In the golden years of AR, ASI Global Absolute Return Strategies (GARS), Invesco Global Total Return (GTR) and Aviva Investors Multi Strategy Targeted Return (AIMS) were some of the biggest funds in the industry, housing several billions between them.

But since then, the asset class "has fallen a long way from grace", according to Ruli Viljoen, the head of manager selection at Morningstar.

2021 was the fourth consecutive year of outflows from absolute return funds, according to Morningstar, and in a study carried out by Investment Week, only 56 out of 108 AR funds have achieved their investment goal since Brexit.

But there is some context to this performance. Markets have generally been in a one-way trade from 2008 to 2021 (big tech and growth) and the ‘goal' of an AR fund is not to outperform the equity universe, but to deliver rolling returns at a steady pace: not quite reaching the highs of equity markets or the lows when markets turn.

Deep Dive: Long-term prospects for China remain bright despite continued uncertainty

Since the vaccine rollout in late 2021, markets have been in a totally different state, now characterised by high volatility and fluctuating asset classes, in which AR should thrive, Viljoen said.

"If ever there was a year when they could once again potentially shine, it had to be 2022, with developed market equities experiencing the most difficult first half of the year in over 50 years and government bonds failing to provide the protection that investors usually seek."

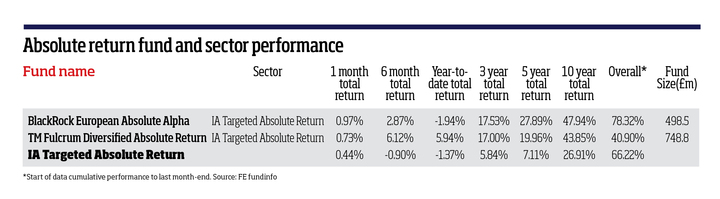

She highlighted the TM Fulcrum Diversified Absolute Return and BlackRock European Absolute Alpha funds for exposure to this space.

Both funds are up year-to-date, with the Fulcrum portfolio having a particularly strong 2022 with a nearly 6% return, according to FE fundinfo. The average IA Targeted Absolute Return fund has lost 1.4% during that time.

Viljoen added it had "shone" in 2022, owing to its process of "macro-driven directional bucket, a diversified relative value sleeve, and a trend-following diversifying component".

The latter fund has also done well, having come under its new manager Stefan Gries just over a year ago. Gries took over from David Tovey, who left the asset manager after 23 years, but had been involved with the strategy since launch in 2013.

Polina Kurdyavko, head of emerging markets and portfolio manager at BlueBay Asset Management, echoed Viljoen's sentiment, adding that, given the amount of volatility and uncertainty now abound in markets, "investors would do well to consider taking an active absolute return or unconstrained approach to investing".

Within her universe of emerging markets, Kurdyavko said taking an unconstrained approach was particularly important, as "dispersion is so high, it is more important than ever to focus on identifying the 'winners' and 'losers' to optimise the return profile of investment holdings".

In her fund, Kurdyavko was bullish commodities such as energy and agriculture and less keen on emerging market currencies, as a rallying dollar has historically been a drag on this asset.

Deep Dive: Frontier markets require caution due to 'barrage' of shocks

Implementing a net short EM currencies position "could help to protect downside" and "has proven successful for us on multiple occasions, such as in late 2016, during 2018 and even in 2020 amid Covid-19 shocks," she added.

Absolute return strategies are able to deploy hedges to deliver rolling outperformance.

"Hedging or avoiding exposure to significantly weak ESG stories is another way to protect downside in portfolios. For example, before the Russian invasion of Ukraine we implemented a CDS protection position which was beneficial," Kurdyavko said.

For investors less bullish on emerging markets, Murray Collis, CIO at Manulife Investment Management, said Asian bonds had some resilient opportunities.

He said that unlike many Western economies, "inflationary outlook in Asia is generally more benign".

Inflation has been the main macroeconomic factor for fund managers to contend with over the past 18 months and has been a key driver to the aforementioned volatility.

Finding assets which can hedge against this is one of the main selling points AR tries to offer and having some added diversification via an Asian bond absolute return strategy could be beneficial, Collis said.

Within Asian markets, the Fed's monetary policy has created a "dislocation opportunities in Asian currency bond markets as valuations in the Asian high yield space have seemed compelling amid China's property slump and negative investor sentiment", he added.

He said that because inflation was less rampant in Asia versus the US, for example, he expected to see a variety of monetary policies implemented, but all less hawkish than the Fed.

"This backdrop may be attractive for selective Asian fixed-income markets. In fact, on a year-to-date basis, Asian fixed income has outperformed its developed-market peers, a trend we believe may continue."

Deep Dive: Property markets in this recession are not like 2008

One area AR has not been synonymous with in the past is ESG.

Catie Wearmouth, ESG investment director at abrdn, said that while in other areas ESG integration tends to focus on bottom-up analysis, when it comes to AR, a top-down approach is preferable.

"Demographics and income equality - both key social factors in ESG - have a material effect on the long-term path of interest rates, for example. This path affects the returns of a wider range of asset classes including government bonds, forex, derivatives, credit and equity globally.

"While these social factors in isolation do not directly drive investment decisions, the interest rate environment is an important contextual factor in investment thinking. Equally, ESG can be a primary driver of returns and this is particularly true for more granular equity trades," she added.

At present, there are only 13 portfolios in the IA Targeted Absolute Return sector that are explicitly ESG- or sustainably-focused.