Dollar Holds Firm Against Euro In Quiet Trading, Cautious Sentiment Prevails

Dollar remains firm against European majors in relatively quiet trading today. Despite slightly better-than-expected GDP data from France, Euro has not gained significant support. While today’s Eurozone GDP and tomorrow’s CPI flash are important, they are unlikely to cause substantial movements in Euro. Traders’ attention is firmly on tomorrow’s FOMC rate decision and the accompanying press conference.

Meanwhile, Yen is broadly softer within its established near-term range as markets await BoJ meeting. It is anticipated that BoJ will lay out its plan to taper bond purchases, but there is uncertainty over whether an additional rate hike will be announced. This uncertainty keeping low volatility in Yen.

Swiss Franc follows Yen as the second weakest currency for the week so far, with Euro also underperforming. In contrast, Australian Dollar is currently the strongest, followed by New Zealand Dollar and then the greenback. However, with the exception of EUR/USD, all major pairs and crosses are currently trading within last week’s range, indicating a lack of decisive movements ahead of key events.

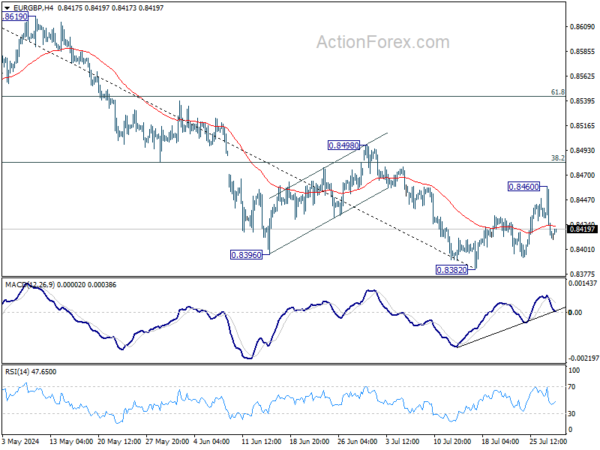

Technically, EUR/GBP’s sharp decline overnight affirms the case that price action from 0.8382 is merely a corrective move. It might be completed with three waves up to 0.8460 already. Break of 0.8382 should confirm larger up trend resumption. Meanwhile, even in case of another rise, outlook will continue to stay bearish as long as 0.8498 resistance holds.

In Asia, at the time of writing, Nikkei is down -0.09%. Hong Kong HSI is down -1.31%. China Shanghai SSE is down -0.71%. Singapore Strait Times is up 0.15%. Japan 10-year JGB yield is down -0.0187 at 1.010. Overnight, DOW fell -012%. S&P 500 rose 0.08%. NASDAQ rose 0.07%. 10-year yield fell -0.022 to 4.178.

French GDP exceeds expectations with 0.3% qoq growth in Q2

France’s GDP grew by 0.3% qoq in Q2, surpassing the expected 0.2% growth. This positive performance was driven by a slight rebound in gross fixed capital formation , which increased by 0.1% after a decline of 0.4% in the previous quarter. Consequently, final domestic demand, excluding inventories, made a modest contribution to GDP growth, adding 0.1 percentage points compared to no contribution in Q1 2024.

Household consumption remained stable at 0.0%, following a slight decline of 0.1% in the first quarter. Foreign trade also contributed positively to GDP growth, adding 0.2 percentage points. This was supported by stable imports (0.0% after -0.3%) and dynamic exports, which grew by 0.6% following a 0.7% increase in Q1.

Lastly, changes in inventories had no impact on GDP growth, continuing the trend from the previous quarter with a neutral contribution of 0.0 points.

Japan’s Unemployment Rate Falls to 2.5% in June, Job Availability Declines

Japan’s unemployment rate fell to 2.5% in June, down from 2.6%, outperforming expectations of being unchanged at 2.6%.

The number of employed persons reached 68.22mmarking an increase of 370k compared to the same month last year. This represents the 23rd consecutive month of employment growth and the highest number since comparable records began in 1953. However, the number of unemployed persons also saw an increase, rising by 20k from the same month last year to 1.81m marking the third consecutive month of increase.

In separate data, the Ministry of Health, Labor and Welfare reported that the job availability ratio fell by 0.01 point from June to 1.23. This marks the third consecutive month of decline in the ratio, indicating that there are now 123 jobs available for every 100 job seekers, down slightly from previous months.

Looking ahead

Eurozone GDP is the main focus in European session while Swiss will release KOF economic barometer. Later in the day, US will release house price index and consumer confidence.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0793; (P) 1.0831; (R1) 1.0860; More…..

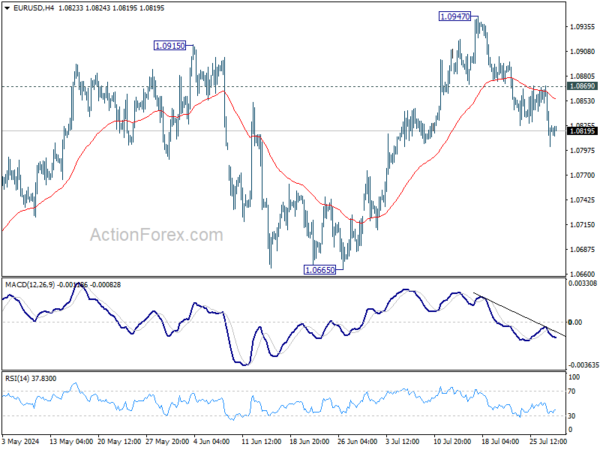

Intraday bias in EUR/USD remains on the downside for the moment. Sustained break of 55 D EMA (now at 1.0815) will argue that whole rebound from 1.0601 has completed with three waves up to 1.0947. Deeper decline should then be seen to 1.0601/0665 support zone next. Nevertheless, break of 1.0869 minor resistance will bring retest of 1.0947 instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still be in progress. Break of 1.1138 resistance will be the first signal that rise from 0.9534 (2022 low) is ready to resume through 1.1274 (2023 high). However, break of 1.0665 support will extend the correction with another falling leg back towards 1.0447 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Jun | 2.50% | 2.60% | 2.60% | |

| 01:30 | AUD | Building Permits M/M Jun | -6.50% | -2.30% | 5.50% | 5.70% |

| 06:45 | EUR | France Consumer Spending M/M Jun | -0.50% | -0.40% | 1.50% | |

| 05:30 | EUR | France GDP Q/Q Q2 P | 0.30% | 0.20% | 0.20% | |

| 07:00 | CHF | KOF Leading Indicator Jul | 102.6 | 102.7 | ||

| 08:00 | EUR | Italy GDP Q/Q Q2 P | 0.20% | 0.30% | ||

| 08:00 | EUR | Germany GDP Q/Q Q2 P | 0.10% | 0.20% | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.20% | 0.30% | ||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Jul | 95.9 | |||

| 09:00 | EUR | Eurozone Industrial Confidence Jul | -10.1 | |||

| 09:00 | EUR | Eurozone Services Sentiment Jul | 6.5 | |||

| 09:00 | EUR | Eurozone Consumer Confidence Jul F | -13 | -13 | ||

| 12:00 | EUR | Germany CPI M/M Jul P | 0.30% | 0.10% | ||

| 12:00 | EUR | Germany CPI Y/Y Jul P | 2.20% | 2.20% | ||

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y May | 7.40% | 7.20% | ||

| 13:00 | USD | Housing Price Index M/M May | 0.20% | 0.20% | ||

| 14:00 | USD | Consumer Confidence Jul | 99.8 | 100.4 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more