Dollar Indecisive After CPI, Sterling Down But Not Out After Poor GDP

Dollar attempts to rally in early US session after modestly stronger than expected US consumer inflation data. But there is no clear follow through buying. Headline CPI’s bounce back to a 14-month high was slightly above expectations. Meanwhile, core CPI’s monthly reading also beat market forecasts. Yet, it appears that traders are not convinced that this set of data is strong enough to sway Fed much away from the policy path ahead. Whether there is another hike by the end of the year, after next week’s expected pause, would remain largely a coin toss.

Sterling was under some selling pressure after deeper than expected UK GDP contraction but there was also no clear follow through momentum. Indeed for now, Aussie is the worst performer for the day, followed by Yen, and then Swiss Franc. Kiwi is the best performer, followed by Dollar and then Euro and Canadian. The Pound is just mixed in the middle.

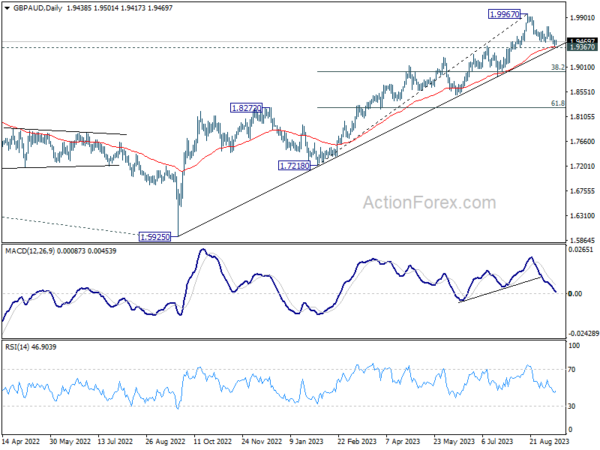

Aussie will be a focus in the upcoming Asian session with Australian employment data featured. GBP/AUD is now pressing 1.9367 resistance turned support, 55 D EMA (now at 1.9377), as well as a medium term rising trend line. Strong bounce from current level will argue that pull back from 1.9967 has completed, and larger up trend from 1.5929 is ready to resume. On the downside, sustained break of 1.93 handle will indicate that it’s at least in correction to the rise from 1.7218, and target 38.2% retracement of 1.7218 to 1.9967 at 1.8917. Let’s see how it goes.

In Europe, at the time of writing, FTSE is down -0.09%. DAX is down -0.55%. CAC is down -0.50%. Germany 10-year yield is up 0.0199 at 2.666. Earlier in Asia, Nikkei dropped -0.21%. Hong Kong HSI dropped -0.09%. China Shanghai SSE dropped -0.45%. Singapore Strait Times rose 0.14%. Japan 10-year JGB yield dropped -0.0001 to 0.710.

US CPI at 0.6% mom, 3.7% yoy; CPI core at 0.3% mom, 4.3% yoy

US CPI rose 0.6% mom in August, matched expectations. CPI core (ex food and energy) rose 0.3% mom, above expectation of 0.2% mom. Energy index was up 5.6% mom. Food index was up 0.2% mom. Gasoline was the largest contributor to monthly CPI rise, accounting for over half of the increase. Another contributor was shelter index, which rose for the 40th consecutive month.

For the 12 months period, headline CPI rose from 3.2% yoy to 3.6% yoy above expectation of 3.6% yoy. CPI core slowed from 4.7% yoy to 4.3% yoy, matched expectations. Energy index decreased -3.6% yoy. Food index rose 4.3% yoy.

Eurozone industrial production down -1.1% mom in Jul

Eurozone industrial production fell -1.1% mom in July, worse than expectation of -0.7% mom. Production of capital goods fell by -2.7% mom and durable consumer goods by -2.2% mom, while production of intermediate goods grew by 0.2% mom, non-durable consumer goods by 0.4% mom and energy by 1.6% mom.

EU industrial production was down -1.1% mom. Among Member States for which data are available, the largest monthly decreases were registered in Denmark (-9.1%), Ireland (-6.6%) and Lithuania (-4.4%). The highest increases were observed in Sweden (+5.1%), Malta (+3.4%) and Hungary (+2.9%).

UK GDP down -0.5% mom in Jul, dragged by services contraction

UK GDP contracted -0.5% mom in July, much worse than expectation of -0.2% mom. Services was down -0.5% mom, the main contributor to the fall in GDP. Production fell by -0.7% mom. Construction fell by -0.5% mom.

In the three months to July compared with the prior three-month period, GDP increased by 0.2%. Production rose 0.6%, and was the main contributing sector. Services and construction both rose by 0.1%.

Also released, industrial production came in at -0.7% mom, 0.4% yoy in July, versus expectation of -0.5% mom, 0.5% yoy. Manufacturing was at -0.8% mom, 3.0% yoy, versus expectation of -0.9% mom, 2.7% yoy. Goods trade deficit narrowed to GBP -14.1B, versus expectation of GBP -15.9B.

Japan’s CGPI records eighth consecutive month of slowdown in August

Japan’s annual wholesale inflation, as measured by Corporate Goods Price Index, registered a slowdown for the eighth consecutive month in August. CGPI eased to 3.2% yoy, aligning with market expectations and continuing its downward trend from the peak of 10.6% yoy recorded in December.

Export price index recorded a lesser contraction of -0.8% yoy compared to -2.6% yoy in July. Meanwhile, import price index also demonstrated a slight moderation in its decline, posting a -15.9% yoy compared to -16.0% yoy observed in the preceding month.

On a month-on-month basis, PPI saw an uptick of 0.3% mom. Delving into the specifics, export price index witnessed a recovery, improving by 0.5% mom. In contrast, the import price index reported a decline of 0.9% mom. within the same period.

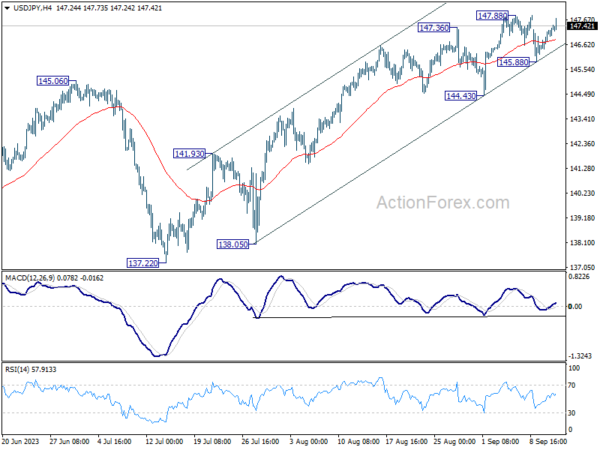

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 146.61; (P) 146.92; (R1) 147.40; More…

USD/JPY’s rebound from 145.88 extends higher today, but upside is still capped by 147.88 resistance. Intraday bias remains neutral at this point and more consolidations could be seen. But even in case of another pull back, near term outlook will remain bullish as long as 144.43 support holds. On the upside, firm break of 147.88 will resume larger rise from 127.20, to retest 151.93 high.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by break of 137.22 support will indicate that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Aug | 3.20% | 3.20% | 3.60% | 3.40% |

| 23:50 | JPY | BSI Large Manufacturing Conditions Q3 | 5.4 | 0.2 | -0.4 | |

| 06:00 | GBP | GDP M/M Jul | -0.50% | -0.20% | 0.50% | |

| 06:00 | GBP | Industrial Production M/M Jul | -0.70% | -0.50% | 1.80% | |

| 06:00 | GBP | Industrial Production Y/Y Jul | 0.40% | 0.50% | 0.70% | |

| 06:00 | GBP | Manufacturing Production M/M Jul | -0.80% | -0.90% | 2.40% | |

| 06:00 | GBP | Manufacturing Production Y/Y Jul | 3.00% | 2.70% | 3.10% | |

| 06:00 | GBP | Goods Trade Balance (GBP) Jul | -14.1B | -15.9B | -15.5B | |

| 09:00 | EUR | Eurozone Industrial Production M/M Jul | -1.10% | -0.70% | 0.50% | 0.40% |

| 11:00 | GBP | NIESR GDP Estimate Aug | 0.20% | 0.30% | ||

| 12:30 | USD | CPI M/M Aug | 0.60% | 0.60% | 0.20% | |

| 12:30 | USD | CPI Y/Y Aug | 3.70% | 3.60% | 3.20% | |

| 12:30 | USD | CPI Core M/M Aug | 0.30% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Core Y/Y Aug | 4.30% | 4.30% | 4.70% | |

| 14:30 | USD | Crude Oil Inventories | -2.2M | -6.3M |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more