Dollar Rises On Robust NFP, But Gains Tempered By Hesitation

Dollar rises broadly in early U.S. session, spurred by a robust set of job data that surpassed expectations in all key areas including headline employment growth, unemployment rate, and wage growth. This robust data also propelled 10-year treasury yield further above 4% mark, while concurrently driving stock futures lower. However, while Dollar’s gains against Yen and Australian Dollar are pronounced, there appears to be some hesitation in its performance against European majors. This hesitance raises the question of whether the greenback will require additional momentum from the upcoming US CPI report next week.

Japanese Yen remains the weakest performer, largely due to the rally in US and European yields. Australian and New Zealand Dollars are also underperforming for the day, influenced by prevailing risk-off sentiment. Meanwhile, Canadian Dollar, despite a miss in employment data, is emerging as the second strongest currency. Euro and British Pound are displaying mixed performance, with Euro showing minimal reaction to lower-than-expected headline CPI reading from Eurozone.

Technically, conditions are there for a deeper correction in GBP/USD , with break of trend line support, as well as bearish divergence condition in 4H MACD. However, it’s still defending 1.2611 support despite the dive in early US session. On the downside, sustained break of 1.2611 will bring deeper fall to 38.2% retracement of 1.2036 to 1.2826 at 1.2524. On the upside, however, break of 1.2729 will maintain near term bullishness for a test on 1.2826 high first. Let’s see which way it goes.

In Europe, at the time of writing, FTSE is down -0.82%. DAX is down -0.76%. CAC is down -1.06%. Germany 10-year yield is up 0.067 at 2.190. UK 10-year yield is up 0.064 at 3.795. Earlier in Asia, Nikkei rose 0.27%. Hong Kong HSI fell -0.66%. China Shanghai SSE fell -0.85%. Singapore Strait Times rose 0.32%. Japan 10-year JGB yield fell -0.0215 to 0.606.

US NFP rises 216k, unemployment rate unchanged at 3.7%

US non-farm payroll employment grew 216k in December, above expectation of 168k. Unemployment rate was unchanged at 3.7%, below expectation of a rise to 3.8%. Participation rate fell from 62.8% to 62.5%. Average hourly earnings rose 0.4% mom, above expectation of 0.3% mom. Over the past 12 months, average hourly earnings increased 4.1% yoy.

Canada’s employment rises 0.1k in Dec, vs exp 13.2k

Canada’s employment rose 0.1k in December, well below expectation of 13.2k. Employment rate fell -0.2% to 61.6%. Unemployment rate was unchanged at 5.8%. Participation rate fell -0.2% to 65.4%. Total hours worked rose 0.4% mom , 1.7% yoy. Average hourly wages rose 5.4% yoy.

Eurozone CPI rises to 2.9% yoy in Dec, core CPI down to 3.4% yoy

Eurozone CPI reaccelerated from 2.4% yoy to 2.9% yoy in December, below expectation of 3.0% yoy. Core CPI (excluding energy, food, alcohol & tobacco) slowed from 3.6% yoy to 3.4% yoy, matched expectations.

Looking at the main components, food, alcohol & tobacco is expected to have the highest annual rate in December (6.1%, compared with 6.9% in November), followed by services (4.0%, stable compared with November), non-energy industrial goods (2.5%, compared with 2.9% in November) and energy (-6.7%, compared with -11.5% in November).

Eurozone PPI down -0.3% mom, -8.8% yoy in Nov

Eurozone PPI was down -0.3% mom, -8.8% yoy in November, versus expectation of -0.1% mom, -8.7% yoy. For the month, industrial producer prices, decreased by -0.8% for energy, by -0.5% for intermediate goods and by -0.1% for both capital goods and durable consumer goods, while prices remained stable for non-durable consumer goods. Prices in total industry excluding energy decreased by -0.2%.

EU PPI was down -0.2% mom, -8.1% yoy. The largest monthly decreases in industrial producer prices were recorded in Slovakia (-3.0%), Portugal (-2.3%) and Spain (-2.1%), while the highest increases were observed in Sweden (+4.1%), France (+2.4%) and Bulgaria (+0.7%).

Japan’s PMI services finalized at 51.5, steeper increase in inflationary pressures

Japan’s PMI Services was finalized at 51.5 in December, up slightly from November’s 50.8, signaling a modest but positive growth in the sector. Composite PMI also improved, reaching the neutral mark at 50.0, up from 49.6 in the previous month.

Usamah Bhatti of S&P Global Market Intelligence attributed this growth to an increase in new orders and customer numbers. This uptick in business activity led firms to end the year with a more positive outlook. Service providers also expressed confidence about future activity, driven by expectations of economic recovery and plans for long-term business expansion.

However, Bhatti noted “steeper increase in inflationary pressures”, mainly from escalated costs for raw materials, fuel, and labor. This resulted in the highest increase in service output charges since August.

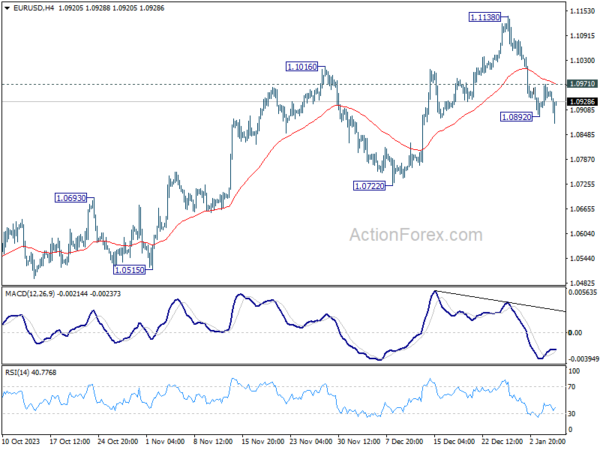

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0917; (P) 1.0944; (R1) 1.0974; More…

EUR/USD’s fall from 1.1138 short term top is trying to resume by breaking 1.0892 temporary low. Intraday bias is back on the downside for 1.0722 support first. Sustained break there will argue that whole rise from 1.0447 has completed, and break deeper fall back to this support. On the upside, however, break of 1.0971 will turn bias back to the upside for retesting 1.1138 high instead.

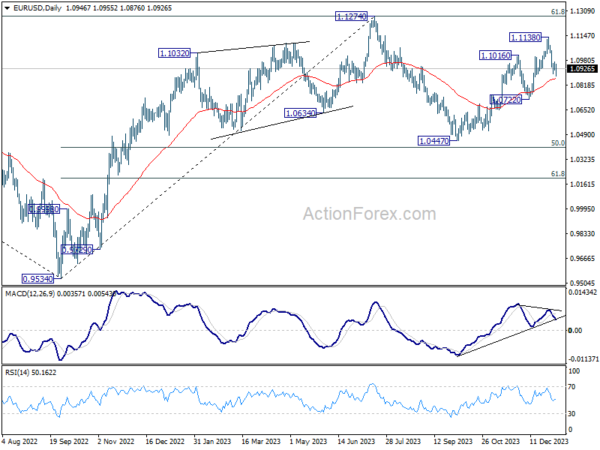

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Dec | 7.80% | 9.00% | 8.90% | |

| 05:00 | JPY | Consumer Confidence Index Dec | 37.2 | 36.6 | 36.1 | |

| 07:00 | EUR | Germany Retail Sales M/M Nov | -2.50% | -0.50% | 1.10% | |

| 09:30 | GBP | Construction PMI Dec | 46.8 | 46.1 | 45.5 | |

| 10:00 | EUR | Eurozone CPI Y/Y Dec P | 2.90% | 3.00% | 2.40% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec P | 3.40% | 3.40% | 3.60% | |

| 10:00 | EUR | Eurozone PPI M/M Nov | -0.30% | -0.10% | 0.20% | 0.30% |

| 10:00 | EUR | Eurozone PPI Y/Y Nov | -8.80% | -8.70% | -9.40% | |

| 13:30 | USD | Nonfarm Payrolls Dec | 216K | 168K | 199K | 173K |

| 13:30 | USD | Unemployment Rate Dec | 3.70% | 3.80% | 3.70% | |

| 13:30 | USD | Average Hourly Earnings M/M Dec | 0.40% | 0.30% | 0.40% | |

| 13:30 | CAD | Net Change in Employment Dec | 0.1K | 13.2K | 24.9K | |

| 13:30 | CAD | Unemployment Rate Dec | 5.80% | 5.90% | 5.80% | |

| 15:00 | USD | ISM Services PMI Dec | 52.7 | 52.7 | ||

| 15:00 | USD | Factory Orders M/M Nov | 2.30% | -3.60% | ||

| 15:00 | CAD | Ivey PMI Dec | 55 | 54.7 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more