Aussie Rises On Inflation Data And Chinese Stimulus; Eyes On BoC And Gold Movements

Australian Dollar made significant gains in Asian session today following unexpectedly robust inflation figures for Q3 and September. This has caused a flurry of revised predictions from economists who now anticipate a rate hike by RBA in its next meeting in November. While there’s speculation about a subsequent hike in December, such a back-to-back move by RBA remains a distant probability. Boosting Aussie’s ascent is also reports on China’s intentions to roll out a new fiscal stimulus to bolster its economic recovery. New Zealand Dollar is tailing Aussie, marking its position as the day’s second strongest currency.

Conversely, all eyes are on Canadian Dollar as it lags, with BoC’s impending rate decision looming large. Although the consensus leans towards BoC maintaining its current stance, market participants will be keenly observing the accompanying statement and freshly minted economic forecasts. Dollar is also on the softer side, possibly marking time until the release of US GDP figures tomorrow. With treasury yields hinting at short-term stabilization, the forthcoming economic data could be pivotal for the greenback. Meanwhile, Yen and Swiss Franc are on standby, tracking overarching risk sentiments. The Euro and Sterling are displaying a moderate recovery, offsetting some of the previous day’s losses post PMI data release.

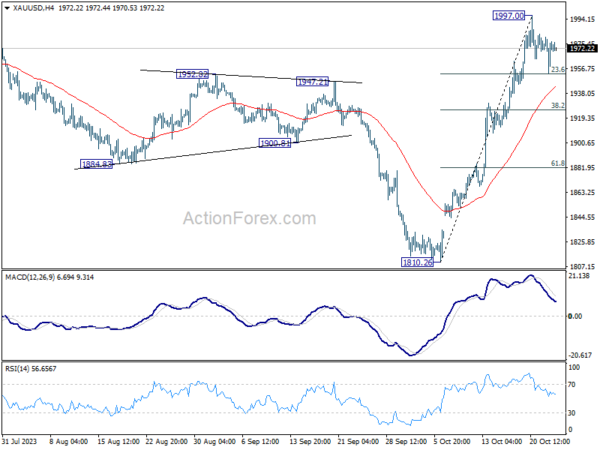

From a technical standpoint, Gold is now at a near term juncture. The precious metal’s immediate challenge is to capitalize on its rebound from t3.6% retracement of 1810.26 to 1997.00 at 1925.25 and surpass the 1997.00 resistance in the next two days. Failure to do so might send it back to 38.2% retracement at 1925.66, extending the correction into mid-November.

In Asia, at the time of writing, Nikkei is up 0.87%. Hong Kong HSI is up 0.79%. China Shanghai SSE is up 0.45%. Singapore Strait Times is up 0.07%. Japan 10-year JGB yield is up 0.0024 at 0.856. Overnight, DOW rose 0.62%. S&P 500 rose 0.73%. NASDAQ rose 0.93%. 10-year yield rose 0.002 to 4.840.

Australia CPI slows to 5.4% yoy in Q3, but rises to 5.6% yoy in Sep

Australia’s CPI for Q3 registered a 1.2% qoq rise, exceeding expectation of 1.1% qoq and marking an acceleration from the previous quarter’s 0.8% qoq. Notably, some of the most pronounced price hikes were observed in automotive fuel (+7.2%), rents (+2.2%), new dwelling purchases by owner-occupiers (+1.3%), and electricity (+4.2%).

Over the twelve months, inflation saw a deceleration, with CPI moving from 6.0% yoy to 5.4% yoy in Q3. However, this figure surpassed the anticipated 5.3% yoy. It’s essential to note that this is the third consecutive quarter where the annual inflation rate has experienced a downturn, dropping from its high of 7.8% in Q4 2022.

The trimmed mean CPI, which excludes volatile items, recorded a 1.2% qoq increase again outpacing the forecasted 1.1% qoq and the previous quarter’s 1.0% qoq . When analyzing the annualized data, the trimmed mean CPI decelerated from 5.9% yoy to 5.2% yoy, surpassing the predicted 5.1% yoy.

Commenting on the latest figures, Michelle Marquardt, ABS head of price statistics, highlighted that “prices continued to rise for most goods and services.” However, she also noted a few sectors that registered price declines, notably child care, vegetables, and domestic holiday travel and accommodation.

Furthermore, the monthly CPI for September recorded acceleration from 5.2% yoy to 5.6% yoy , which was above the anticipated 5.4% yoy. Significant price surges in this period were identified in Housing (+7.2%), Transport (+9.4%), and Food and non-alcoholic beverages (+4.7%).

Reflecting on these trends, Marquardt stated, “This is the second consecutive rise in the annual movement up from 5.2% in August and 4.9% in July. While many industries’ price increases are slowing, automotive fuel has had large annual increases in the last two months, which has been driving the movement higher.”

Aussie soars on anticipated RBA Nov hike; GBP/AUD targets 1.8854 support

Australian Dollar experienced a notable surge following the release of higher-than-anticipated consumer inflation figures. The data illustrates an accelerated quarterly inflation rate for Q3, and a more modest deceleration in the annual inflation rate than projected. Furthermore, the monthly CPI has been on the rise for two consecutive months. Given this backdrop, market participants are now anticipating another 25bps rate hike by RBA in their upcoming November 7th meeting, pushing the rate to 4.35%.

For a deeper understanding, one can refer to the minutes from RBA’s October meeting which highlighted the Board’s “low tolerance” towards unexpected surges in inflation. Adding weight to these expectations, Governor Michelle Bullock made it clear just a day prior, stating, “The Board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation.”

GBP/AUD’s steep decline this week argues that corrective rebound from 1.8854 has completed at 1.9339 already. That came after failure to sustain above 55 D EMA (now at 1.9226). Risk will now stay on the downside as as 1.9339 resistance holds, in case of recovery. Break of 1.8854 support will confirm resumption of whole fall from 1.9967 to 61.8% projection of 1.9967 to 1.8854 from 1.9339 at 1.8651 next.

BoC to hold, with hawkish untone?

BoC rate decision is today’s market highlight, as the consensus veers towards maintaining interest rate at 5.00%. The potential for a rate hike has dwindled, especially after the September CPI data revealed a more rapid deceleration in inflation than anticipated. Now, speculations swirl regarding the possibility of a “hawkish hold,” which leaves the door open for further tightening.

Market consensus on the BoC’s next moves, however, isn’t unanimous. A recent Reuters poll showcased a split opinion. A slim majority of 8 of the 18 economists surveyed perceive a a “high” likelihood of another hike. As for rate reductions, opinions stand divided too. 19 economists project rates falling beneath the current benchmark by the end of June, while 11 anticipate maintaining or even exceeding the current level.

As the BoC is set to unveil its latest growth and inflation forecasts, market participants are keenly awaiting insights that might shed light on the bank’s future monetary stance.

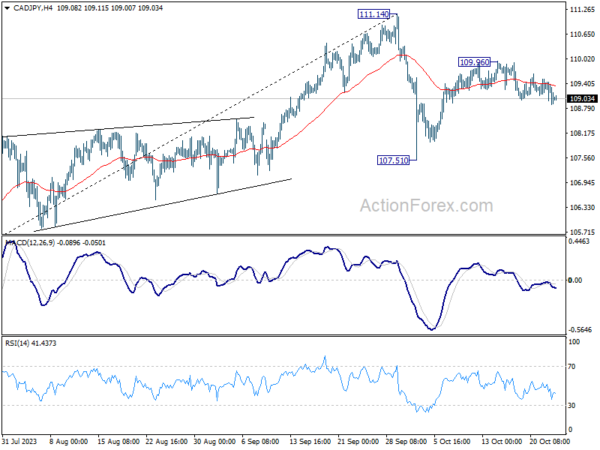

Amid these discussions, the Canadian Dollar isn’t faring well, even when pitted against the underperforming Yen. Risk is mildly on the downside for CAD/JPY as long as 109.96 resistance holds. Deeper fall is slightly in favor as to 107.51 support and below to extend the corrective pattern from 111.14 high. While a break of 109.96 will resume the rebound from 107.51. Breaking 111.14 to resume larger up trend is not expected. So upside potential is limited for the near term.

Elsewhere

Germany Ifo business climate will be the highlight of European session. Later in the day, US will release new home sales.

AUD/USD Daily Report

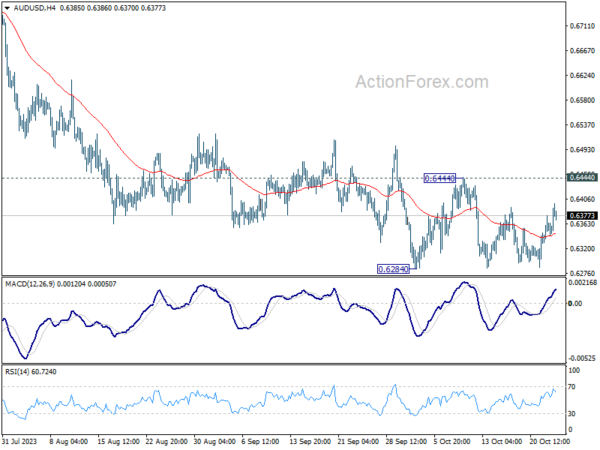

Daily Pivots: (S1) 0.6333; (P) 0.6356; (R1) 0.6379; More…

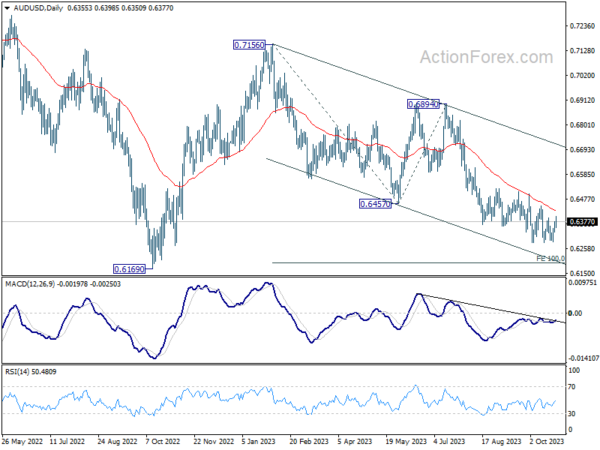

AUD/USD recovers further today but stays below 0.6444 resistance. Intraday bias remains neutral and downside breakout is expected. On the downside, firm break of 0.6284 will resume whole fall from 0.7156. Next target is 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195, which is close to 0.6169 medium term support. However, firm break of 0.6444 will turn bias to the upside for stronger rebound.

In the bigger picture, down trend from 0.8006 (2021 high) is possibly still in progress. Decisive break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Monthly CPI Y/Y Sep | 5.60% | 5.40% | 5.20% | |

| 00:30 | AUD | CPI Q/Q Q3 | 1.20% | 1.10% | 0.80% | |

| 00:30 | AUD | CPI Y/Y Q3 | 5.40% | 5.30% | 6.00% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q3 | 1.20% | 1.10% | 1.00% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q3 | 5.20% | 5.00% | 5.90% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Oct | -27.6 | |||

| 08:00 | EUR | Germany IFO Business Climate Oct | 85.9 | 85.7 | ||

| 08:00 | EUR | Germany IFO Current Assessment Oct | 88.5 | 88.7 | ||

| 08:00 | EUR | Germany IFO Expectations Oct | 83.3 | 82.9 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Sep | -1.70% | -1.30% | ||

| 14:00 | USD | New Home Sales Sep | 684K | 675K | ||

| 14:00 | CAD | BoC Interest Rate Decision | 5.00% | 5.00% | ||

| 14:30 | USD | Crude Oil Inventories | -0.5M | -4.5M | ||

| 15:00 | CAD | BoC Press Conference |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more