Dollar Dips Following Non-Farm Payroll Disappointment

Dollar falls broadly in early US session following slightly below-expectation non-farm payroll job growth. However, the downside is currently limited, thanks to stronger-than-expected wage growth. The market behavior seems to suggest that traders are merely lightening their positions ahead of the weekend and CPI data release next week, rather than initiating any significant position reversals.

Meanwhile, Canadian Dollar is showing a slightly steeper decline following disappointing employment data. For the moment, Australian and New Zealand Dollars are reaping the most benefits, bolstered by US futures indicating a higher open. However, their recoveries may prove to be fragile if risk-off sentiment resurfaces later in the session.

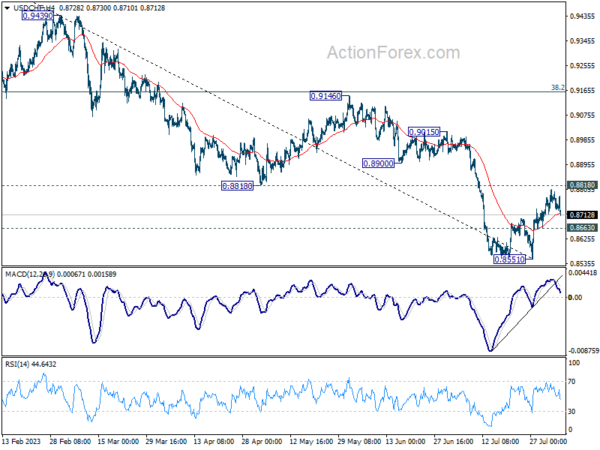

Technically, near term focus in USD/CHF will be back on 0.8663 minor support if the current pull back extends. Firm break there will confirm rejection by 0.8818 support turned resistance, and thus retain near term bearishness in the pair. In other words, larger down trend from 1.0146 could be ready to resume through 0.8551 low if that happens.

In Europe, at the time of writing, FTSE is down -0.29%. DAX is down -0.32%. CAC is up 0.17%. Germany 10-year yield is up 0.0074 at 2.611. Earlier in Asia, Nikkei rose 0.10%. Hong Kong HSI rose 0.61%. China Shanghai SSE rose 0.23%. Singapore Strait Times dropped -0.35%. Japan 10-year JGB yield dropped -0.0077 to 0.646.

US NFP rose 187k in Jul, missed expectations

US non-farm payroll employment rose 187k in July, below expectation of 200k. That’s also notably lower than the average monthly gain of 312k over the prior 12 months.

Unemployment rate ticked down from 3.6% to 3.5%, below expectation of 3.6%. Unemployment rate has been ranging between 3.4% and 3.7% since March 2022. Labor force participation rate was unchanged at 62.6% for the fifth consecutive month.

Average hourly earnings rose 0.4% mom, above expectation of 0.3% mom. Over the past 12 months, average hourly earnings has increased by 4.4% yoy. Average workweek fell slightly by -0.1 hour to 34.3 hours.

Canada employment down -6.4k in Jul, unemployment rate rose to 5.5%

Canada employment fell -6.4k in July, below expectation of 15.5k growth.

Unemployment rate rose from 5.4% to 5.5%, matched expectations, and marked the third consecutive monthly increase

Average hourly wages growth jumped from 4.2% yoy to 5.0% yoy. Total hours worked was virtually unchanged over the month, and up 2.1% yoy.

Eurozone retail sales down -0.3% mom in Jun, EU down -0.2% mom

Eurozone retail sales dropped -0.3% mom in June, much worse than expectation of 0.3% mom. Volume of retail trade decreased by -0.3% for food, drinks and tobacco and by -0.2% for non-food products, while it increased by 1.0% for automotive fuels.

EU retail sales fell -0.2% mom. Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were registered in the Slovenia (-2.6%), Romania (-1.9%) and Portugal (-1.6%). The highest increases were observed in Luxembourg (+2.6%), Netherlands (+1.5%) and Belgium (+1.2%).

RBA downgrades 2023 CPI and GDP forecasts slightly

In the quarterly Statement on Monetary Policy, RBA reiterated that “some further tightening of monetary policy may be required”. This decision, however, would hinge on the incoming data and the evolving assessment of risks. Economic forecasts remain largely unchanged, with a slight downgrade in 2023 CPI forecast as well as 2023 and 2024 GDP projections.

The central bank’s outlook for inflation remains more or less steady as compared to three months ago. “CPI inflation is forecast to continue to decline, to be around 3¼ per cent at the end of 2024 and back within the 2–3 per cent target range in late 2025,” the statement highlighted. The Board maintains that the risks around the inflation outlook are “broadly balanced”.

While the labour market remains tight, conditions have seen slight relaxation. The bank notes, “In response to the tight labour market and high inflation, wage growth picked up to its highest rate in a decade.”

The economic growth perspective appears somewhat muted, with the statement acknowledging that “Growth in economic activity has been subdued this year.” Looking ahead, the central bank remains cautious, predicting that “Growth in the economy is expected to remain subdued over the period ahead.”

New economic forecasts

CPI inflation at (vs previous forecast):

- 4.25% in Dec 2023 (down from 4.50%).

- 3.50% in June 2024 (unchanged).

- 3.25% in Dec 2024 (unchanged).

- 300% in Jun 2025 (unchanged).

- 2.75% in Dec 2025 (new).

Trimmed mean CPI inflation at:

- 4.00% in Dec 2023 (unchanged).

- 3.25% in Jun 2024 (unchanged).

- 3.00% in Dec 2024 (unchanged).

- 3.00% in Jun 2025 (unchanged).

- 2.75% in Dec 2025 (new).

Year-average GDP growth at:

- 1.50 in 2023 (down from 1.75%).

- 1.25% in 2024 (down from 1.50%).

- 2.00% in 2025 (new).

EUR/USD Mid-Day Outlook

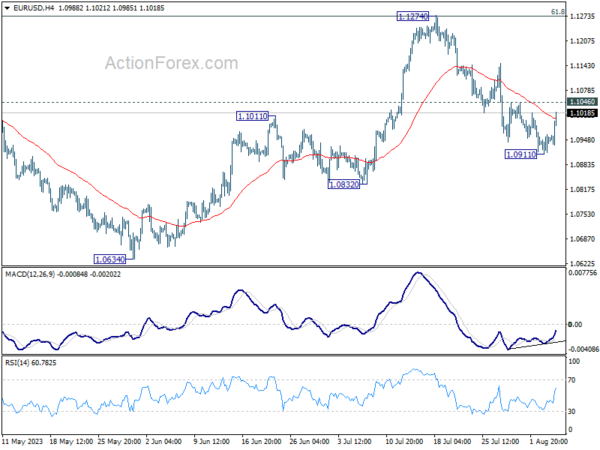

Daily Pivots: (S1) 1.0920; (P) 1.0941; (R1) 1.0971; More…

Intraday bias in EUR/USD is turned neutral first with current recovery. Break of 1.1046 minor resistance will argue that pull back from 1.1274 has completed at 1.0911. Intraday bias will be back on the upside for retesting 1.1274. On the downside, break of 1.0911 will resume the decline to 1.0832 support. Sustained trading below there will target 1.0609/34 cluster support.

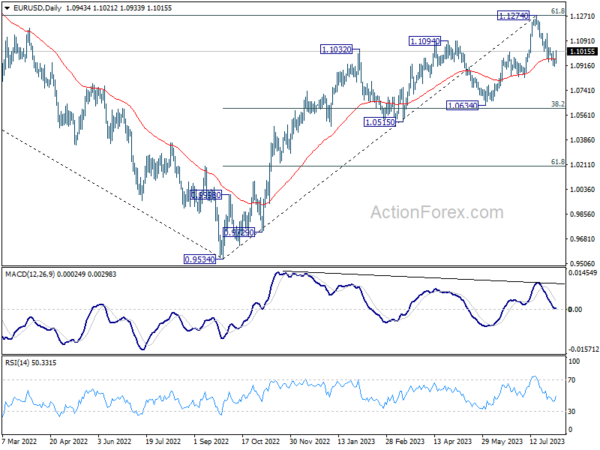

In the bigger picture, a medium term top could be formed at 1.1274, after failing to break through 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 decisively, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.0963) will bring deeper correction to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to set the range for consolidation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Monetary Policy Statement | ||||

| 06:00 | EUR | Germany Factory Orders M/M Jun | 7.00% | -2.00% | 6.40% | 6.20% |

| 06:45 | EUR | France Industrial Output M/M Jun | -0.90% | -0.30% | 1.20% | 1.10% |

| 08:00 | EUR | Italy Industrial Output M/M Jun | 0.50% | 0.00% | 1.60% | 1.70% |

| 08:30 | GBP | Construction PMI Jul | 51.7 | 48.2 | 48.9 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Jun | -0.30% | 0.30% | 0.00% | 0.60% |

| 12:30 | USD | Nonfarm Payrolls Jul | 187K | 200K | 209K | |

| 12:30 | USD | Unemployment Rate Jul | 3.50% | 3.60% | 3.60% | |

| 12:30 | USD | Average Hourly Earnings M/M Jul | 0.40% | 0.30% | 0.40% | |

| 12:30 | CAD | Net Change in Employment Jul | -6.4K | 15.5K | 59.9K | |

| 12:30 | CAD | Unemployment Rate Jul | 5.50% | 5.50% | 5.40% | |

| 14:00 | CAD | Ivey PMI Jul | 50.2 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more