Much has been made of the recent shift from growth to value as markets grapple with the prospects of prolonged elevated inflation and rising interest rates.

This has caused the racier parts of the market to struggle year to date, and this is having knock-on effects in the private equity space.

Private equity has done very well in recent years as more and more companies choose to stay private for longer. This has allowed private equity managers the opportunity to capture large gains in an environment where there was a thirst for growth companies.

Trust supporting under-represented entrepreneurs looks to IPO

Now, however, private equity faces a complicated time as investors switch to a risk-off position in this uncertain environment. Nevertheless, despite market difficulties, private equity remains a long-term theme that investors should be looking to own as part of a wider portfolio.

Given the liquidity concerns of investing in early-stage and illiquid companies, investment trusts have been the traditional vehicle of choice for investors. With shares in the trusts traded on the main market, this helps remove the liquidity issue that has made other illiquid areas of the market, such as property funds, unpopular in open ended format.

There are two investment trusts in particular that we like in this space - HG Capital and HarbourVest Global Private Equity. The former directly invests in private companies that offer business critical software helping to automate workflow. This leads to the portfolio focusing on high quality businesses across several niche industry clusters such as accounting, legal, compliance, tax and payroll. These businesses may be boring, but they are compounders and give the ability to access strong returns, with the trust having an annualised NAV growth of over 15% per annum.

HarbourVest, by contrast, is a fund of funds investment trust investing in third-party private equity funds, with a bias to the US and mid-market buyouts. This gives it strong diversification characteristics and the trust has access to a huge team of investment professionals covering a number of areas of the market.

The private equity investment trust space is one that is seeing a lot of innovation just now too. Many trusts in traditional asset class areas are adding to their ability to buy private. Equity trusts such as those run by Baillie Gifford, most notably via Scottish Mortgage have led the way, but there are a number of other houses that have followed, such as Fidelity and BlackRock. There are also the likes of RIT Capital and Caledonia, which would be considered as hybrid investment trusts, with significant private equity exposure alongside traditional equity and other asset classes in the case of RIT.

With more and more companies wanting to remain private for longer, professional investors are waking up to the opportunities these names can provide. Many trusts will now hold a company from private to well beyond listing, highlighting how private equity can be fertile hunting ground for the winners of tomorrow.

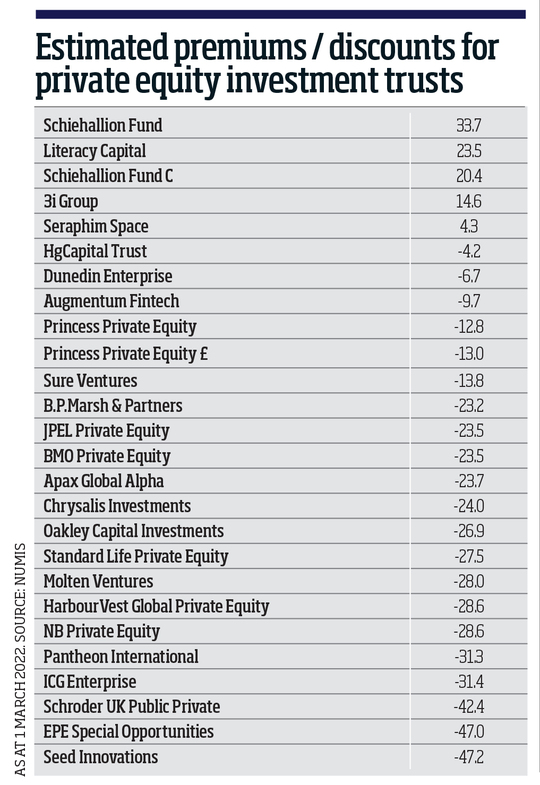

There are clearly risks that investors should be wary of. Premiums and discounts may be inconsistent in the sector and many of the new launches tend to be focused on growth companies and are at big premiums, such as Schiehallion from Baillie Gifford. Discounts can also blow out rapidly and given recent volatility we could see private equity trusts suffer when quarterly valuations are made. At this stage, there is understandable nervousness about how valuations will be affected by the de-rating of quoted growth companies.

Furthermore, costs continue to dominate. Headline charges are coming down in aggregate, although still vary significantly. However, some trusts come with different structures of performance fees and layers of cost that are not always the most straightforward for the end investor. This is fine when a trust is returning in excess of 50% in a given year. However, in leaner years those costs begin to look steep, so investors need to ensure they understand that they are buying for the long term.

That said, private equity remains an innovative sector with almost endless opportunities. With discounts present there are opportunities for investors, but it will be a volatile ride in the short-term.

However, riding it out over the long term should see investors reap the rewards that can be on offer from backing companies at the early stages in their journeys.

Nick Wood is head of fund research at Quilter Cheviot