Aussie Falters While Dollar Sees Slight Uptick

The picture is pretty much the same through Asian and early part of European session, with the Australian and New Zealand Dollars, alongside the Canadian Dollar, persisting as the day’s underperformers. Swiss Franc has also found itself under pressure, particularly against its European counterparts, aligning with the commodity currencies in their struggle. Conversely, Yen and Dollar have eked out modest gains, closely tailed by the Euro and Sterling

Market reactions to the latest PMI services data from the Eurozone and the UK have been subdued. Both reported suggested some persistent inflationary pressure in the services sector, which could deter ECB and BoE for earlier rate cuts. With the ECB’s meeting later this week, market participants are keenly awaiting any hints of future policy direction, especially with new economic projections set to be unveiled.

The economic calendar promises to bring heightened attention to the markets, with several key events lined up. The imminent release of the US ISM services data, Australia’s GDP figures in the next Asian session, and tomorrow’s BoC rate decision, coupled with Fed Chair Jerome Powell’s testimony to Congress, are all poised to influence market sentiment.

Technically, GBP/AUD’s rebound from 1.8584 resumed today by breaking through 1.9527 near term resistance. Prior support from 55 D EMA is a bullish sign, which strength the case that correction from 1.9967 has completed with three waves down to 1.8584. Further rise is now expected as long as 1.9190 support holds, to retest 1.9967. Firm break there will resume larger up trend.

In Europe, at the time of writing, FTSE is down -0.01%. DAX is flat, CAC is up 0.03%. UK 10-year yield is down -0.0675 at 4.153. Germany 10-year yield is down -0.0349 at 2.368. Earlier in Asia, Nikkei fell -0.03%. Hong Kong HSI fell -2.61%. China Shanghai SSE rose 0.28%. Singapore Strait Times fell -0.48%. Japan 10-year JGB yield fell -0.0080 to 0.708.

Eurozone PPI down -0.9% mom, -8.6% yoy in Jan

Eurozone PPI fell -0.9% mom, -8.6% yoy in January, below expectation of -0.1% mom, -0.8% yoy. For the month, PPI decreased by -0.2% for intermediate goods, -2.9% for energy, -0.2% for durable consumer goods, increased by 0.6% for capital goods and by 0.3% for non-durable consumer goods.

EU PPI fell -0.9% mom, -8.4% yoy. Among Member States for which data are available, the largest monthly decreases in industrial producer prices were recorded in Slovakia (-14.3%), Poland (-3.0%) and Austria (-2.2%). The highest increases were observed in Estonia (+5.3%), Ireland (+4.0%) and Czechia (+2.4%).

Eurozone PMI services finalized at 50.2, two important insights for ECB

Eurozone PMI Services was finalized at 50.2 in February, up from January’s 48.7, a 7-month high. PMI Composite was finalized at 49.2, up from January’s 47.9, an 8-month high.

Country-specific data revealed varying degrees of economic activity, with Ireland leading the pack with PMI Composite of 54.4, a 12-month high. Spain and Italy followed closely, posting 9-month highs of 53.9 and 51.1, respectively. However, not all news was positive, as France and Germany trailed behind, with Germany recording a 4-month low of 46.3, and France at 9-month low of 48.1.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, highlighted two critical insights from the PMI survey in the context of the upcoming ECB meeting on March 7.

Firstly, output prices in the service sector continue to “surge at an accelerated rate”, driven by “escalating wages”, underscores inflationary pressures that are yet to abate.

Secondly, the service sector’s “unexpectedly robust pricing power”, amidst a slow economic recovery and a forecasted growth rate below 1% for 2024, suggests the risk of “a wage-price spiral and stagflation” scenario, exacerbated by structural labor shortages impacting productivity.

“Those advocating late rate cuts may very well find reinforcement in the PMI findings,” de la Rubia noted.

UK PMI services finalized at 53.8, rising inflationary pressures

UK PMI Services was finalized at 53.8 in February, down from January’s 54.3. PMI Composite was finalized at 53.0, up fractionally from January’s 52.9.

Tim Moore, Economics Director at S&P Global Market Intelligence, highlighted the trend as evidence that UK economy may be emerging from the shadows of a technical recession experienced in the latter half of 2023, suggesting a “turning of the corner” towards recovery.

Meanwhile, the service sector faces rising input costs, primarily driven by higher salary payments and increased shipping expenses. This led to the most significant input price inflation since September 2023.

Moreover, the pressure to maintain profit margins has prompted service providers to raise their prices at one of the quickest rates since the previous summer, reflecting the necessity to offset the surging staff costs.

Japan’s Tokyo CPI core rises to 2.5% yoy, PMI services finalized at 52.9

Japan’s Tokyo CPI core (ex-fresh food) rose from upwardly 1.8% yoy to 2.5% yoy in February, matched expectations. CPI core-core (ex-food and energy) slowed from 3.3% yoy to 3.1% yoy. Headline CPI in the capital city rose from 1.8% yoy to 2.6% yoy.

Also released, PMI Services was finalized at 52.9 in February, down from January’s 53.1, but stays in expansion for the 18th month in a row. PMI Composite was finalized at 50.6, down from prior month’s 51.5.

According to Usamah Bhatti, Economist at S&P Global Market Intelligence,services business activity growth was sustained into February while the rate of growth in new business accelerated to a six-month high. However, steeper reduction in manufacturing output levels contributed to a slowdown in overall private sector activity growth.

China’s Caixin PMI services falls to 52.5, composite unchanged at 52.5

China’s Caixin PMI Services fell from 52.7 to 52.5 in February, below expectation of 52.9. PMI Composite was unchanged at 52.5.

Wang Zhe, Senior Economist at Caixin Insight Group, noted that both manufacturing and services sectors recorded steady growth. However, he noted supply was “still running ahead” of improved demand. Employment across both sectors saw contraction. On the pricing front, pressures of low prices becoming more pronounced within the manufacturing sector.

Overall, “market sentiment remained optimistic”, Wang noted.

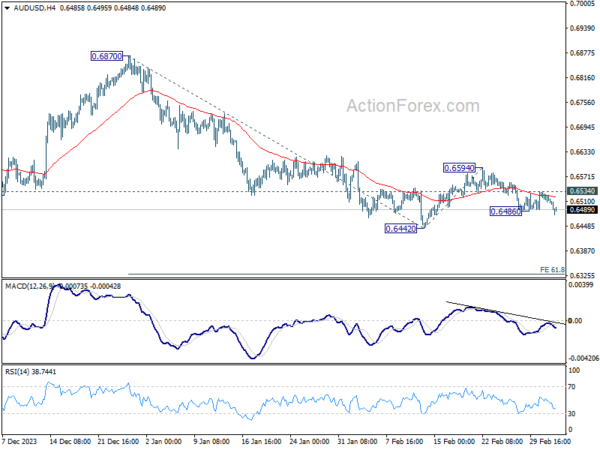

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6499; (P) 0.6517; (R1) 0.6528; More…

Intraday bias in AUD/USD is back on the downside with break of 0.6486 temporary low. Retest of 0.6442 support should be seen next. Firm break there will resume whole decline from 0.6870 for 61.8% projection of 0.6870 to 0.6442 from 0.6594 at 0.6329. On the upside, above 0.6534 minor resistance will turn intraday bias neutral again first. But outlook will stay bearish as long as 0.6594 resistance holds, in case of recovery.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Feb | 2.60% | 1.60% | 1.80% | |

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Feb | 2.50% | 2.50% | 1.60% | 1.80% |

| 23:30 | JPY | Tokyo CPI ex Food & Energy Y/Y Feb | 3.10% | 3.10% | 3.30% | |

| 00:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Feb | 1.00% | 1.40% | ||

| 00:30 | AUD | Current Account Balance (AUD) Q4 | 11.8B | 5.0B | -0.2B | 1.3B |

| 01:45 | CNY | Caixin Services PMI Feb | 52.5 | 52.9 | 52.7 | |

| 07:45 | EUR | France Industrial Output M/M Jan | -1.10% | -0.10% | 1.10% | 0.40% |

| 08:45 | EUR | Italy Services PMI Feb | 52.2 | 52.3 | 51.2 | |

| 08:50 | EUR | France Services PMI Feb F | 48.4 | 48 | 48 | |

| 08:55 | EUR | Germany Services PMI Feb F | 48.3 | 48.2 | 48.2 | |

| 09:00 | EUR | Eurozone Services PMI Feb F | 50.2 | 50 | 50 | |

| 09:30 | GBP | Services PMI Feb F | 53.8 | 54.3 | 54.3 | |

| 10:00 | EUR | Eurozone PPI M/M Jan | -0.90% | -0.10% | -0.80% | -0.90% |

| 10:00 | EUR | Eurozone PPI Y/Y Jan | -8.60% | -8.10% | -10.60% | -10.70% |

| 14:45 | USD | Services PMI Feb F | 51.3 | 51.3 | ||

| 15:00 | USD | ISM Services PMI Feb | 0.30% | 53.4 | ||

| 15:00 | USD | Factory Orders M/M Jan | -2.80% | 0.20% |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more