Expectations are often different from reality. This was true of UK commercial real estate in 2021 where total returns of 16.5% were markedly stronger than the IPF consensus autumn forecast of 1.5% for the year. This strong return was largely reflective of a better-than-expected economic recovery, with GDP returning to pre-pandemic levels for the first time in November. Meanwhile, investor sentiment had improved, reflected in yield compression and £64.9bn of transactions. The industrial sector was the standout performer, but retail warehouses also delivered 21.9% - both segments benefiting from the strong demand drivers associated with the continued growth in e-commerce.

Janus Henderson fund closure an 'ill omen' for wounded open-ended property sector

As we transition from a pandemic to an endemic state, investors are grappling with the macro risks of inflation and interest rate rises. In December 2021, UK consumer price growth rose to a three-decade high of 5.4% per annum. Amid concerns that some of this inflation could endure, the Bank of England increased its base interest rate from 0.1% to 0.25% prompting expectations for further gradual, modest rises this year, which would enable the economy and housing market to absorb without significant impact.

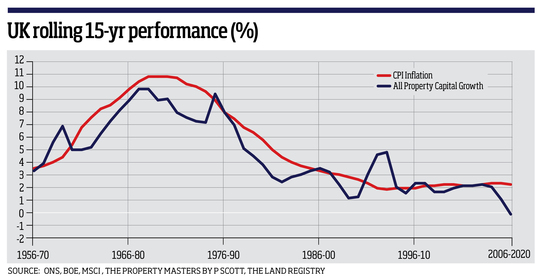

Generally in a UK economic growth environment, both capital and rental growth have historically either kept up with - or outpaced - inflation, demonstrating that real assets can offer some protection. Exposure to leases providing inflation protection such as RPI index-linked leases (common in supermarkets), frequently ‘re-set rents' (residential/hotels) and quality assets with attractive fundamentals with rental growth potential all help to preserve real income.

The latest IPF consensus forecasts a five-year total return of 6.2% per annum, with 8.6% for 2022. But these figures are based off forecasts produced weeks or even months prior to the survey date and bear no regard for the war in Ukraine. Given the change in the economic and geo-political landscape, can we extract much value from such forecasts? Arguably not, but the implied, collective view was that regardless of inflation and interest rate risk, investors had a positive outlook for commercial property. This was based on improving economic and employment growth - both of which are key demand drivers for space - buoyant household savings which are supportive of a retail and leisure recovery and employees returning to the office - a further sign of normality resuming. By how much this emerging confidence will be knocked by the uncertainty of the conflict is to be seen.

What Ukraine crisis means for energy and commodity markets

Indeed, the impact of the war in Ukraine on the global economy and the UK's nascent recovery will depend on its duration. The government may need to repeat some measures implemented during the pandemic to support the economy in response to the effects of sanctions on the cost of living, notably energy. So as is typical in uncertain times, a flight to quality is likely. This has been evident in recent years where core assets have proven their resilience in the face of significant market shocks, supported by investors and occupiers seeking out prime assets with a growing focus on best-in-class sustainability credentials.

With the removal of Covid restrictions and life returning to normal, business activity should increasingly resemble a pre-pandemic world, supportive of tenants paying rent (which in turn pays income to investors) - which was largely achieved during the various lockdowns. With yield compression the main driver of capital growth last year, a greater reliance will be on rental growth, particularly in the industrial sector, to move values on. The war in Ukraine brings a new form of uncertainty which may interrupt the market momentum, yet investors are likely to remain mindful of the protection real assets have tended to offer during times of higher inflation.

Justin Upton is manager of the M&G Property Portfolio