Dollar Recovers Post-Hawkish FOMC Minutes, EUR/GBP In Focus

Trading has been relatively quiet in Asian session today. Dollar regained some ground overnight following hawkish minutes from the latest FOMC meeting, which revealed that several members are prepared to support further rate hike if necessary. Despite this, the greenback lacks clear follow-through momentum at present. For a more sustained near-term rebound, Dollar will need additional support from upcoming economic data, including today’s jobless claims and PMIs, as well as tomorrow’s durable goods orders.

New Zealand Dollar stands out as the strongest performer of the day at the point, driven by unexpectedly robust retail sales data that ended a two-year contraction streak. Kiwi has also been a top performer for the week, buoyed by RBNZ’s hawkish stance. Australian Dollar is the second strongest today, supported by solid PMI data showing solid growth and renewed cost pressures. Conversely, Dollar is the weakest performer, followed by Japanese Yen and then Euro. Notably, all major pairs and crosses are confined within yesterday’s ranges, with the exception of AUD/NZD.

EUR/GBP is a major focus in European session with Eurozone and UK PMIs featured. Fall from 0.8943 resumed this week and is on track to retest 0.8491/7 support zone. Decisive break there will resume larger down trend from 0.9267 (2022 high). Next medium term target is 100% projection of 0.8764 to 0.8497 from 0.8643 at 0.8376.

In Asia, at the time of writing, Nikkei is up 1.20%. Hong Kong HSI is down -1.64%. China Shanghai SSE is down -1.15%. Singapore Strait Times is up 0.22%. Japan 10-year JGB yield ius up 0.0011 at 1.002. Overnight, DOW fell -0.51%. S&P 500 fell -0.27%. NASDAQ fell -0.18%. 10-year yield rose 0.020 to 4.434.

FOMC minutes decidedly hawkish, DOW retreats but stays bullish

US stocks ended lower overnight as minutes from the latest FOMC meeting revealed a more hawkish stance than anticipated. The central focus of the minutes was the “lack of further progress” in reducing inflation towards the 2% target, which has raised fresh concerns about the persistence of inflation.

Additionally, the minutes highlighted recent monthly data showing “significant increases in components of both goods and services price inflation,” adding to the urgency of the situation. More importantly, “various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.”

Despite the hawkish tone of the minutes, it’s important to note that several influential figures, including Chair Jerome Powell and Governor Christopher Waller, have since indicated that they doubt the next move will be an interest rate hike.

Technically, as long as 39371.92 support holds, further rally is expected in DOW in the near term. Current rise is part of the larger uptrend and should target 61.8% projection of 32327.20 to 39889.05 from 37611.56 at 42284.78. However, break of 39371.92 will bring lengthier consolidations first before the up trend resumes.

Japan’s PMI manufacturing rises to 50.5, first expansion in a year

Japan’s PMI Manufacturing rose from 49.6 to 50.5 in May, exceeding expectations of 49.7 and signaling improving business conditions for the first time in a year. Meanwhile, PMI Services declined from 54.3 to 53.6, and PMI Composite inched up from 52.3 to 52.4.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, noted that Japan’s private sector expansion accelerated for the third consecutive month, reaching its fastest pace since August 2023. This suggests continued growth momentum midway through Q2, hinting at a better GDP reading after the disappointing Q1 results.

Pan highlighted that the expansion in business activity remained “services-led,” but the “near-stabilization” of manufacturing output offers hope for broader growth later in the year.

Both input cost and output price inflation rates eased, indicating “softer inflationary pressures across official gauges.” However, manufacturers continue to face rising cost pressures, partly due to “yen fluctuations,” which remain an important factor to monitor.

Australia PMI composite dips to 52.6, increasing cost pressures

Australia’s PMI Manufacturing remained steady at 49.6 in April, a joint 9-month high. PMI Services dropped slightly from 53.6 to 53.1, while PMI Composite decreased from 53.0 to 52.6.

Warren Hogan, Chief Economic Advisor at Judo Bank, noted that PMI remains “firmly in expansionary territory,” and pointed to growth at “around the long-term trend rate, if not a touch higher”.

However, Hogan warned that weak consumer spending will drag on growth in the first half of the year. Despite this, businesses are still hiring, with the employment index reaching a 6-month high.

Composite input price index hit a 6-month high, with service industry cost pressures rising slightly. Hogan remarked, “This does not suggest a material step down in domestic inflation pressures in Q2.”

Additionally, manufacturing input prices hit a one-year high in May, raising doubts about further deflation in domestic goods prices. This has been crucial in bringing inflation below 4% over the past year. Any increase in goods inflation, alongside high service sector inflation, poses a significant concern for RBA, which expects inflation to decrease over the next 18 months.

NZ retail sales up 0.5% in Q1, ending two-year downturn

New Zealand’s retail sales volumes rose by 0.5% qoq to NZD 25B in Q1, significantly outperforming the anticipated -0.3% qoq decline. Sales values increased by 0.7% qoq to NZD 30B.

“In the March quarter, we saw a modest increase in retail activity, with growth across most industries,” said Melissa McKenzie, business financial statistics manager. “This followed two years of declines.”

Of the 15 retail industries, nine experienced higher sales volumes during the quarter. The most notable contributions came from food and beverage services, which rose by 2.2%, motor vehicle and parts retailing, which increased by 1.1%, recreational goods retailing, which surged by 4.7%, and accommodation, which climbed by 4.1%.

Looking ahead

Eurozone and UK PMIs are the main focuses in European session. Later in the day, US will release jobless claims, retail sales, and PMIs.

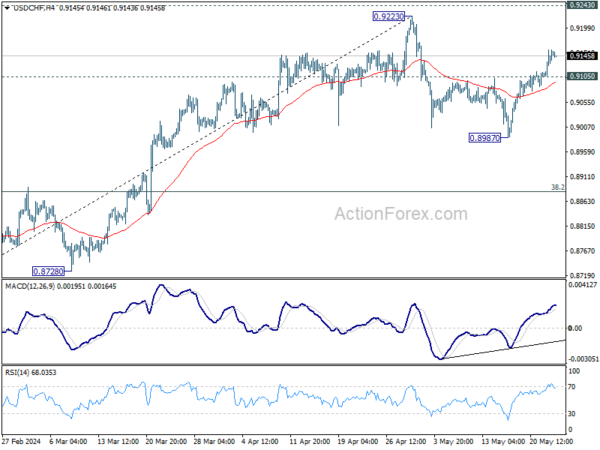

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9117; (P) 0.9138; (R1) 0.9178; More….

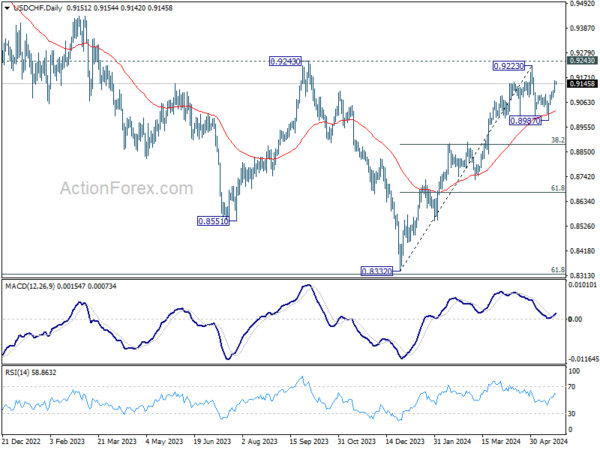

Intraday bias in USD/CHF remains on the upside at this point. Rise from 0.8987 is in progress for retesting 0.9223. On the downside, below 0.9105 minor support will turn intraday bias neutral first. Further break of 0.8987 will resume the fall from 0.9223 to 38.2% retracement of 0.8332 to 0.9223 at 0.8883.

In the bigger picture, price actions from 0.8332 medium term bottom are tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance, followed by sustained break of 38.2% retracement of 0.8332 to 0.9223 at 0.8883 will strengthen this case, and maintain medium term bearishness. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish for 1.0146.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q1 | 0.50% | -0.30% | -1.90% | -1.80% |

| 22:45 | NZD | Retail Sales ex Autos Q/Q Q1 | 0.40% | 0.00% | -1.70% | -1.60% |

| 23:00 | AUD | Manufacturing PMI May P | 49.6 | 49.6 | ||

| 23:00 | AUD | Services PMI May P | 53.1 | 53.6 | ||

| 00:30 | JPY | Manufacturing PMI May P | 50.5 | 49.7 | 49.6 | |

| 00:30 | JPY | Services PMI May P | 53.6 | 54.3 | ||

| 01:00 | AUD | Consumer Inflation Expectations May | 4.10% | 4.60% | ||

| 07:15 | EUR | France Manufacturing PMI May P | 45.5 | 45.3 | ||

| 07:15 | EUR | France Services PMI May P | 51.5 | 51.3 | ||

| 07:30 | EUR | Germany Manufacturing PMI May P | 43.5 | 42.5 | ||

| 07:30 | EUR | Germany Services PMI May P | 53.5 | 53.2 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI May P | 46.6 | 45.7 | ||

| 08:00 | EUR | Eurozone Services PMI May P | 53.5 | 53.3 | ||

| 08:30 | GBP | Manufacturing PMI May P | 49.2 | 49.1 | ||

| 08:30 | GBP | Services PMI May P | 54.8 | 55 | ||

| 12:30 | USD | Initial Jobless Claims (May 17) | 220K | 222K | ||

| 13:45 | USD | Manufacturing PMI May P | 50.1 | 50 | ||

| 13:45 | USD | Services PMI May P | 51.5 | 51.3 | ||

| 14:00 | USD | New Home Sales Apr | 674K | 693K | ||

| 14:00 | EUR | Eurozone Consumer Confidence May P | -14 | -15 | ||

| 14:30 | USD | Natural Gas Storage | 70B |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more