Consolidation and an increasingly stringent regulatory environment within the traditional banking sphere have reshaped the global lending landscape for small and medium-sized enterprises (SMEs). With the retrenchment of banks, private lenders have stepped in to fill the lending vacuum.

For fixed income investors, we believe an allocation into private debt may offer several benefits over traditional fixed income.

Potential for higher yields

Private debt is an illiquid asset class - meaning investors are locked in for a set period of time - often a number of years. Loans from private debt funds are made to private companies who have been looking for a customised funding solution and been unable to obtain financing through a traditional lender such as a bank.

The financing may be used for a number of reasons such as acquisition, growth, management buyout or expansion. For companies in the lower middle market, about €5bn to €25bn, where traditional financing is becoming increasingly hard to source, private lenders can provide the loan. However, investors need to be compensated for the extended time their money is locked up, hence the potential for higher yields - the so-called illiquidity premium.

Premier Miton's Rayner: Why 'low risk' assets have changed for first time in 30 years

Protection from rising rates

Interest rates have been at extremely low levels in many parts of the world for a considerable period. However, as the global economy recovers from the Covid-19 pandemic the surge in demand and manufacturing, combined with chain disruptions, have led to higher inflation.

In emerging markets, many central banks have already implemented rate rises while in developed markets, central banks are planning to scale back asset purchase programmes and, in some cases, implement rate rises. With traditional fixed income so closely linked to interest rates, earnings are eroded for existing debt holders as interest rates rise. However, the loans in private debt have a floating base rate which may help to provide protection against rising interest rates.

Exposure to the global economic growth

The global macroeconomic backdrop is continuing to gain traction and we believe companies in the lower middle market are the growth engines of the global economy.

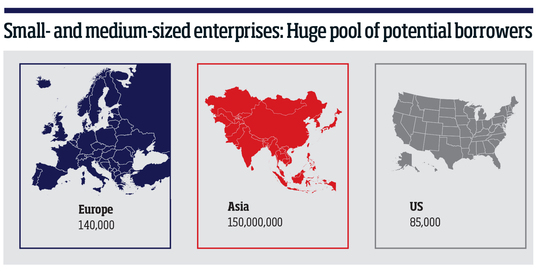

There is a huge pool of potential borrowers in this segment of the market. The US has 85,000 businesses with revenues of more than $25m, in Europe there are more than 140,000 companies generating in aggregate over €8trn in revenue, while the Asia Pacific region is home to around 150 million SMEs.

IW Podcast: Transitioning from fossil fuels

This vast pool of prospective investments provides the potential for private investors to benefit from and contribute to global economic growth. However, we believe it is critical to have an in-depth understanding of the risks and opportunities facing the businesses to which we lend. This is as much about the financial circumstances of a business as the way it manages environmental, social and governance (ESG) factors. We believe companies with diligent governance structures and policies, with engaged workforces, and the ones which manage their environmental impacts well are more likely to be financially resilient over longer time horizons. Importantly, ESG due diligence and ongoing monitoring is now coming to the fore as a key element of best practice within the asset class.

We believe it is a good time to start deploying capital into the private debt markets on a global basis. With the potential for protection against rising interest rates, the possibility of higher yields and exposure to global economic growth, we believe global private debt presents a compelling opportunity in the current market environment.

Kirsten Bode is co-head of private debt, pan-Europe, Muzinich & Co