Dollar Soars And Stocks Hit Records As Markets Rethink Rate Cut Timing

Last week’s market development suggest growing skepticism among traders on their own aggressive bets on early rate cut by major central banks. After a batch of economic data from US and UK, as well as the chorus of central banker comments, Q2 is starting to look much less likely for the start of a global monetary easing cycle.

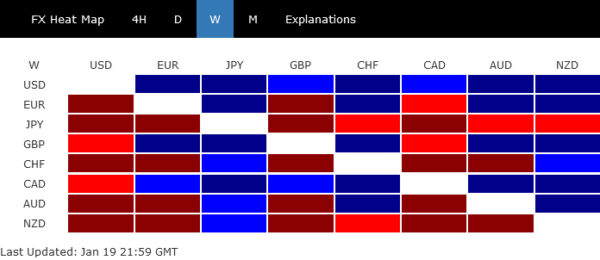

This reassessment has led to an uptick in benchmark treasury yields across US, UK, and Germany. Beyond that, the impact notably varied across regions reflecting the differing economic resilience. Dollar stood out as the strongest performer while US stock markets reached new record highs. Sterling and Euro also saw gains against most other major currencies, though they were outshone the Canadian Dollar, which clinched the second spot in currency strength rankings.

In contrast, Japanese Yen faced significant headwinds as the week’s weakest performer. Japan’s latest inflation data did not provide the signs of a wage-price spiral, a key factor BoJ has been monitoring for its policy direction. Meanwhile, Swiss Franc also suffered, with its performance impacted by the shifting rate cut expectations in other major economies and concerns raised by SNB about the adverse effects of strong Franc on the economy.

Australian and New Zealand Dollars, on the other hand, were weighed down by the increasing pessimism surrounding China’s economic prospects. As countries closely tied to China’s economic performance, the deteriorating outlook in China has had a ripple effect on these currencies as usual.

Robust US consumer data eclipses waning bets on Fed cut

US stocks staged a remarkable rally last week, with DOW and S&P 500 reaching new record highs and NASDAQ climbing to its highest level in over two years. Investor sentiment was bolstered by a combination of robust consumer data and declining inflation expectations. Interestingly, this positive market trend has unfolded even as traders have scaled back their bets on a Fed rate cut in March.

A series of robust US economic data collectively suggest that Fed’s previous rate hikes have been well absorbed by consumers and the economy is well-positioned for a strong start in 2024. December retail sales outperformed expectations, registering 0.6% mom increase against forecasted 0.4% om. Ex-auto sales also exceeded 0.2% mom predictions by rising 0.4% mom. University of Michigan consumer sentiment index surged substantially from 69.7 to 78.8 in January, hitting its highest mark since July 2021. Additionally, one-year inflation expectation in the same survey fell from 3.1% to 2.9%, hitting the lowest point since December 2020. Furthermore, initial jobless claims dropped to 187k, the lowest since September 2022.

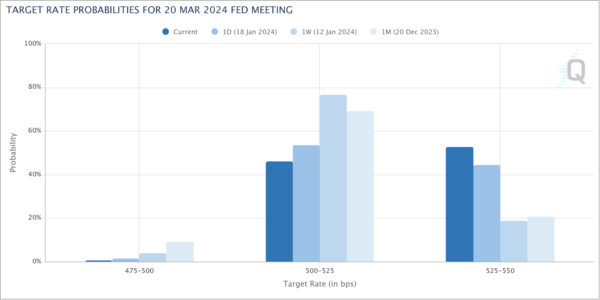

At the same time, Fed fund futures market has scaled back its expectations for a March rate cut, with the likelihood now standing at just 47%. This is a significant decrease from the 81% probability priced in just a week ago. Fed might lean towards maintaining the current restrictive monetary policy for a longer duration to ensure the economy does not overheat again. While three rate cuts are still anticipated this year, the first might not occur until the third quarter. As Atlanta Fed President Raphael Bostic, a centrist, noted, the bar for a rate cut before July is high.

Technically, S&P 500 is now on track to next near term target of 100% projection of 3808.86 to 4607.07 from 4103.78 at 4901.99. But the real test lies in the zone between 5000 psychological level and 61.8% projection of 2191.86 to 4818.62 from 3491.58 at 5395.28. In any case, outlook will remain bullish as long as 4714.82 support holds.

10-year yield’s recovery from 3.785 extended higher last week, and met 55 D EMA (now at 4.163). While further rise cannot be ruled out, strong resistance is expected from 38.2% retracement of 4.997 to 3.785 at 4.247 to limit upside. As expectation of Fed rate cut regrows at a later stage, TNX should resume the decline from 4.997 through 3.785. However, decisive break of 4.247 could be a signal of some fundamental shifts in Fed expectation, that opens up further rally to 61.8% retracement at 4.534.

Dollar Index’s rebound from 100.61 short term bottom extended higher last week. The break of 55 D EMA (now at 103.24) argues that fall from 107.34 has completed. Rise from 100.61 could be the third leg of the consolidation pattern from 99.57. Further rise is in favor as long as 102.08 support holds. Break of 104.26 resistance will strength this bullish case and target 107.334 next.

Global markets show divergence as China struggles

The positive momentum in US stock markets contrasts starkly with the performance of other global markets. FTSE closed the week with down over -2%, reacting to a combination of stronger-than-expected UK CPI data and weaker-than-anticipated retail sales figures. These developments placed BoE in a difficult position, as its ability to cut interest rate is constrained, while the ongoing restrictive monetary policy continues to impact the UK economy negatively. In Europe, both DAX and CAC ended the week with slight losses, indicating cautious sentiment among investors in these markets. Meanwhile, Japan’s Nikkei index achieved another three-decade high, though it only recorded a modest weekly gain of 1.1%.

However, the most significant downturns were observed in the markets of China and Hong Kong, with recent rout intensifying The Shanghai SSE Composite plunged to its lowest level since April 2020, and the Hong Kong HSI also tumbled its lowest point in over a year. Despite China achieving its official growth target last year, recent data releases, including Q4 GDP and retail sales, have not been well-received by the markets. Investors perceived the economic performance as mixed at best, raising fresh concerns about the country’s future prospects. Additionally, China is currently experiencing a significant deflationary period coupled with continuous decline in home prices, and hope for forceful stimulus by the government is dim.

Technically speaking, while further decline is expected in China Shanghai SSE, there is prospect of some support from 100% projection of 3322.12 to 3923.51 from 3089.77 at 2691.16 to bring a sustainable bounce. However, firm break of 2923.51 support turned resistance is needed to signal short term bottoming first. Otherwise, risk will stay on the downside even in case of strong recovery.

NZD and AUD weaken amidst China’s market slump

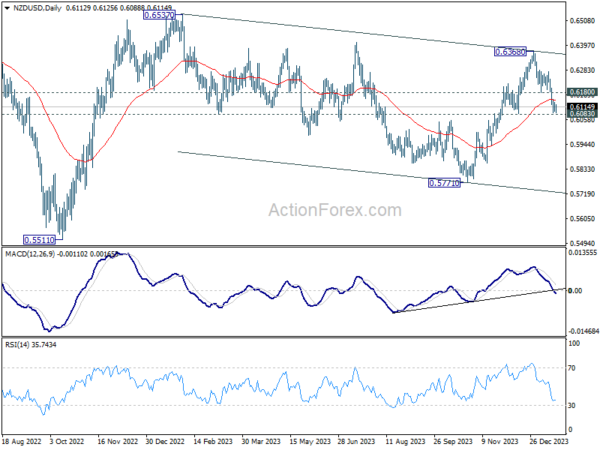

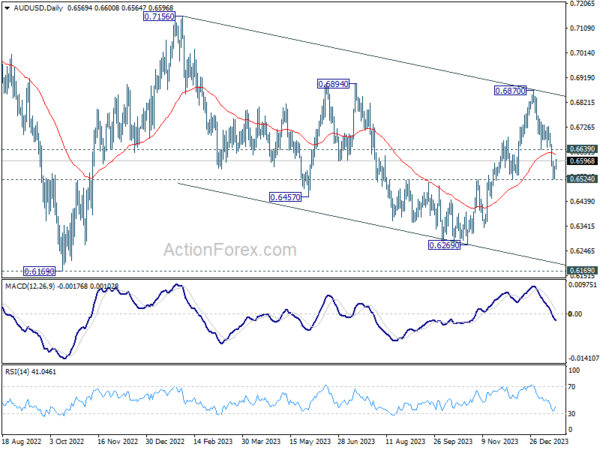

Because of the close economic ties with China, New Zealand and Australian Dollar weakened notably last week, following the decline in Chinese stocks.

After breaking through 55 D EMA (now at 0.6144), NZD/USD pressing 0.6083 key near term support. Sustained break there will argue that whole rebound from 0.5771 has completed at 0.6368 already. More importantly, that would argue that whole corrective fall from 0.6537 (2023 high) is still in progress, with fall from 0.6368 has the third leg. In the case, near term outlook will be turned bearish for 0.5771 support and possibly below

Nevertheless, strong bounce from current level, followed by decisive break of 0.6180 resistance, will retain near term bullishness. NZD/USD should then head for a test on 0.6368 instead.

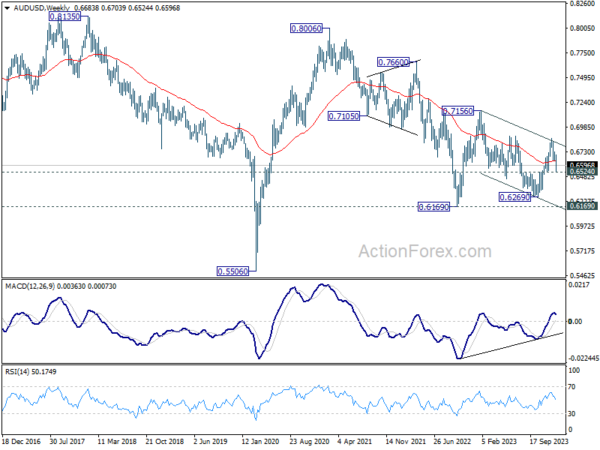

Similarly, AUD/USD also broke through 55 D EMA (now at 0.6620). And it’s now pressing 0.6524 support. Sustained break there will argue that rebound from 0.6269 has completed at at 0.6870. Deeper fall would then be seen back to 0.6269 support and possibly below. Nevertheless, strong bounce from current level, followed by firm break of 0.6639 resistance, will retain near term bullishness. AUD/USD should then rise further to retest 0.6870.

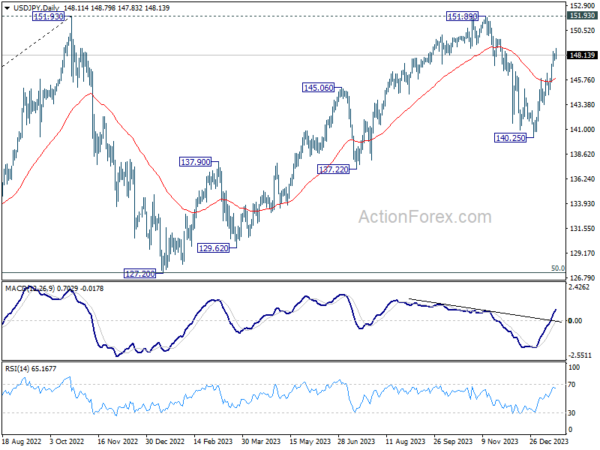

USD/JPY’s rise from 140.25 extended to as high as 148.79 last week, then retreated mildly. Initial bias remains neutral this week for some consolidations first. Current development argues that whole pull back from 151.89 has already completed. Further rise is in favor as long as 145.97 resistance turned support holds. Above 148.79 will target 151.89/93 key resistance zone.

In the bigger picture, stronger than expected rebound from 140.25 dampened the original bearish review. Strong support from 55 W EMA (now at 141.89) is also a medium term bullish sign. Fall from 151.89 could be a correction to rise from 127.20 only. Decisive break of 151.89/93 will confirm resumption of long term up trend. This will now be the favored case as long as 140.25 support holds.

In the long term picture, as long as 125.85 resistance turned support holds (2015 high), up trend from 75.56 (2011 low) is still in favor to continue through 151.93 (2022 high) at a later stage.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more