Dollar Falls As Disinflation Accelerates, EU Holds Fire On Tariff Retaliation

Dollar faced renewed selling pressure in early US session, as markets digested softer-than-expected inflation data. The latest CPI report confirmed that disinflation is regaining traction, with both headline and core inflation easing more than expected in March. This strengthens the case for Fed to resume its rate cut cycle in the coming months.

A May rate cut remains unlikely — with Fed fund futures currently pricing in an 84% chance of a hold. Markets are still more confident that a move will come by June, with odds now standing around 78%. If the disinflation trend persists, that expectation could soon become consensus.

On the trade front, the mood is notably less tense today. The European Union announced a 90-day suspension of its first wave of retaliatory tariffs, originally planned in response to the US’s 25% steel and aluminum duties. This follows US decision to pause the broad reciprocal tariff for 90 days.

European Commission President Ursula von der Leyen emphasized, “We want to give negotiations a chance”. But she also made clear that the EU remains ready to act if talks fail. Preparatory work for broader countermeasures remains underway, with all options said to be “on the table.”

Despite this temporary de-escalation, overall market sentiment remains shaky. US futures are pointing to a weaker open after yesterday’s massive relief rally, suggesting that investors are still wary of the underlying risks. In contrast, European markets are tracking Asia higher, but overall confidence is fragile.

In the currency markets, Dollar is currently the worst performer of the week, followed by Sterling and Loonie. Swiss Franc continues to shine as a safe haven, with Aussie and Kiwi showing resilience as well. Meanwhile, Yen and Euro are positioning in the middle.

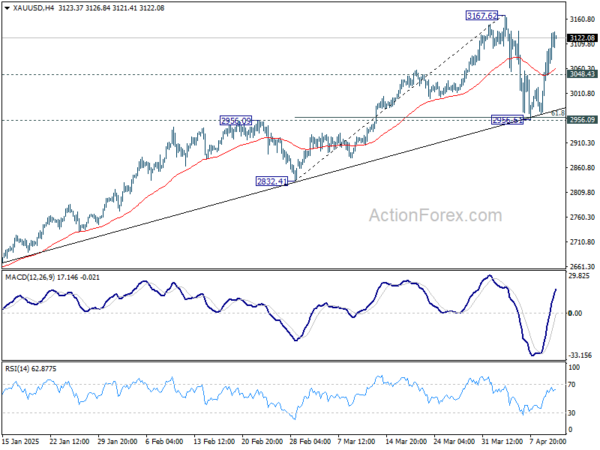

Technically, Gold’s rebound from 2956.61 extended higher today. The strong support from 2956.09, as well as rising trend line, keeps Gold’s up trend intact. Nevertheless, corrective pattern from 3167.62 might still be incomplete. Break of 3048.43 support will start another down leg. Though, firm break of 3167.62 will confirm up trend resumption.

In Europe, at the time of writing, FTSE is up 3.84%. DAX is up 4.83%. CAC is up 4.49%. UK 10-year yield is down -0.073 at 4.742. Germany 10-year yield is up 0.049 at 2.640. Earlier in Asia, Nikkei rose 9.13%. Hong Kong HSI rose 2.06%. China Shanghai SSE rose 1.16%. Singapore Strait Times rose 5.43%. Japan 10-year JGB yield rose 0.095 to 1.377.

US CPI surprise: Both headline and core inflation cools sharply in March

US inflation came in much softer than expected in March, with headline CPI falling -0.1% mom, surprising markets that had forecast a 0.2% mom increase. Core CPI, which excludes food and energy, also underwhelmed with just a 0.1% mom gain, well below the anticipated 0.3% mom. The pullback was led by a -2.4% mom drop in energy prices, while food costs continued to climb, rising 0.4% mom.

On an annual basis, the CPI decelerated from 2.8% yoy to 2.4% yoy, lower than the expected 2.5% yoy. Core CPI also slowed to 2.8% yoy, down from 3.1% yoy, and marked the smallest 12-month increase since March 2021. The sharp drop in energy prices, down -3.3% yoy, played a significant role, although food inflation remained sticky at 3.0% yoy.

US initial jobless claims rise to 223k, vs exp 222k

US initial jobless claims rose 4k to 223k in the week ending April 5, slightly above expectation of 222k. Four-week moving average of initial claims was unchanged at 223k.

Continuing claims fell -43k to 1850k in the week ending March 29. Four-week moving average of continuing claims fell -250 to 1868k.

ECB’s Villeroy: Thank God we created Euro, as tariff turmoil undermines Dollar

French ECB Governing Council member François Villeroy de Galhau emphasized today that while the US has long championed the global centrality of the Dollar, recent policy moves on tariffs are beginning to erode international confidence in the greenback.

Speaking on France Inter radio, Villeroy said the Trump administration’s approach is “very incoherent,” and suggested that its recent actions “play against the confidence” typically held in Dollar.

He contrasted this with the Euro, praising Europe’s foresight in establishing its own independent monetary system 25 years ago. “Thank God that Europe… created the Euro,” he noted, adding that the bloc now enjoys “monetary autonomy” that allows ECB to manage interest rates in a way that diverges from US policy, something that was not possible in the past.

RBA’s Bullock: Too early to call rate path amid tariff-driven uncertainty

RBA Governor Michele Bullock stated today that it is “too early” to judge how escalating global trade war will shape the path of Australian interest rates. “it’s too early for us to determine what the path will be for interest rates,” she added.

Bullock noted that “a period of uncertainty and adjustment” is inevitable as countries react to Washington’s trade moves. RBA plans to stay patient while assessing how these global shocks might affect both supply and demand dynamics. “It will take some time to see how all of this plays out,” she said.

Japan’s PPI accelerates to 4.2% while import costs ease

Japan’s PPI rose 4.2% yoy in March, a slight acceleration from February’s 4.1% yoy and topping expectations of 3.9% yoy rise. The increase was broad-based, with notable gains in food prices, which rose 3.1% yoy, and energy costs, with petroleum and coal prices surging by 8.6% yoy.

Despite the uptick in domestic producer prices, import costs in Yen terms fell -2.2% yoy in March, extending the -0.9% decline in February. Export prices, however, rose a modest 0.3% yoy, slowing sharply from February’s 1.7% yoy growth.

China’s CPI falls -0.1% yoy in March, PPI highlights persistent deflationary pressures

China’s consumer inflation remained in negative territory for a second straight month in March, with CPI falling -0.1% yoy, missing expectations of 0.1% yoy increase. While the decline was narrower than February’s -0.7% yoy, it still reflects subdued demand pressures across the economy.

Food prices was a drag, down -1.4% yoy, while service prices provided only modest support, rising 0.3% yoy. Core CPI, which excludes volatile food and energy prices, edged up to 0.5% yoy from 0.3% previously, offering a slight glimmer of resilience.

However, with headline inflation still hovering around zero and signs of consumer caution persisting, the broader disinflation trend appears entrenched.

On a monthly basis, CPI dropped -0.4% mom, following February’s -0.2% mom decline, suggesting continued weakness in household spending momentum.

Meanwhile, producer prices extended their decline for a 30th straight month, with PPI dropping -2.5% yoy, deeper than the expected -2.3%.

EUR/USD Mid-Day Outlook

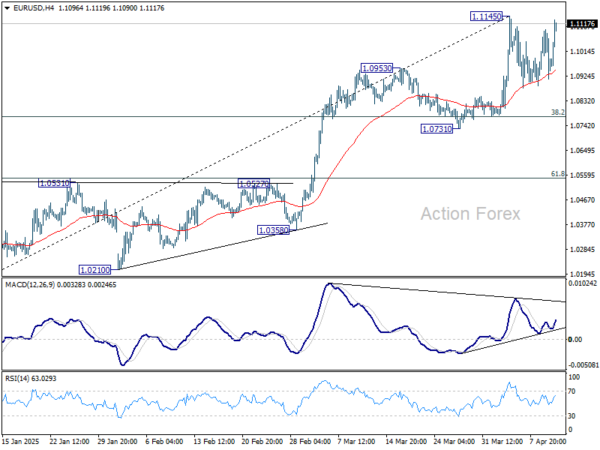

Daily Pivots: (S1) 1.0876; (P) 1.0986; (R1) 1.1057; More…

Intraday bias in EUR/USD remains neutral first, but focus is immediately on 1.1145 resistance with today’s rebound. Firm break there will resume whole rally from 1.0176. Next target is 1.1213/74 key resistance zone next. In case of another retreat, downside should be contained by 38.2% retracement of 1.0176 to 1.1145 at 1.0775 to complete the near term consolidation.

In the bigger picture, fall from 1.1274 (2024 high) has completed as a three wave correction to 1.0176. Rise from 0.9534 ready to resume. Decisive break of 1.1274 will target 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. Also, that will send EUR/USD through the multi-decade channel resistance will carries larger bullish implication. This will now be the favored case as long as 1.0731 support holds.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more