Continued Euphoria Pushes Global Markets To New Records

The past week marked a significant milestone in global financial markets, as major indices like DOW, S&P 500, DAX, CAC, and even Nikkei all reached new record highs, buoyed by the widespread euphoria surrounding artificial intelligence related sectors. This wave of optimism to eclipsed the recalibrated expectations that some major central banks, like Fed, would delay anticipated interest rate cuts. Additionally, China’s historic rate cut injected further momentum into the market, leading to a sharp rally in Chinese stocks and bolstering confidence across the region.

In the currency realm, Yen emerged as the week’s weakest performer, alongside Swiss Franc and Dollar. These safe-haven currencies found themselves out of favor as traders shifted their focus towards riskier assets amid the prevailing positive sentiment. Canadian Dollar also faced a downturn, reacting negatively to unexpectedly weak CPI data.

Conversely, New Zealand and Australian Dollars stood out as the week’s strongest currencies, benefiting from the risk-on market environment and the positive ripple effects of China’s monetary policy actions. Sterling followed closely, capitalizing on the general market optimism too. Euro, however, displayed a mixed performance, caught between divergent views within ECB Governing Council on the timing of monetary policy easing.

Hawkish Fed Meets AI Mania

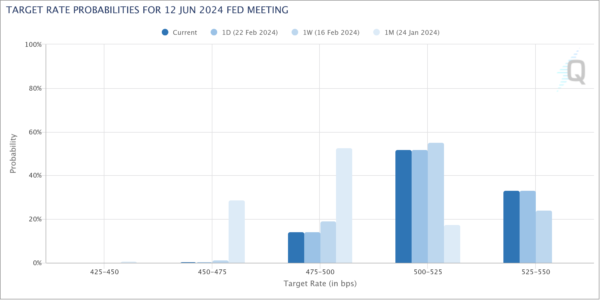

In the wake of Fed’s latest meeting minutes, which carried a decidedly hawkish tone, the financial markets are undergoing a notable recalibration of rate cut expectations. The shift in sentiment is starkly evident in fed fund futures, where there’s now a 33% likelihood that Fed will maintain the interest rate at the current bracket of 5.25-5.50% following the June meeting. That’s a significant departure from the 0% chance anticipated just a month earlier.

This pivot in expectations is largely attributed to Fed policymakers’ cautious stance on rate reductions, as outlined in the January FOMC minutes. The document highlighted a majority concern among participants over the perils of easing monetary policy too early, indicating a preference, from a risk management viewpoint, for prolonging the wait before any rate cuts, with the flexibility to accelerate policy easing later if necessary.

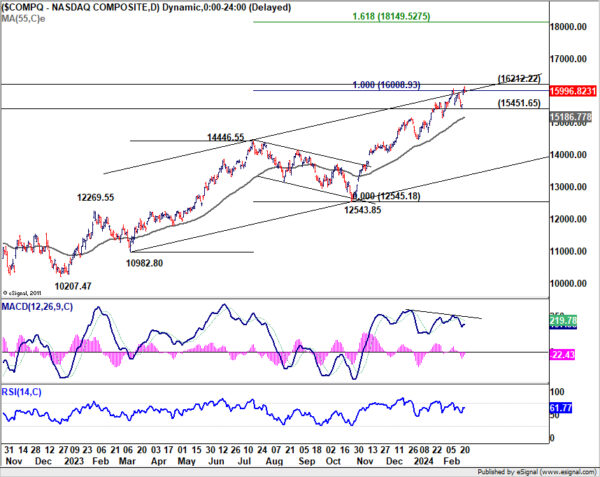

Despite these adjustments in monetary policy expectations, stock investors continue to ride the wave of AI euphoria, propelling the DOW and S&P 500 to record highs, with NASDAQ not far behind.

However, from a technical perspective, NASDAQ is not sitting at a critical juncture, confronting a cluster of resistances levels. That include medium term channel resistance, 100% projection of 10982.80 to 14446.55 from 12543.85 at 16008.93, as well as 16212.22 (2021 high). Additionally, bearish divergence in D MACD hints at diminishing upside momentum, suggesting potential shifts in the near future.

Firm break of 15451.65 support could be the first sign that whole rise from 10207.47 has completed a five-wave rally. Further break of 55D EMA (now at 15186.77) would bring deeper correction back to 12543.85/14446.55 support zone.

Conversely, decisive break of 16000/16200 resistance zone will set the next target at 161.8% projection at 18149.52. However,this development would imply a fifth-wave extension structure that often heralds the climax of a major uptrend. Investors should remain vigilant, as such developments could indicate an approaching end to the current bullish phase.

Retreating Dollar Index and Stalled 10-Year Yield Rally

Dollar index extended the retreat from 104.97, in reaction to broad risk-on sentiment. For now, further rally is still in favor as long as 102.90 support holds. Rise from 100.61 is seen as the third leg of the pattern from 99.57 (2023 low). Above 104.97 will target 107.34 support and possibly above. However, firm break of 102.90 support will argue that rise form 100.61 has completed and turn near term outlook bearish for 99.57/100.61 support zone instead.

10-year yield also struggled to extend the rebound from 3.785 and closed the week slightly lower. Still, with 55 D EMA (now at 4.175) intact, outlook is unchanged. Rise from 3.785 is seen as the second leg of the three wave corrective pattern from 4.997. Further rally is in favor to 61.8% retracement of 4.997 to 3.785 at 4.534 and possibly above. However, sustained break of 55 D EMA will dampen this bullish view and bring deeper decline back towards 3.785.

The next moves of Dollar Index and 10-year yield would likely be in tandem.

PBoC’s Surprise Rate Cuts Fuel Optimism, Shanghai SSE Marks a Turnaround

Another important development to note was the sharp turnaround in the Chinese stock markets in the past two weeks. Sentiment was given a strong boost by PBoC’s record cut to a key lending rate. That was the latest in the surprise by the central bank, under the leadership of new Governor, after on the heels of last month’s significant reduction in banks’ reserve requirement ratio. These moves, seemingly aimed at garnering more market attention and altering sentiment, have led some economists to anticipate further surprises from PBoC too support market sentiment and the economy.

Technically, China’s Shanghai SSE Composite should have made a medium term bottom at 2635.08 with subsequent rebound. The strong break of 2923.51 cluster resistance (38.2% retracement of 3418.95 to 2635.08 at 2934.51), as well as 55 D EMA (now at 2909.09) are clearly bullish signals. The close above 3000 handle is also psychologically important.

The critical test now lies in whether SSE can break through 55 W EMA (now at 3081.47) with the same vigor. If realized that would suggest that whole down trend from 3731.68 (2021 high) has completed. SSE should then be in a medium term up trend to 3418.95/3731.68 resistance zone to extend the long term range pattern. Nevertheless, rejection by, or failure to break through 3081.47 will keep medium term outlook bearish for down trend resumption at a later stage.

The pivot in China’s stock market has also lent some support to Australian Dollar. AUD/JPY is now eyeing 99.32 key resistance (2022 high) with last week’s rally. Decisive break there will confirm resumption of whole up trend from 59.85 (2020 low). In this case, next near term target will be 61.8% projection of 86.04 to 97..66 from 93.00 at 100.18, which is close to 100 psychological level.

ECB’s Dovish Voices Clash with Hawkish Cautions

ECB’s January meeting minutes revealed broad consensus that it was too soon to consider interest rate cuts at “that meeting”. Members also emphasized the “high reputational costs” that could arise from having to reverse policy direction should the central bank be forced to hike again after policy loosening. Yet, a closer inspection of individual comments from Governing Council members reveals a spectrum of opinions, ranging from dovish openness to hawkish restraint.

On the dovish front, Portuguese central bank’s chief Mario Centeno emphasized the importance of being “open” to the possibility of discussing rate cuts as early as March meeting, citing the significant influx of new data expected by that time. This stance found resonance with Maltese central bank head Edward Scicluna, who suggested that “March could be it” for initiating discussions on policy loosening.

Conversely, the hawkish camp, led by Bundesbank President Joachim Nagel, insists that the current price outlook is not clear enough to justify immediate policy easing. Austrian central bank head Robert Holzmann went even further, highlighting ECB’s historical tendency to trail Fed’s policy decisions by about six months, implying a more delayed approach to rate cuts if Fed opts for easing in the latter half of the year.

ECB President Christine Lagarde occupies a more central position in this debate. While open to the idea of a rate cut, she predicates such a move on the forthcoming Q1 wage data expected in May. That would set June as the earliest plausible timing for policy easing, contingent on economic conditions aligning with ECB’s expectations.

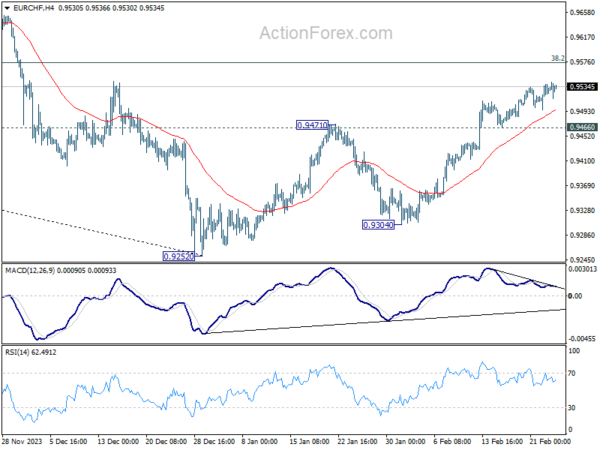

Euro’s mixed performance over the week seems to mirror the uncertainty stemming from these diverse viewpoints within the ECB. EUR/CHF edged higher last week as rebound form 0.9252 continued, despite loss of upside momentum as seen in 4H MACD. Further rise is still in favor to 38.2% retracement of 1.0095 to 0.9252 at 0.9574 as long as 0.9466 support holds.

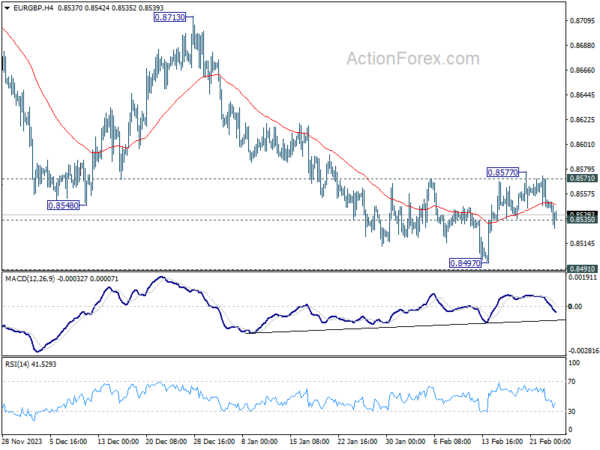

On the other hand, EUR/GBP’s breach of 0.8535 support argues that recovery from 0.8497 has completed at 0.8577, after rejection by 0.8571 resistance. Deeper decline is in favor for retesting 0.8491/7 support, and decisive break there will resume larger down trend.

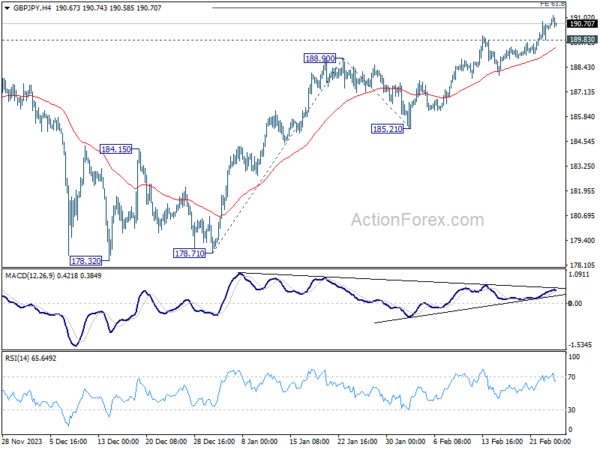

GBP/JPY’s up trend continued last week and there is no sign of topping yet. Initial bias remains on the upside this week for 61.8% projection of 178.71 to 188.90 from 185.21 at 191.50. Firm break there will target 100% projection at 195.40. On the downside, below 189.83 minor support will turn intraday bias neutral and bring consolidations, before staging another rally.

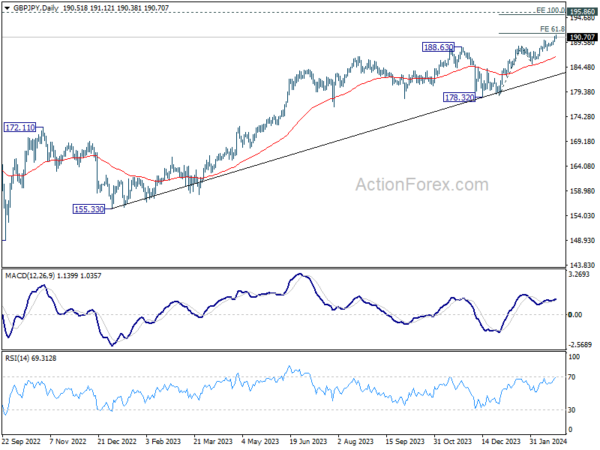

In the bigger picture, up trend from 123.94 (2020 low) is in progress. Medium term outlook will stay bullish as long as 178.32 support holds. Next target is 195.86 long term resistance (2015 high).

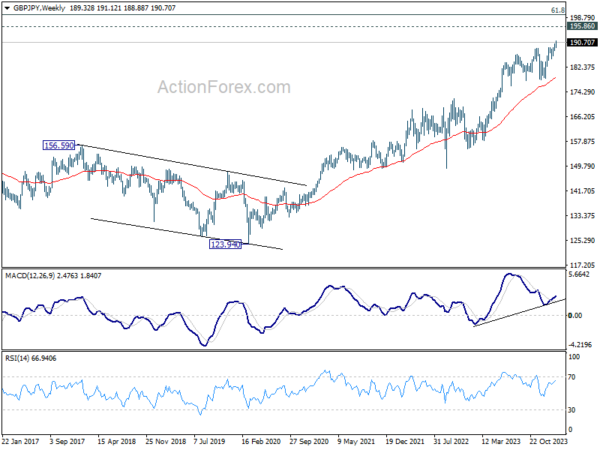

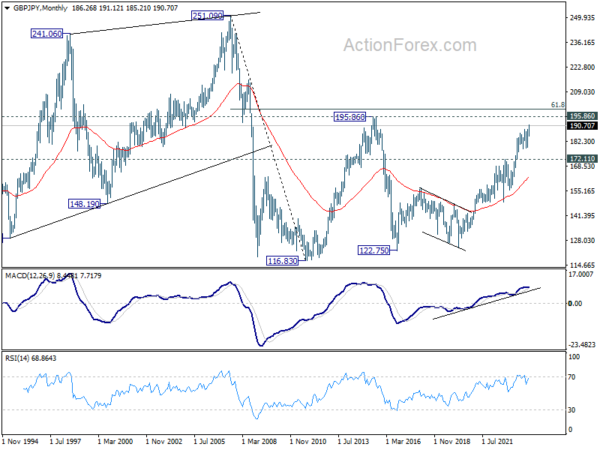

In the longer term picture, rise from 122.75 (2016 low) is seen as the third leg of the pattern from 116.83 (2011 low). Further rally will remain in favor as long as 172.11 resistance turned support holds. Break of 195.86 (2015 high) is possible. But strong resistance could be seen from 61.8% retracement of 251.09 (2007 high) to 116.83 at 199.80 to limit upside, at least on first attempt.

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more