Aussie Down Slightly After RBA, Bitcoin Ready For Breakout In Calm Markets

Australian Dollar dips slightly after RBA decided stand pat. But it hasn’t seen substantial follow through selling pressure yet. While the decision might have surprised half of the market participants, it doesn’t change the tightening path of the central bank. It’s more of a decision on delivering the hike today or in August. What next will continue to depend on upcoming economic data. The forex markets are overall rather quiet, with major crosses and pairs generally trapped inside yesterday’s range for now. Trading could remain subdue considering that the US is on July 4 holiday today.

Technically, Bitcoin looks ready to break through 31412 short term top to resume recent rally. But the real test lies in 61.8% projection of 19552 to 31011 from 24739 at 31820. Rejection by this level, followed by break of 29443 support would trigger steep pull back to 55 D EMA (now at 28222) and below. Nevertheless, strong break there could pave the way to 100% projection at 36198. As usual, Bitcoin will be used as one of the guides to gauge the over sentiment on NASDAQ.

Overnight, DOW rose 0.03%. S&P 500 rose 0.12%. NASDAQ rose 0.21%. 10-year yield rose 0.039 to 3.858. In Asia, at the time of writing, Nikkei is down -0.94%. Hong Kong HSI is up 0.38%. China Shanghai SSE is down -0.14%. Singapore Strait Times is down -0.07%. Japan 10-year JGB yield is down-0.0233 at 0.383.

RBA holds cash rate steady, further tightening may be in the offing

RBA keeps cash rate target at 4.10% today, leaving room for further evaluation of the economic landscape. However, the central bank’s statement hinted at the possible need for further tightening of monetary policy in the future.

The statement noted, “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe,” with the stipulation that this would be dependent on how the economy and inflation evolve.

The bank justifies its decision to keep rates unchanged, stating it “provides the Board with more time to assess the state of the economy and the economic outlook and associated risks.”

The statement highlighted concerns over the risk of persistent high inflation leading to broader increases in both prices and wages. This concern is heightened due to the limited spare capacity in the economy coupled with a very low unemployment rate.

In response to these potential inflationary pressures, RBA pledged vigilance, stating it “will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms.”

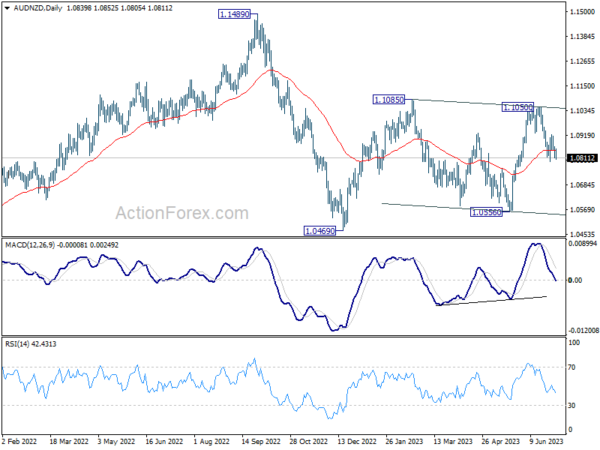

AUD/NZD dips after RBA, but holding above 1.0795 temp low

Australian Dollar dips broadly after RBA’s hold, but loss is so far limited. AUD/NZD is staying above 1.0795 temporary low for now, even though near term bearish bias is maintained after prior rejection by 55 4H EMA.

Current fall in AUD/NZD from 1.1050 is seen as the third leg of the pattern from 1.1085 for now. Deeper decline is expected as long as 1.0920 resistance holds. Break of 1.0795 will target 1.0056 support and possibly below. But in that case, buying should emerge above 1.0469 support to finish the fall from 1.1050, as well as the pattern from 1.1085.

Looking ahead

Germany trade balance and Canada manufacturing PMI are the only features for today. US is on July 4 holiday.

AUD/USD Daily Report

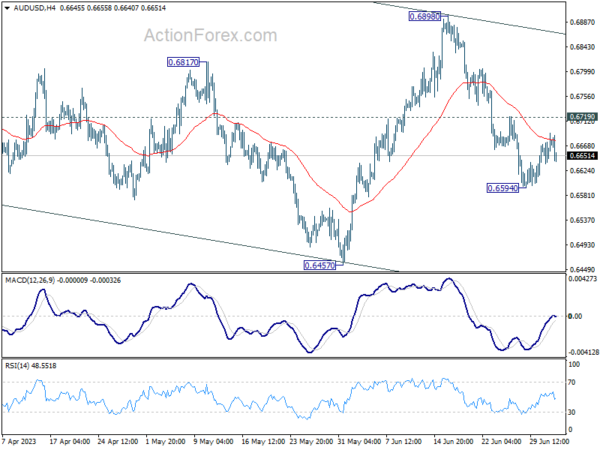

Daily Pivots: (S1) 0.6643; (P) 0.6667; (R1) 0.6698; More…

AUD/USD falls slightly after failing to sustain above 55 4H EMA, but stays above 0.6594 support. Intraday bias remains neutral this point. Further fall is in favor with 0.6719 resistance intact. On the downside, break of 0.6594 will resume the decline from 0.6898 to 0.6457 support next. Nevertheless, firm break of 0.6719 will turn bias back to the upside for stronger rebound.

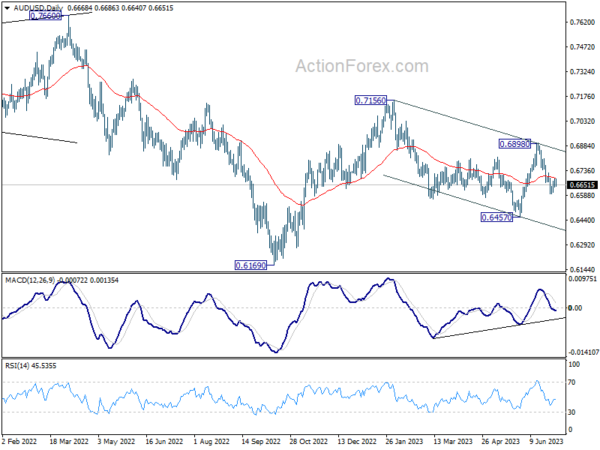

In the bigger picture, price actions from 0.7156 are seen as a correction to the rebound from 0.6169 only, rather than part of larger down trend from 0.8006 (2021 high). Break of 0.6457 could be seen but downside should be contained above 0.6169. This will now remain the favored case as high as 0.6898 resistance holds. Nevertheless, break of 0.6898 resistance will argue that rise form 0.6169 is ready to resume through 0.7156.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | NZD | NZIER Business Confidence Q2 | -63 | -66 | ||

| 23:50 | JPY | Monetary Base Y/Y Jun | -1.00% | -0.70% | -1.10% | |

| 04:30 | AUD | RBA Interest Rate Decision | 4.10% | 4.35% | 4.10% | |

| 06:00 | EUR | Germany Trade Balance (EUR) May | 17.0B | 18.4B | ||

| 13:30 | CAD | Manufacturing PMI Jun | 49 |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more