Dollar Remains Weak Post-FOMC Minutes; Eyes On Upcoming CPI Data

Dollar continues its slide, maintaining its position as the week’s worst performer and further descending following the release of FOMC minutes. The document indicated a majority of the Committee members anticipate an additional rate hike this year, aligning with recent dot plot projections. However, the market seems to have shrugged off this hawkish message.

Attention now pivots to the imminent release of US consumer inflation data, which is expected to reveal lower annual headline and core CPI for September. However, the monthly readings, especially the core, may draw heightened attention due to their exclusion of last year’s base effects. Current Fed fund futures indicate a subdued expectation of a rate hike, with less than 10% likelihood for November and approximately 28% for December.

On the global stage, Yen trails Dollar as the week’s second-worst performer, with New Zealand Dollar and Euro following suit. Sterling and Swiss Franc are leading the way, with the former awaiting cues from UK’s GDP data release. Canadian and Australian dollars remain ambivalent in their positions.

Treasuries are also in focus, particularly the reaction of yields to US CPI data. Technically, 10-year yield has seen a significant dip from last week’s high of 4.887 to the current 4.595, yet early signs of steadiness are emerging.

A rebound at this juncture would argue that price actions from 4.887 are merely a sideway consolidation pattern. That would provide a buffer against the dollar’s sell-off. However, a definitive break below 4.5 could suggest a deeper correction from the earlier surge to 3.253, prompting a more pronounced decline to the 55 D EMA (now at 4.339) , thereby adding to Dollar’s woes.

In Asia, at the time of writing, Nikkei is up strongly by 1.63%. Hong Kong HSI is up 1.89%. China Shanghai SSE is up 0.83%. Singapore Strait Times is up 0.89%. Japan 10-year JGB yield is down -0.25 at 0.754. Overnight, DOW rose 0.19%. S&P 500 rose 0.43%. NASDAQ rose 0.71%. 10-year yield dropped further by -0.060 to 4.595.

Fed minutes show majority leaning towards further rate hike

In the minutes from Fed’s September 19-20 meeting, while “a majority of participants” believed another rate increase might be in order, a contrasting view was held by “some” who deemed no further hikes necessary.

A unanimous consensus was evident among all attendees that the existing policy stance needs to “remain restrictive for some time”. The chief rationale behind this unified sentiment is to ensure that inflation trends downwards in a sustained manner to Fed’s target.

An interesting shift in communication strategy was proposed by “several participants”. They emphasized that discussions and subsequent messaging should transition from deliberating the potential height of rate hikes to determining the duration for which rates should be maintained at these elevated, restrictive levels.

In terms of gauging risks, participants “generally judged” that challenges to fulfilling the Fed’s mandates had become “more two sided”. However, a lingering concern persists. Despite this balanced view of risks, “most participants” continued to see upside risks to inflation.

Fed’s Collins eyes prolonged restrictive rates

Boston Fed President Susan Collins noted overnight her expectation that the central bank may need to maintain interest rates at restrictive levels “for some time” until there’s tangible evidence of inflation moving back to 2% target.

While acknowledging that the policy rates might currently be near their peak, Collins did not rule out the possibility of additional rate hikes.

She stated, “And while we are likely near, and could be at, the peak for policy rates, further tightening could be warranted depending on incoming information.”

Amidst the pervasive economic uncertainties and risks characterizing the current financial climate, Collins remains cautiously optimistic. She believes that the restoration of price stability is achievable, anticipating an “orderly slowdown in activity and only a modest increase in the unemployment rate.”

Japan’s PPI slows to 2% yoy in Sep, trailing CPI core for the first time since 2021

Japan PPI slowed from 3.3% yoy to 2.0% yoy in September, below expectations of 2.3%. That’s the lowest level since March 2021. Also, PPI is now below CPI core (at 3.1% yoy) for the first time since early 2021.

Import price index was unchanged at -15.6% yoy, the sixth month of decline. Export price index rose for the first time in seven months, up 0.2% yoy, comparing to prior month’s -0.7% yoy.

For the month, PPI fell -0.3% mom. Import price index rose 0.6% mom. Export price index rose 0.5% mom.

Looking ahead

UK GDP, production and trade balance will be released in European session. ECB will also publish meeting accounts. Later in the day, US CPI and jobless claims are the main releases.

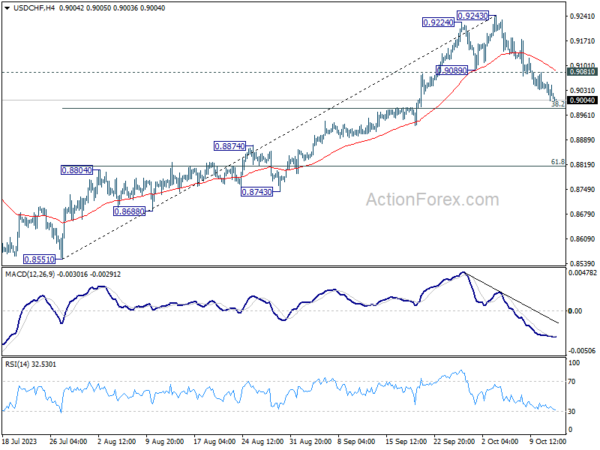

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.8996; (P) 0.9026; (R1) 0.9049; More….

USD/CHF’s fall from 0.9243 is in progress and intraday bias stays on the downside. Strong support could be see around 38.2% retracement of 0.8551 to 0.9243 at 0.8979 to contain downside on first attempt. Break of 0.9081 will turn bias back to the upside for stronger rebound. However, sustained break of 0.8979 will argue that deeper fall is under way to 61.8% retracement at 0.8815.

In the bigger picture, current development indicates that rise from 0.8551 is reversing whole down trend from 1.0146. Further rally would then be seen to 61.8% retracement at 0.9537 and above. For now, this will be the favored case as long as 55 D EMA (now at 0.8971) holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Sep | -69% | -68% | ||

| 23:50 | JPY | Bank Lending Y/Y Sep | 2.90% | 3.10% | 3.10% | |

| 23:50 | JPY | PPI Y/Y Sep | 2.00% | 2.30% | 3.20% | 3.30% |

| 23:50 | JPY | Machinery Orders M/M Aug | -0.50% | 0.70% | -1.10% | |

| 00:00 | AUD | Consumer Inflation Expectations Oct | 4.80% | 4.60% | ||

| 06:00 | GBP | GDP M/M Aug | 0.20% | -0.50% | ||

| 06:00 | GBP | Industrial Production M/M Aug | -0.20% | -0.70% | ||

| 06:00 | GBP | Industrial Production Y/Y Aug | 1.70% | 0.40% | ||

| 06:00 | GBP | Manufacturing Production M/M Aug | -0.40% | -0.80% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Aug | 3.40% | 3.00% | ||

| 06:00 | GBP | Goods Trade Balance Aug | -15.2B | -14.1B | ||

| 11:00 | GBP | NIESR GDP Estimate (3M) Sep | 0.20% | |||

| 11:30 | EUR | ECB Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (Oct 6) | 215K | 207K | ||

| 12:30 | USD | CPI M/M Sep | 0.30% | 0.60% | ||

| 12:30 | USD | CPI Y/Y Sep | 3.60% | 3.70% | ||

| 12:30 | USD | CPI Core M/M Sep | 0.30% | 0.30% | ||

| 12:30 | USD | CPI Core Y/Y Sep | 4.10% | 4.30% | ||

| 14:30 | USD | Natural Gas Storage | 85B | 86B | ||

| 15:00 | USD | Crude Oil Inventories | -0.4M | -2.2M |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more