Data provided by ESG Book found that some measures, such as the share of non-renewable energy versus renewable energy consumption, were reported by just 0.4% of firms.

Overall, the majority of companies do not make any disclosures against 12 of the 17 mandatory indicators.

The mandatory measures, known as Principle Adverse Impacts (PAIs), are a set of 14 mandatory indicators (with the first containing three indicators to disclosure Scope 1, 2 and 3 greenhouse gas emissions), and 31 voluntary indicators.

According to Article 4 of SFDR, financial market participants are obligated to publish and maintain certain information on their PAIs.

"If fund managers think they are ready for SFDR, they are mistaken," warned Daniel Klier, CEO of ESG Book. "The barren data landscape currently leaves them with very few options."

Only 22.2% of all firms reported their total greenhouse gas emissions, with that number falling as low as 14% in the US and just 3% in China.

ESG investing popularity declines among UK investors over greenwashing fears

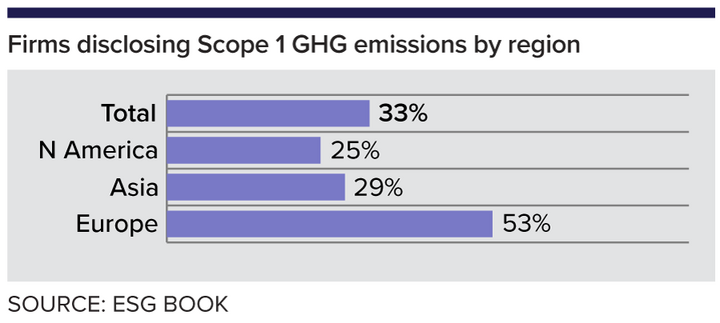

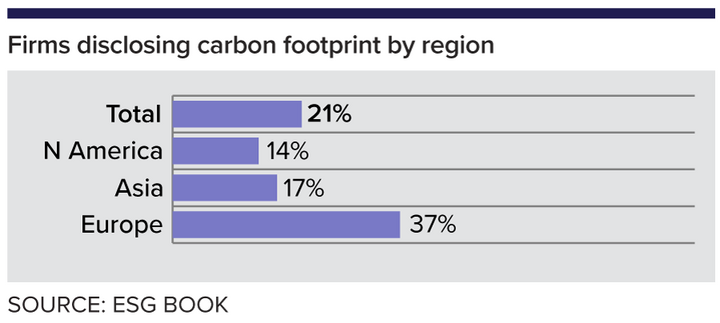

The reporting rate of various SFDR disclosure measures often vary largely across region and industry, the data revealed. For example, 26% of financial services firms worldwide disclosed their carbon footprint, compared to just 9% of healthcare technology firms or major pharmaceutical firms.

Meanwhile, European companies had significantly higher disclosures than in other continents, averaging 51% disclosure across all categories compared to North America's 36% and Asia's 40%.

The poorest reported measure was share of non-renewable energy versus renewable energy consumption, which was followed by the gender pay gap of investee companies and tonnes of emissions discharged into water generated by investee companies per million euros invested.

Pressure mounts on 'out of touch' asset managers over fossil fuel investments

Only three measures received a 100% disclosure rate: investment in firms that may affect biodiversity-sensitive areas, investment in firms involved in violations of the UN Global Compact principles or OECD Guidelines for Multinational Enterprises, or do not have policies or complaints handling mechanisms to address violations of them.

Beyond those, the highest reporting measure was the average ratio of female to male board members in investee companies, at 72.4%, followed by the share of investments in investee companies involved in the manufacture or selling of controversial weapons, at 70.5%.

The average unadjusted gender pay gap of investee companies was reported by just 1.4% of all firms, with only 14 American firms and 8 Asian firms disclosing it, out of 3812 and 3121, respectively.

Klier added: "Companies will not be required to disclose until the CSRD next year. And in any case, CSRD will not align with SFDR.

"Nonetheless, they should feel the pressure now. Because those who are not disclosing against PAI indicators will be left behind by the major asset managers selling products in Europe."