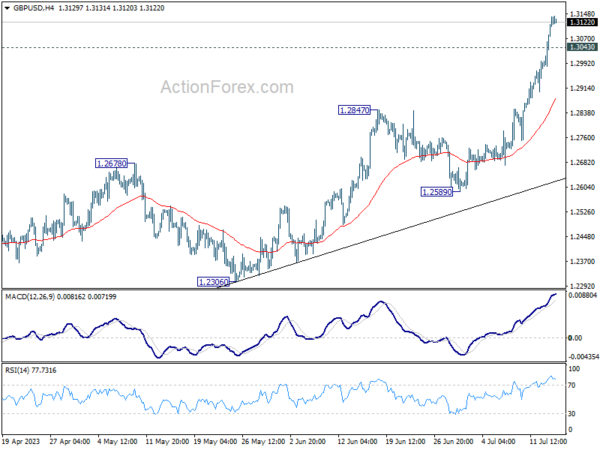

Daily Pivots: (S1) 1.3032; (P) 1.3087; (R1) 1.3190; More…

Intraday bias in GBP/USD remains on the upside for the moment. Current rally is part of the up trend from 1.0351. Next target is 100% projection of 1.0351 to 1.2445 from 1.1801 at 1.3895.On the downside, below 1.3043 minor support will turn intraday bias neutral first. But retreat should be contained by 1.2847 resistance turned support to bring another rally.

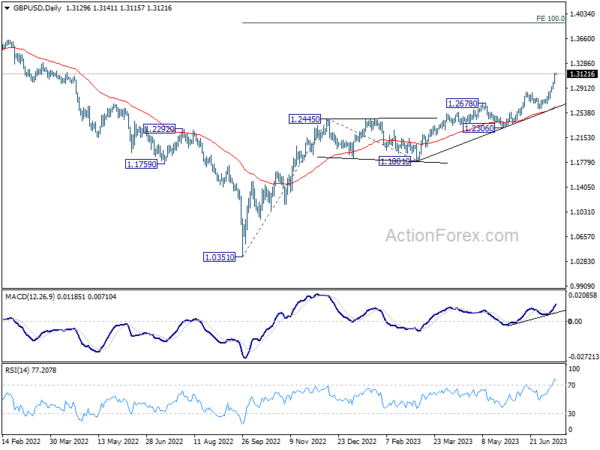

In the bigger picture, the strong support from 55 W EMA (now at 1.2341) is a medium term bullish sign. Outlook will stay bullish as long as 1.2445 resistance turned support holds. Rise from 1.0351 medium term bottom (2022 low) is expected to extend further to retest 1.4248 key resistance (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Industrial Production M/M May F | -2.20% | -1.60% | -1.60% | |

| 06:30 | CHF | Producer and Import Prices M/M Jun | 0.20% | -0.30% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Jun | -0.30% | |||

| 08:00 | EUR | Italy Trade Balance (EUR) May | 1.45B | 0.32B | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) May | -10.3B | -7.1B | ||

| 12:30 | CAD | Manufacturing Sales M/M May | 0.80% | 0.30% | ||

| 12:30 | USD | Import Price Index M/M Jun | -0.60% | |||

| 14:00 | USD | Michigan Consumer Sentiment Index Jul P | 65.5 | 64.4 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more