Dollar Index Nearing Key Resistance Zone Ahead Of An Important Fortnight

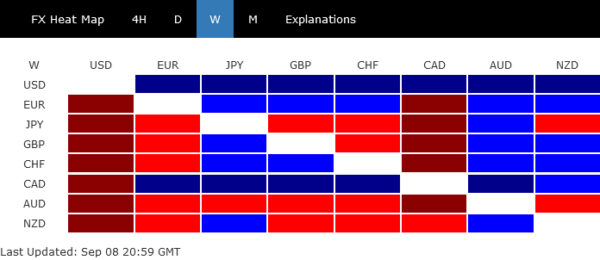

In a week characterized by significant currency movements, Dollar asserted its dominance, closing as the top performer and pushing the Dollar Index tantalizingly close to a pivotal medium-term resistance zone. The upcoming fortnight will be instrumental in assessing Dollar’s upside momentum, which, in turn, will shed light on whether the currency is embarking on a sustained medium-term rally. Canadian Dollar clinched the second spot on the leaderboard, buoyed by robust employment figures.

Despite noticeable vulnerability against surging Dollar and looming uncertainties surrounding the ECB imminent rate decisions, the Euro still managed to outpace both Sterling and Swiss Franc, and closed as overall third strongest. However, the trio largely continued their trend of near-term range-bound movements, indicating a wait-and-watch approach among investors.

Down under, Australian Dollar faced a rough patch, ending the week as the most beleaguered currency. Despite evading sustained selling pressure towards the week’s conclusion, Aussie continues to hang in a precarious balance, its fate intricately tied to the unfolding developments in China. This includes the renewed downward trajectory of the Yuan, which plumbed new lows, signaling concerns that could further dent the Australian Dollar’s standing.

Adding to the narrative of struggling currencies was Yen, which emerged as the second most feeble currency over the week. While attempts to resurrect its stance through heightened verbal interventions by Japan did foster a transient recovery, it fell short of altering the entrenched downtrend.

Dollar Index Approaches Critical Resistance with Eight-Week Winning Streak

Dollar Index has notched its eighth consecutive week of gains, marking its longest winning streak since 2014 and closing at its highest point since March. The pivotal resistance zone of 105/106 is expected to be a decisive territory that could shape the medium-term outlook for the index. Investors and analysts are gearing up for a potentially significant period in the next two weeks, with key events including US CPI release on September 13, followed by ECB rate decision on September 14, and FOMC rate decision on September 20, which could delineate the future path of the dollar.

The narrative that Fed might persist with its high interest rates (if not higher) for an extended period is gaining traction. Last week’s data release displayed unexpectedly strong performance by US services sector in August, characterized also by robust employment and price readings. Moreover, initial jobless claims descended to their lowest point since February, steering the sentiment towards positivity. Although the consensus anticipates a pause from Fed this, discussions are rife, with bets on another rate hike this year lingers around a 50-50 chance. Additionally, the central theme is beginning to shift to the duration for which current restrictive interest rates should be upheld to ensure a full circle back to the target inflation level, completing the last mile of disinflation.

The prolonged weakness of Euro, which constitutes a massive 57.6% of Dollar Index, has been a cornerstone in the protracted rally of the index. Last week saw EUR/USD declined by -0.7%, rounding off its eighth successive month in the red. The spotlight now turns towards ECB’s upcoming actions. A recent Reuters poll showcased a polarized expectation, with 39 out of 69 participants foreseeing a hold in deposit rate at 3.75% in the Thursday announcement. Futures market is leaning towards a pause too, with a 65% probability. The end of the year prediction remains equally split, as 36 of 69 respondents expecting the deposit rate to stay unchanged through 2023, with 33 expecting one more 25bps hike.

Technically, it’s still uncertain if Dollar Index’s rise from 99.57 represents a correction to the down trend from 114.77 (2022 high), or it’s reversing the trend. The pickup in upside momentum as seen in D MACD is adding favor to the bullish case. In the background, DXY was also supported well by 55 M EMA (now at 98.41) and 38.2% retracement of 70.69 (2008 low) to 114.77 at 97.93.

Sustained break of 38.2% retracement of 114.77 to 99.57 at 105.37, and more preferably 105.88 resistance) would add more weight to the bullish scenario, and set up further rally to 61.8% retracement at 108.96 next. Nevertheless, rejection by 105.37/88 zone, followed by break of 102.93 will turn near term outlook bearish for retesting 99.57 low again.

The next move would hopefully be decided after the rate decisions of ECB and then Fed, as well as their new economic projections.

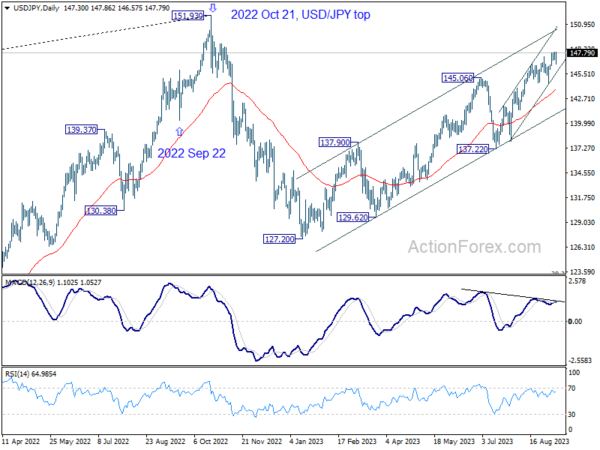

Japan’s intervention might only slow Yen’s decline for now

In the face of a 10-month low against Dollar nearing 148 mark, Japan intensified its verbal intervention last week, indicating a strong vigilance towards the ongoing depreciation in Yen’s exchange rate. Following the assertive comments from Japan’s top officials, USD/JPY exhibited a brief pullback only to resurge swiftly, wrapping up the week on a strong note.

Masato Kanda, noted as Japan’s FX czar by several quarters, emphasized the government’s heightened sense of urgency as they closely monitor the currency fluctuations, asserting a readiness to respond adeptly to curb any excesses. This stance found a resonance in Finance Minister Shunichi Suzuki’s affirmation that all options remained on the table to mitigate excessive volatility, reflecting a reinforced government vigilance over the currency dynamics.

A retrospection to the scenario exactly a year back brings to light Ministry of Finance’s direct intervention in the currency market, as USD/JPY escalated past 145. This move managed to momentarily pull back the pair to around 140 on September 22. However, the respite was transient as a potent rally propelled USD/JPY past 150 in October.

The strategic approach adopted by Japan was apparent — a cautious foray to gauge the readiness of Yen buyers, and opting not to combat forcefully when the markets exhibited unreadiness. Later, the government adopted a more assertive posture in latter part of October, capitalizing on the positive shift in US market risk sentiment.

The government’s concerted Yen purchasing action on October 21 last year, synchronized with the intensified rally of DOW breaking through 55 D EMA, spurred speculators to relinquish their short positions on Yen. This collaborative force fueled a sustained Yen rebound, ensuing a nearly three-month downtrend in USD/JPY.

As history often paints the potential future, it is inferred that any successful intervention by Japan — verbal or tangible — hinges predominantly on a transformation in the broader market environment. The ongoing rally in US stocks does little to bolster Yen. Bearish reversal in equities could paradoxically fuel Dollar’s overall rally, rendering support to Yen quite limited.

The prospect of US 10-year yield piercing through the significant 4% psychological threshold to invoke a bearish reversal seems remote at this juncture. Consequently, while Japan’s vigilant stance and readiness for intervention echo loud, reversal of USD/JPY’s up trend through the hands of the government appears to be a distant objective, with slowing down being a more immediate and realistic expectation.

Chinese Yuan plummets to historic lows

Chinese Yuan’s downslide resumed vigorously last week, with the onshore Yuan depreciating to its lowest point against Dollar since 2007. Concurrently, its offshore equivalent dipped to a ten-month nadir against the greenback. The Yuan’s decline began early this year, pressured by stumbling post-pandemic economic recovery and expanding yield gap with other global economies. These dynamics shifted capital flows. An escalating crisis in the property markets only intensified the gloomy economic outlook.

Recent economic indicators point towards an unabated slowdown in the Chinese economy. August Caixin PMI services underscored a sharper-than-anticipated contraction in the sector. This pullback mirrors the reluctance of Chinese households to spend, further evidenced by subdued inflation figures for August, which saw the CPI inch up by just 0.1% yoy.

China’s response to these development has been perplexing. Attempts were made to buttress Yuan, including the 200 basis points cut in the foreign exchange reserve requirement ratio by China’s central bank. Yet, in a twist, PBoC on Friday reversed a recent practice, adjusting the daily reference rate – or “fixing” – to its lowest point in two months. This indicates a potential willingness by PBoC to accommodate a weaker Yuan.

Amid this backdrop, a Bloomberg analysis brings to light the potential for China’s economic woes to send shockwaves across global financial markets. Citing a Fed discussion paper titled “Global Spillovers of a China Hard Landing” published in 2019, the report highlighted the historical precedence from 2015-16 where capital flight from China induced swift devaluation of Yuan and steep descents in Chinese equities. These shifts spilled over, impacting global markets across various sectors, from forex and stocks to treasuries and commodities.

However, the prevailing rally in USD/CNH appears to be more a reflection of the Dollar’s robustness rather than intrinsic Yuan weaknesses. EUR/CNH, which stands at 7.8768, remains well below its July peak of 8.1219. The alarm bells shouldn’t ring unless there’s a simultaneous extended sell-off in EUR/USD combined with a bullish breakout in EUR/CNH.

As for USD/CNH, the focal point will be on whether 61.8% projection of 6.8100 to 7.2853 from 7.1154 at 7.4091 could cap upside after the pair passes through 7.3745.

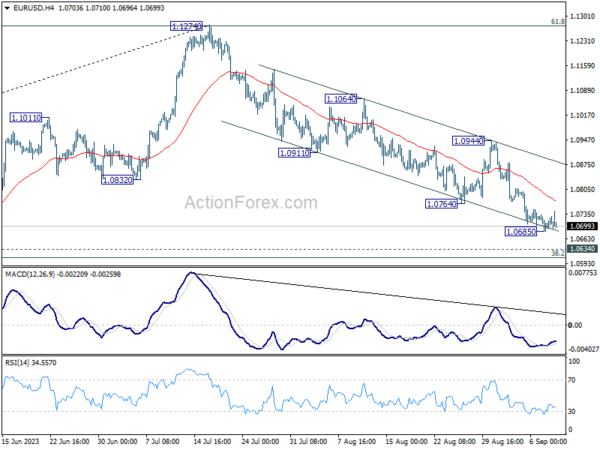

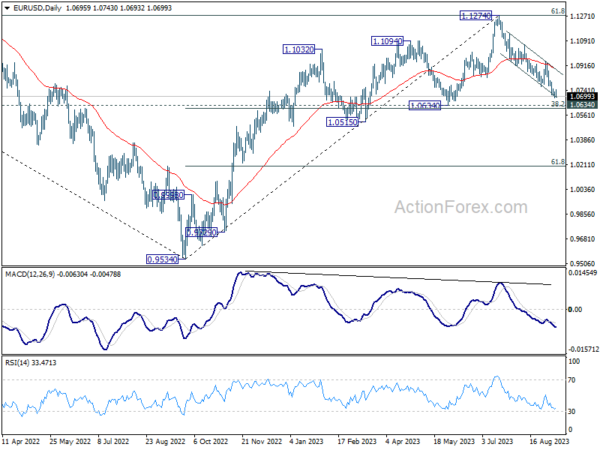

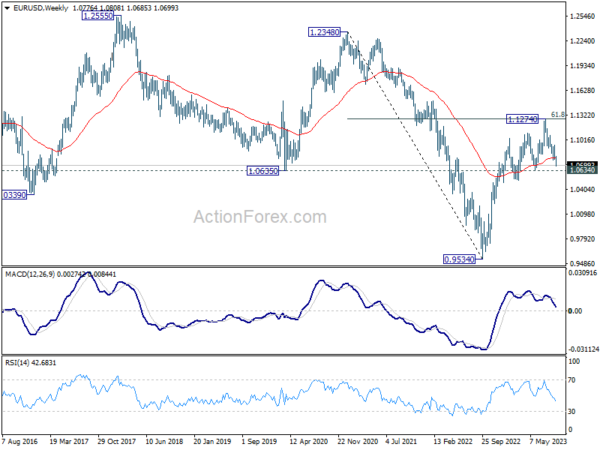

EUR/USD’s decline from 1.1274 resumed last week and hit as low as 1.0685. As a temporary low was formed, initial bias stays neutral this week for consolidations first. But outlook will remain bearish as long as 1.0944 resistance holds. Below 1.0685 will target 1.0609/34 cluster support zone next.

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Strong support could be seen from 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609) to bring rebound, at least on first attempt. Break of 1.0944 will indicate the start of the second leg, and target retest of 1.1274. However, sustained break of 1.0609/0634 will raise the chance of bearish trend reversal, and target 61.8% retracement at 1.0199.

In the long term picture, focus stays on 55 M EMA (now at 1.1124). Rejection by this EMA will revive long term bearishness for resuming the down trend form 1.6039 (2008 high). However, sustained break above there will affirm the case of long term bullish reversal and target 1.2348 resistance for confirmation.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more