Dollar Rally Continues With Tailwinds From Risk Aversion

Amid the backdrop of surging treasury yields, Dollar has pressed on, extending its recent rally. The mounting sentiment of risk aversion has provided additional tailwinds for the greenback, especially after the DOW experienced its sharpest decline since March. For now, Yen emerges as the day’s runner-up in strength, shadowed closely by Canadian Dollar. Conversely, Australian and New Zealand Dollars trail behind. Euro and Sterling are holding their ground in a muddled middle, their positions buffered to some extent by Swiss Franc’s selloff.

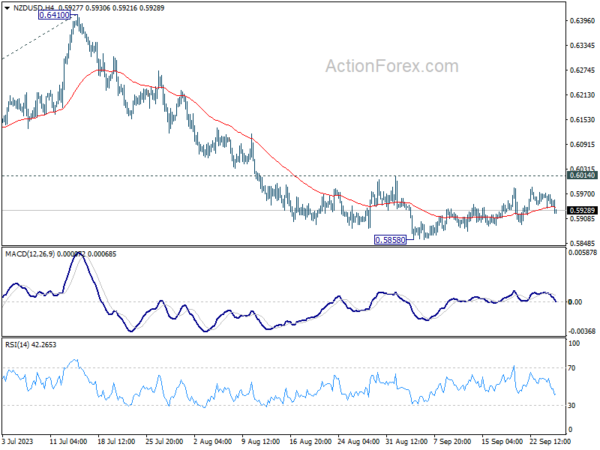

From a technical standpoint, Dollar’s might against commodity currencies appears to be held in check. For the greenback to truly showcase its dominance, it would necessitate AUD/USD to decisively break 0.6356 support level. Similarly, NZD/USD would have to pierce 0.5858 support to reinitiate its recent down trend. At the same time, USD/CAD will need to break through 1.3548 resistance to confirm complete of its near term pull back from 1.5693. Attention is now on whether the Dollar can achieve these milestones before the close of September.

In Asia, at the time of writing, Nikkei is down -0.18%. Hong Kong HSI is up 0.54%. China Shanghai SSE is up 0.19%. Singapore Strait Times is down -0.82%. 10-year JGB yield is down -0.001 at 0.745. Overnight, DOW dropped -1.14%. S&P 500 dropped -1.47%. NASDAQ dropped -1.57%. 10-year yield rose 0.016 to 4.558.

Australia’s monthly CPI rose to 5.2%, led by housing and transport

Australia CPI for August rose from 4.9% yoy to 5.2% yoy, in line with market expectations.

Digging into the specifics, the sectors showing the most substantial annual gains were housing, which surged by 6.6%, followed by transport at 7.4%. Additionally, food and non-alcoholic beverages reported an increase of 4.4%. Notably, insurance and financial services marked the highest significant rise of 8.8%.

On the other hand, when considering CPI that excludes volatile items such as holiday travel, there was a slight dip from 5.8% yoy to 5.5% yoy. Meanwhile, the Annual trimmed mean CPI, which gives a clearer picture by removing the most volatile items, remained steady at 5.6% yoy.

BoJ minutes reveal diverging views on future policy direction

The minutes from BoJ meeting held on July 27 and 28 have unveiled differing perspectives among board members regarding the future direction of monetary policy. While a consensus was apparent on the immediate need to sustain ultra-low interest rates, members were divided on how to approach the medium to long term.

One member stated, “there was still a significantly long way to go before revising the negative interest rate policy, and the framework of yield curve control needed to be maintained”.

The same member emphasized the importance of patience and consistency, suggesting that “it should carefully nurture the long-awaited signs of change in firms’ behavior by patiently continuing with monetary easing.”

Another participant weighed the risks of delaying versus hastening monetary tightening. In their perspective, the “risk of missing a chance to achieve the 2 percent target due to a hasty monetary tightening outweighed the risk of the inflation rate continuing to exceed 2 percent if monetary tightening fell behind the curve.”

Yet another member presented a more optimistic outlook on the inflation target, noting that the “achievement of 2 percent inflation in a sustainable and stable manner seemed to have clearly come in sight.” They further suggested that between January and March 2024, it might be feasible to evaluate the Bank’s success in achieving the inflation target.

Despite the differences in outlook, BoJ decided to persist with its current easing policy settings but also opted to grant long-term borrowing costs more flexibility to rise.

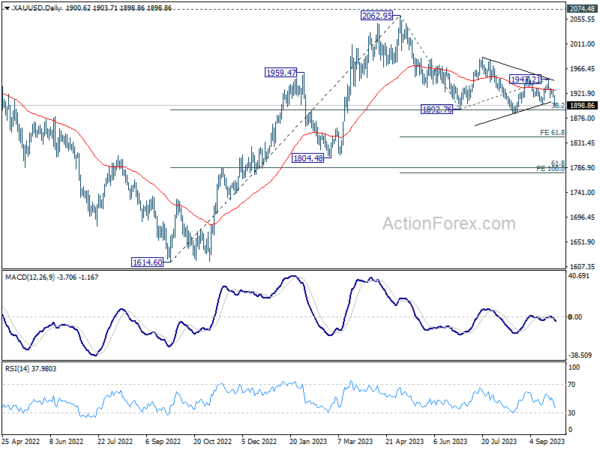

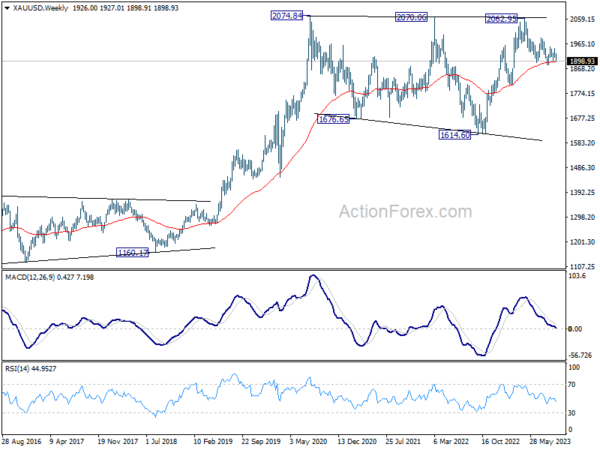

Gold at 1900 key support zone as selloff intensifies

Gold is under intensifying selling pressure this week. The prominent drivers behind this selloff are strengthening Dollar and, crucially, surging treasury yields. As a result, the yellow metal finds itself back at a crucial support zone around 1900 mark.

Within this critical support region lies 38.2% retracement of 1614.60 (2022 low) to 2062.95 at 1891.68, as well as 55 W EMA (now at 1896.68). A clear break below this pivotal range would underscore the notion that whole rally originating from 1614.60 has completed at 2062.95 already, stopping short of 2020 high of 2074.84. This descent from 2062.95 could then be interpreted as a medium-term fall trend, as one of the falling legs inside the long term consolidation pattern from 2074.84.

For now, risk will stay on the downside as long as 1947.21 resistance holds. Sustained break of 1884.83 support will pave the way to 61.8% projection of 2062.95 to 1892.76 from 1947.21 at 1842.03 in the near term. 100% projection at 1777.02 and below will be the medium term target.

Drawing parallels with other markets, the extended decline in Gold, if realized, would be consistent with Dollar Index surging towards 108/110 zone.

Looking ahead

Germany Gfk consumer sentiment, Swiss Credit Suisse economic expectations and Eurozone M3 money supply will be released in European session. Later in the day, US durable goods orders will take center stage.

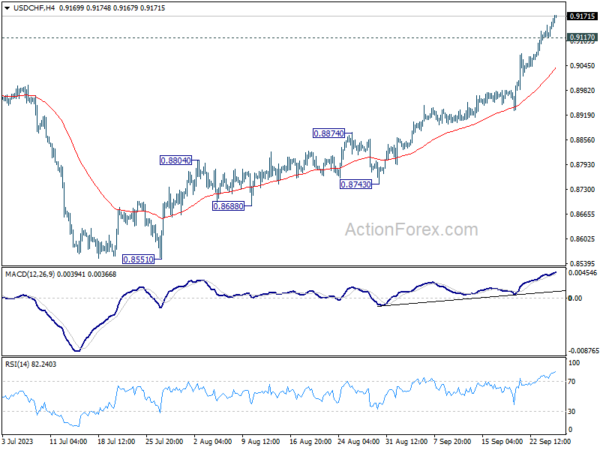

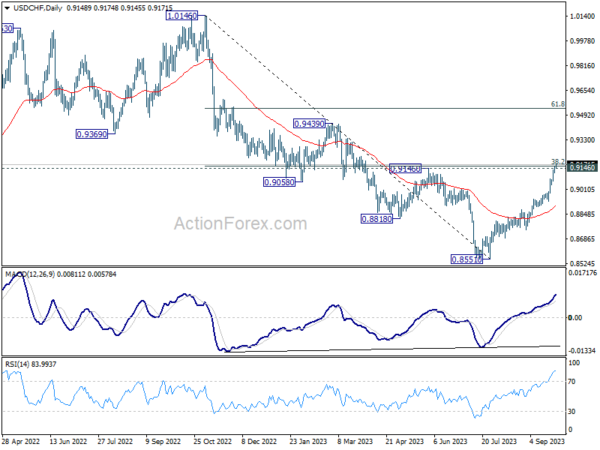

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9130; (P) 0.9145; (R1) 0.9174; More….

USD/CHF’s rally continues today and breaks 0.9146/60 cluster resistance. There is no sign of topping yet, and intraday bias stays on the upside. Next target is 0.9439 resistance. On the downside, below 0.9117 minor support will turn intraday bias neutral and bring consolidations, before staging another rally.

In the bigger picture, sustained trading above 0.9146 cluster resistance (38.2% retracement of 1.0146 to 0.8551 at 0.9160) will argue that rise from 0.8551 is reversing whole down trend from 1.0146. Further rally would then be seen to 61.8% retracement at 0.9537 and above. For now, this will be the favored case as long as 55 D EMA (now at 0.8905) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | ||||

| 01:30 | AUD | Monthly CPI Y/Y Aug | 5.20% | 5.20% | 4.90% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Oct | -25.5 | -25.5 | ||

| 08:00 | CHF | Credit Suisse Economic Expectations Sep | -38.6 | |||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Aug | -1.00% | -0.40% | ||

| 12:30 | USD | Durable Goods Orders Aug | -0.40% | -5.20% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Aug | 0.20% | 0.40% | ||

| 14:30 | USD | Crude Oil Inventories | -0.7M | -2.1M |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more