Dollars Post-CPI Slump Faces Strong Resilience

Despite an initial dip in Dollar after release of US consumer inflation data, the greenback has shown resilience against further selling pressures. The CPI figures, aligning with market predictions, bolster the possibility of Fed maintaining its current interest rates this September. However, several key considerations remain. Firstly, another round of inflation and employment data will be released before any potential rate adjustments. Secondly, with inflation still notably elevated, the prospect of another rate increase before the cycle concludes cannot be totally dismissed. Additionally, this week’s significant rise in oil and gas prices could be an underlying risk to the deflation process.

As of now, Yen and the Dollar are vying for the title of the day’s weakest performer, with Canadian Dollar trailing behind as a distant third. On the other end of the spectrum, Aussie and Kiwi are demonstrating robust performance as the best. Euro and Swiss Franc, meanwhile, are managing to edge out Sterling, which awaits potential impetus from tomorrow’s UK GDP data to shift its trajectory.

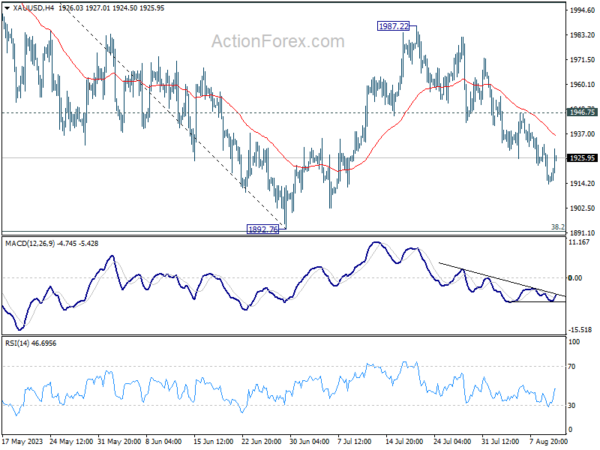

Technically, Gold is also recovering today on Dollar’s weakness. However, firm break of 1946.75 resistance is needed to indicate completion of the choppy fall from 1987.22. Otherwise, risk will stay mildly on the downside for retesting 1892.76 low. Nevertheless, firm break of 1946.75 could trigger upside acceleration, which is also accompanied by steep selloff in Dollar.

In Europe, at the time of writing, FTSE is up 0.09%. DAX is up 0.55%. CAC is up 1.10%. Germany 10-year yield is up 0.0028 at 2.500. Earlier in Asia, Nikkei rose 0.84%. Hong Kong HSI rose 0.01%. China Shanghai SSE rose 0.31%. Singapore Strait Times rose 0.28%. Japan 10-year JGB yield rose 0.0241 to 0.589.

US CPI and core CPI rose 0.2% mom in Jul, matched expectations

US CPI and core CPI rose 0.2% mom in July, matched expectations. Food prices rose 0.2% mom,Energy prices rose 0.1% mom. The index for shelter was by far the largest contributor to the monthly all items increase, accounting for over 90 percent of the increase, with the index for motor vehicle insurance also contributing.

For the 12 months, headline CPI rose slightly from 3.0% yoy to 3.2% yoy, below expectation of 3.3% yoy. Core CPI slowed slightly from 4.8% yoy to 4.7% yoy, below expectation of being unchanged. Food prices were up 4.9% yoy while energy prices were down -12.5% yoy.

US jobless claims rose to 248k, above expectations

US initial jobless claims rose 21k to 248k in the week ending August 5, above expectation of 230k. Four-week moving average of initial claims rose 3k to 228k.

Continuing claims dropped -8k to 1684k in the week ending July 29. Four-week moving average of continuing claims dropped -9k to 1701k.

Japan’s PPI slows down for seventh consecutive month

Japan’s PPI for July has once again reported a slowdown, decelerating from 4.3% yoy in the previous month to 3.6% yoy. However, this figure slightly surpassed market expectations, which anticipated a drop to 3.5% yoy. It’s worth noting that this marks the seventh consecutive month of decline for PPI, tracing back from its December peak of 10.6% yoy.

Looking at some details, yen-denominated import prices saw a significant dip. The -14.1% yoy decline in July, a steeper fall than June’s -11.4% yoy, extends the negative trend to its fourth consecutive month.

Simultaneously, yen-denominated export prices also demonstrated downward trends, slipping from a positive growth of 0.8% yoy in the preceding month to a negative -0.2% yoy in July.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0952; (P) 1.0974; (R1) 1.0995; More…

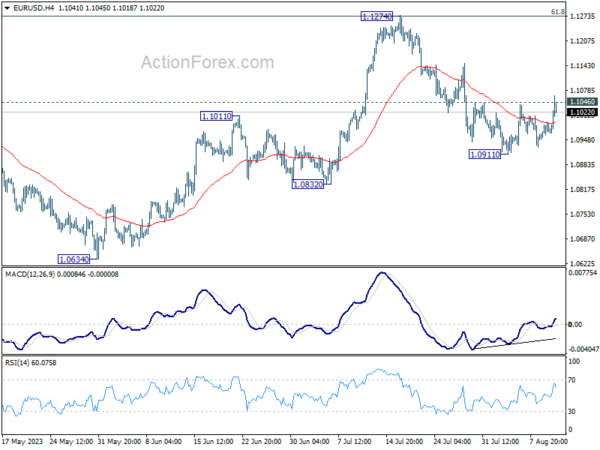

EUR/USD breaches 1.1046 minor resistance but couldn’t sustain above there so far. Initial bias remains neutral first. On the downside, break of 1.0911 will resume the fall from 1.1274 to 1.0832 support. Sustained trading below there will target 1.0609/34 cluster support. However, firm break of 1.1046 minor resistance will argue that pull back from 1.1274 has completed, and bring stronger rebound.

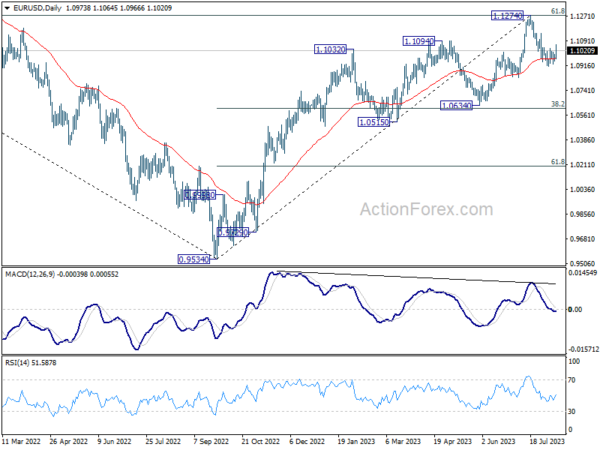

In the bigger picture, a medium term top could be formed at 1.1274, after failing to break through 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 decisively, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.0966) will bring deeper correction to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to set the range for consolidation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Jul | -53% | -51% | -46% | |

| 23:50 | JPY | PPI Y/Y Jul | 3.60% | 3.50% | 4.10% | 4.30% |

| 01:00 | AUD | Consumer Inflation Expectations Aug | 4.90% | 5.20% | ||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 12:30 | USD | Initial Jobless Claims (Aug 4) | 248K | 230K | 227K | |

| 12:30 | USD | CPI M/M Jul | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Y/Y Jul | 3.20% | 3.30% | 3.00% | |

| 12:30 | USD | CPI Core M/M Jul | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Core Y/Y Jul | 4.70% | 4.80% | 4.80% | |

| 14:30 | USD | Natural Gas Storage | 24B | 14B |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more